A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 the H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

Coming at you directly from the weekly chart this morning, the single currency continues to exhibit bearish intentions from the weekly supply penciled in at 1.1533-1.1278. This area has managed to cap upside since May 2015, so further selling from here is very possible. Sliding down to the daily chart, Wednesday’s cut through daily demand at 1.1215-1.1264, as anticipated, forced the EUR to connect with a neighboring daily demand coming in at 1.1143-1.1179. Alongside this, H4 action also crossed swords with H4 demand seen at 1.1168-1.1198 during yesterday’s sessions, which conveniently sits on top of the daily demand base mentioned above at 1.1143-1.1179.

Our suggestions: As we mentioned in yesterday’s report, a buy from the current H4 demand is most certainly a possibility. H4 candle activity, as far as we see, shows that the bulls likely want to press higher today. Check out the H4 wick seen marked with a black arrow at 1.1227; this wick has already likely consumed a truckload of sellers from the H4 supply marked with a red arrow at 1.1229-1.1211. Therefore, as long as the buyers remain strong above the 1.12 mark, coupled with daily demand at 1.1143-1.1179 bolstering the H4 demand zone, an advance is likely up to H4 supply drawn from 1.1256-1.1265. We would, however, advise waiting for lower timeframe confirmation here guys (for ideas on how to confirm a zone please see the top of this report) since by entering long from this H4 barrier, despite having a daily demand as confluence, you’re still buying against weekly flow (see above in bold).

Levels to watch/live orders:

- Buys: 1.1168-1.1198 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

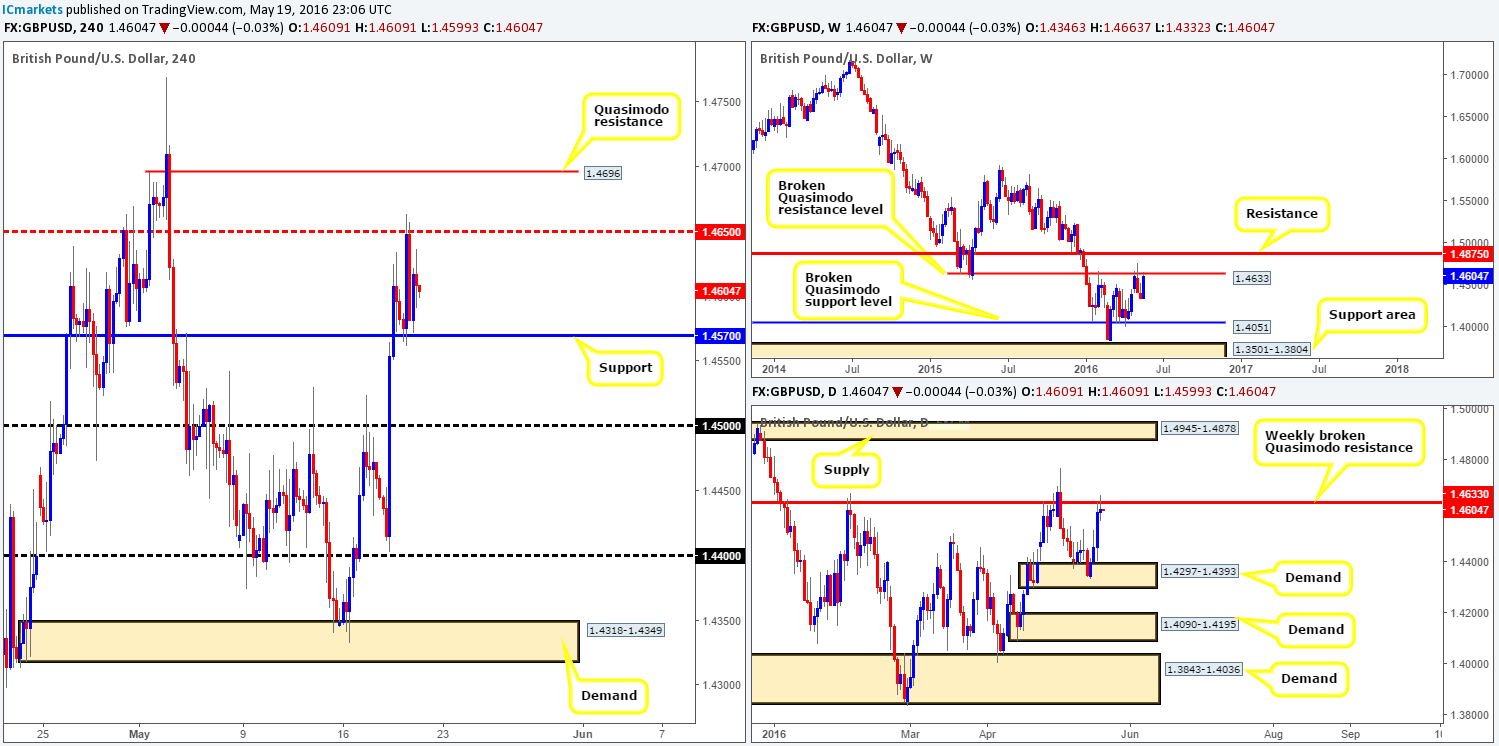

GBP/USD:

In recent trading, Cable retested the H4 support at 1.4570 just beautifully and, fuelled by better-than-expected UK retail sales data, went on to test the H4 mid-way resistance seen at 1.4650. Nevertheless, price quickly retreated from here to end the day trading mid-range between the two aforementioned H4 barriers.

As was discussed in our previous report, the GBP continues to flirt with a broken weekly Quasimodo resistance line at 1.4633. In addition to this, over on the weekly chart on silver (a highly correlating market with the Pound) we can see price has already rebounded from weekly supply at 18.480-17.769, and shows room to continue lower down to weekly support coming in at 16.029. There is still an air of uncertainty surrounding this weekly level on the Pound, however, which was displayed during yesterday’s trading on the daily chart with an indecision candle.

Our suggestions: Given the H4 support 1.4570 and its converging H4 demand seen over on Silver at 16.129-16.325, selling right now, despite where price is positioned on the higher-timeframe structure (see above), is still not something our team is willing to risk. Conversely, buying is also tricky right now considering the overhead resistance lurking nearby on the weekly chart at 1.4633.

Assuming that price closes below the current H4 support line, nonetheless, this will likely attract further selling down to the 1.45 handle. To take advantage of this potential move south (a high-probability trade in our opinion, since you’d be trading WITH weekly flow), one could either sell at market – effectively selling the breakout, or conservatively wait to see if price retests the broken level as resistance and sell with lower timeframe confirmation. For confirmation techniques, please see the top of this report.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to close below 1.4570 and look to trade any retest seen thereafter (lower timeframe confirmation required).

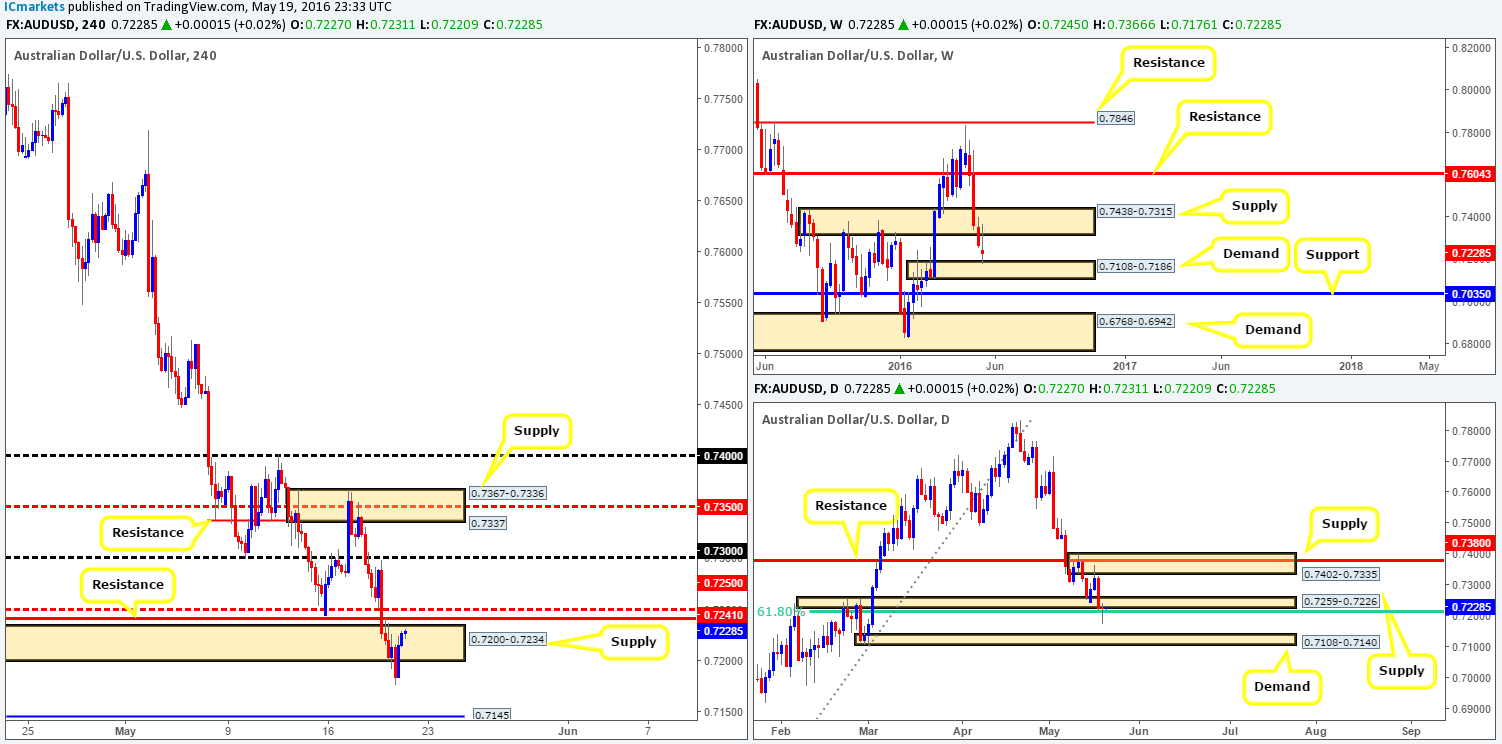

AUD/USD:

Kicking-off our analysis with a quick peek at the weekly chart shows price recently connected with weekly demand at 0.7108-0.7186, which, as you can see, so far looks to be holding firm. On the assumption that the bulls continue to defend this area, it is possible an advance could be seen back up to retest weekly supply logged in at 0.7438-0.7315. Moving down to the daily chart, candle action printed a nice-looking daily buying tail which pierced through the daily 61.8% Fibonacci support at 0.7210. Together with the weekly demand (see above), this daily buying tail could attract further buying into this market today and break through overhead daily supply seen at 0.7259-0.7226.

Stepping over to the H4 chart, the recent selling took out H4 demand at 0.7200-0.7234 and is now seen being retested as H4 supply. This area – coupled with H4 resistance lurking above at 0.7241, H4 mid-way resistance at 0.7250 as well as the small daily supply zone at 0.7259-0.7226, makes it very difficult for us to consider buying from the weekly demand base at the moment.

Our suggestions: The best we feel we can do here, since selling into weekly flow is not something we want to be a part of, is wait and see if price closes above and retests 0.7250 (with lower timeframe confirmation – required to avoid any fakeout that may take place) for a potential move up to the 0.73 handle. If this fails to come to fruition, however, we’ll happily place this pair on the back burner for now and reassess next week.

Levels to watch/live orders:

- Buys: Watch for price to close above 0.7250 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

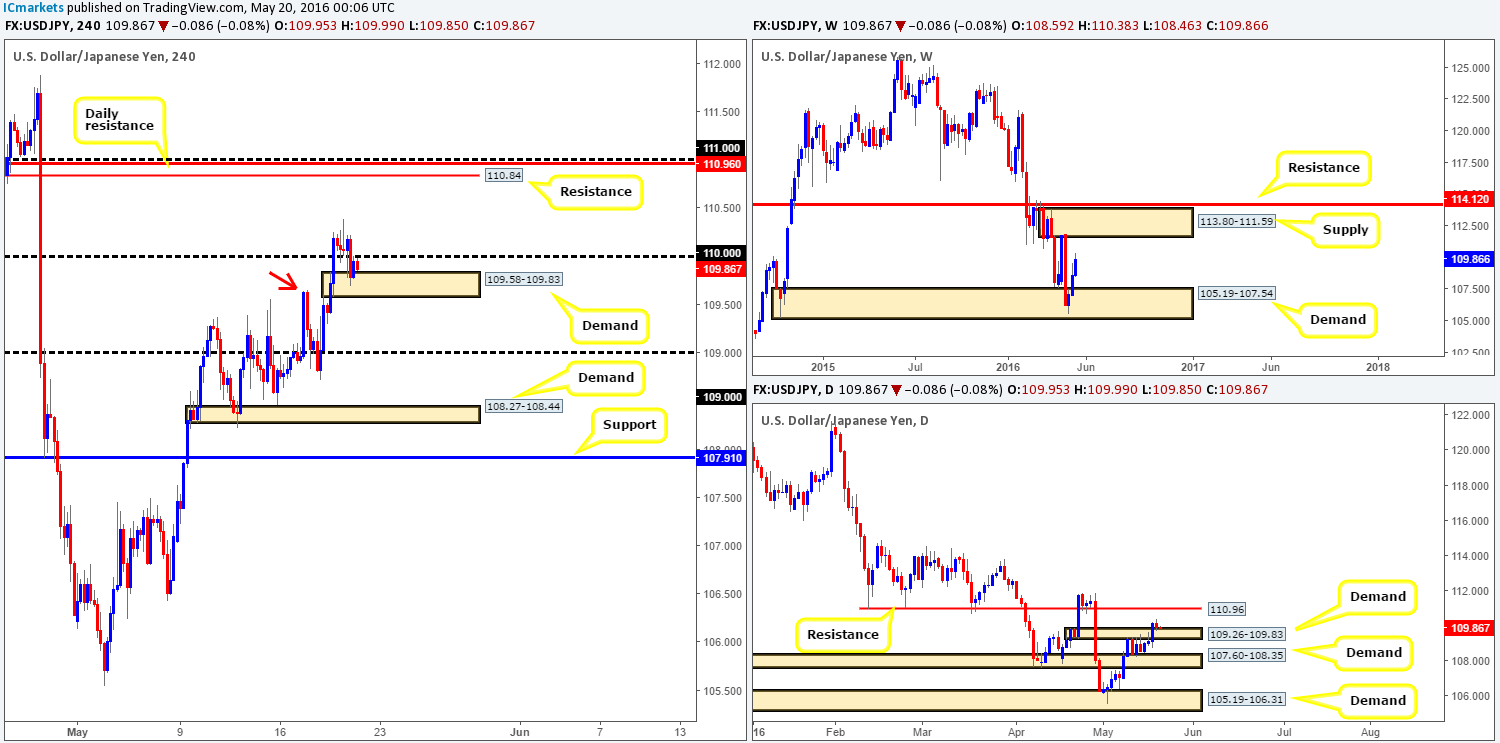

USD/JPY:

For those who read our previous report on the USD/JPY you may recall us mentioning to watch for price to retest the 110 handle and look for a lower timeframe buy entry. There was confirmation seen on the M30 yesterday (tops around the 110.24 region were taken out which followed with a reversal to enter long around the 110 mark), which gave one a chance for a small profit or at worst a breakeven trade.

At the time of writing, the pair has found support around a small H4 demand coming in at 109.58-109.83. Usually we would not consider this area but seeing as how it was a zone formed from the break of the 17th May high 109.65 (red arrow), it does hold some worth in our book. What is more, daily price is also seen retesting daily demand from 109.26-109.83 which shows room to continue north up to 110.96 – a daily resistance line. Furthermore, let’s not forget that weekly buyers continue to push this market higher from weekly demand at 105.19-107.54, likely en-route to weekly supply coming in at 113.80-111.59.

Our suggestions: In light of the above points we still feel this pair wants higher prices. Keep an eye out for a break above and retest of the 110 handle to buy, targeting the 111.00/110.84 area today (formed by a H4 resistance at 110.84, a daily resistance at 110.96 and the 111.00 resistance handle). Again though, we would recommend waiting for a lower timeframe buy setup to form following the retest of 110. A break/retest of supply, a trendline break/retest or simply a cluster of buying tails around the 110 region would be sufficient enough for us. Stops are usually placed 5-10 pips beyond confirming structures.

Levels to watch/live orders:

- Buys: Watch for price to close above 110 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

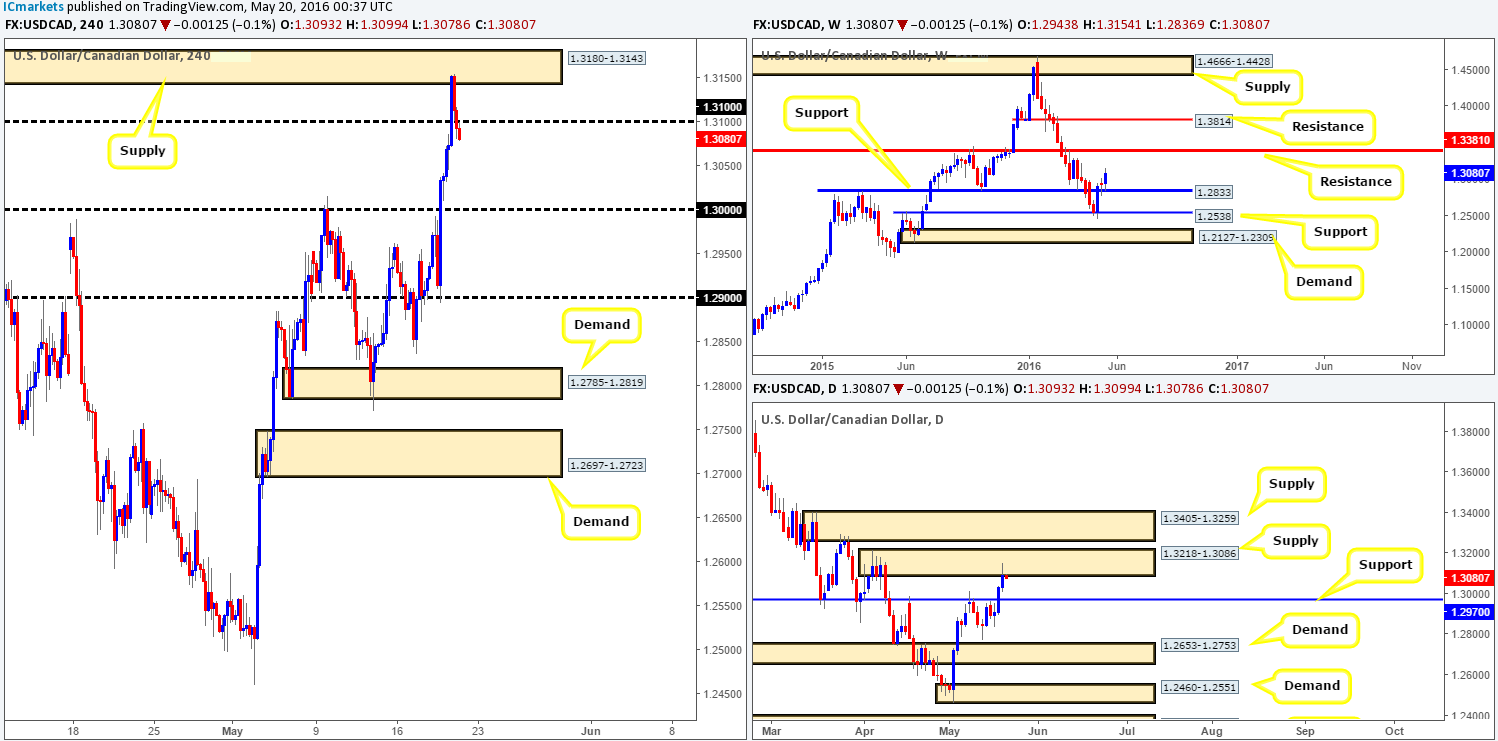

USD/CAD:

From the weekly chart, it’s clear to see that the USD/CAD bulls appear in good form at the moment. Recent action saw the pair extend its bounce from weekly support at 1.2833 to highs of 1.3154, opening up the possibility for further buying up to weekly resistance at 1.3381. Be that as it may, before the weekly bulls can drive this market higher, offers will need to be taken out around daily supply coming in at 1.3218-1.3086, which would immediately place one within the jaws of daily supply drawn from 1.3405-1.3259.

The H4 chart on the other hand shows price reacted beautifully to a H4 supply zone at 1.3180-1.3143 going into yesterday’s American session, consequently squeezing out longs from the 1.31 handle by the close.

Our suggestions: Look for selling opportunities on any retest seen at 1.31 today. With the path looking very clear on the H4 down to the key 1.30 number, and the daily chart showing room for price to decline from the current daily supply down to daily support at 1.2970, we feel selling this market is high probability. Nevertheless, we WOULD NEED to see some form of lower timeframe confirmation following the retest of 1.31 (for confirmation techniques please see the top of this report), due to the weekly picture reflecting more of a bullish stance at the moment (see above).

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.3100 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

USD/CHF:

(Live trade update: Short taken from 0.9883 was stopped out at 0.9917)

Starting from the top this morning, the Swissy pair is now seen trading within touching distance of weekly supply chalked up at 1.0092-0.9928. As far as we’re concerned this area is fresh, thus the chance of a bounce lower from here is very high in our opinion. However, a pullback from this zone may not come into view until price tests the extremes of this weekly supply base. The reason we say this is simply because yesterday’s trading spiked above daily supply at 0.9913-0.9869, and now looks like the pair wants to shake hands with a daily Quasimodo resistance at 1.0037 (lodged within the extremes of the current weekly supply).

With the H4 supply at 0.9913-0.9885 (was housed within the above said daily supply) also now consumed (acting demand), this market is likely going to extend higher. From this angle, upside targets can be seen around H4 mid-way resistance at 0.9950, followed by 1.0000 (parity).

Our suggestions: Our team is bullish this pair at least until parity comes into view. Therefore, if one is able to spot a lower timeframe buy setup from the current H4 demand, it may worth a shot (with lower timeframe confirmation), targeting 0.9950 and closing the remainder at parity (for confirming techniques please see the top of this report). In regards to selling this market, we really like the daily Quasimodo resistance at 1.0037 coupled with parity as a sell zone, which let’s not forget is also housed within the extremes of the above said weekly supply. Therefore, it may be an idea to note this zone down in your watch list for future use.

Levels to watch/live orders:

- Buys: 0.9913-0.9885 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: 1.0037/1.0000 [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

DOW 30:

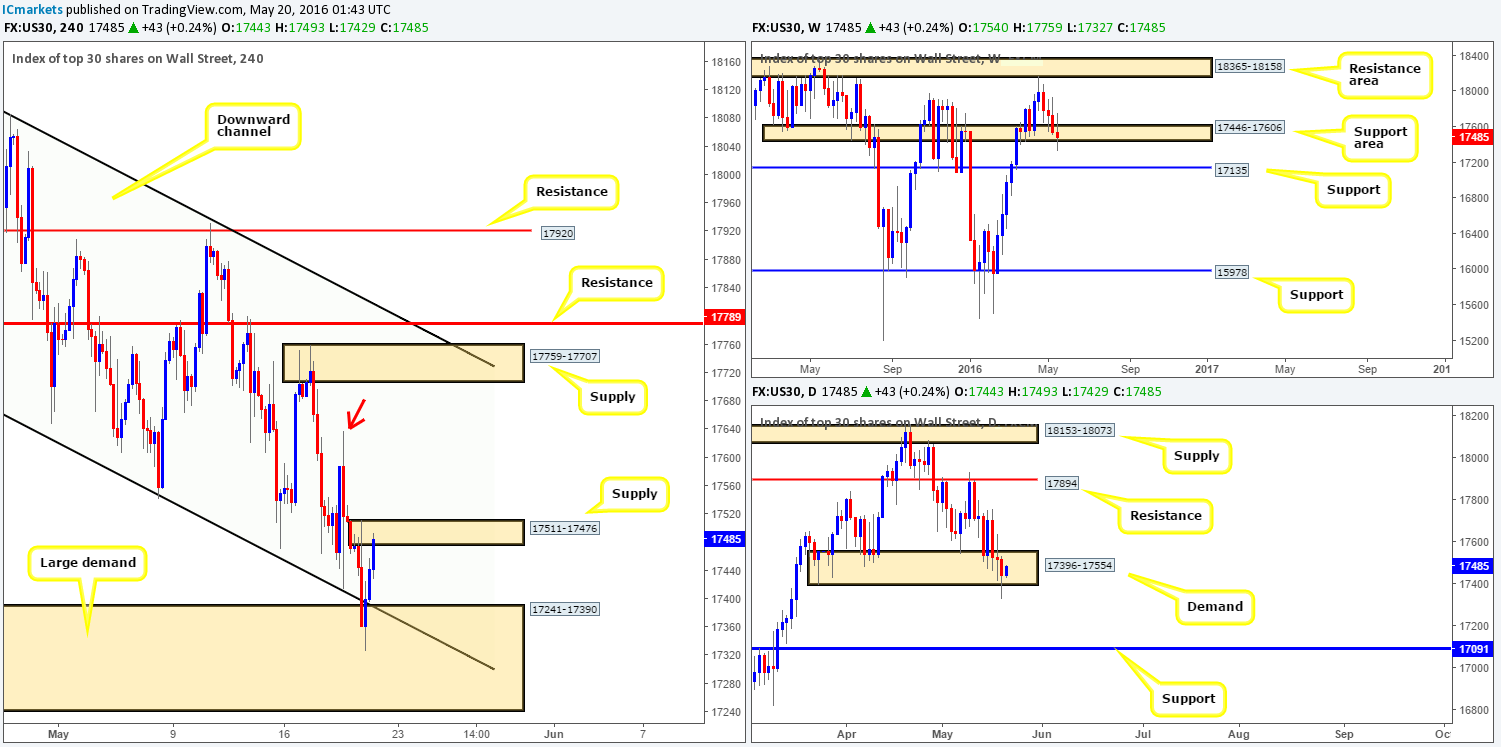

During the course of yesterday’s sessions H4 candle action sold-off early on in the morning, slam dunking price into a rather large H4 demand coming in at 17241-17390. Price then bottomed out going into the American session, and rallied over 100 points higher into the close. Despite this H4 demand also converging with a H4 channel support line taken from the low 17776, we will not be looking to enter long until the H4 supply at 17511-17476 has been consumed.

Over on the bigger picture, however, weekly price remains trading within the support area at 17446-17606 despite spiking lower recently. On a similar note, daily action continues to trade within the daily demand base at 17396-17554. The bid-side of this market continues to look incredibly weak from here, especially with yesterday’s spike south!

Our suggestions: WAIT for the bulls to confirm strength exists in the market! If price closes above the current H4 supply, this suggests (at least to us) there is some tenacity left on the bid-side of this index. Should this come to fruition, we’d be looking to enter long around the top-side of the current H4 demand with a stop below it at 17235, targeting the 18th may high 17637 (red arrow) as a first take-profit target.

Levels to watch/live orders:

- Buys: Watch for a close above H4 supply at 17511-17476 and then look to enter on the retrace around the top-side of H4 demand at 17390 (Stop loss: 17235).

- Sells: Flat (Stop loss: N/A).

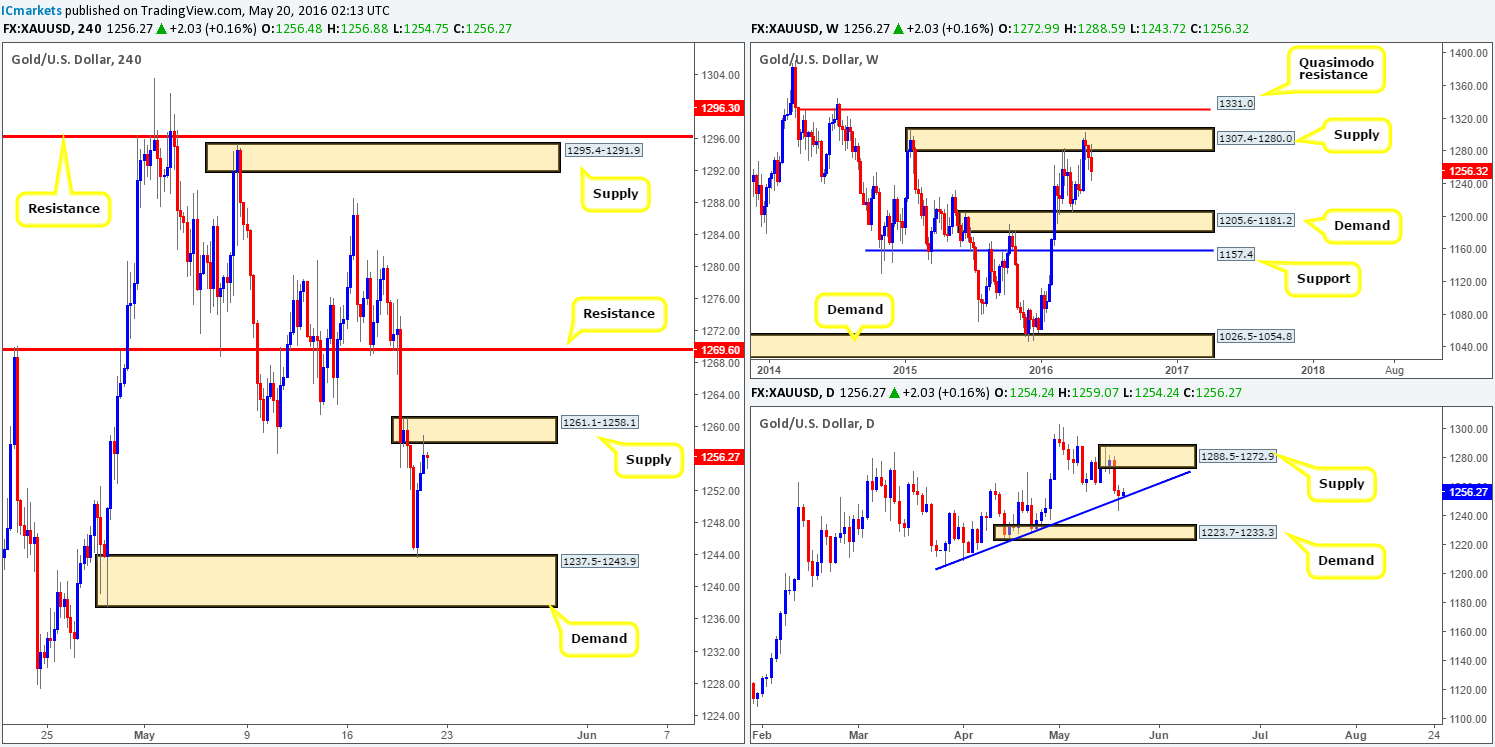

Gold:

Mid-way through London trading yesterday we saw the yellow metal reverse tracks from H4 demand coming in at 1237.5-1243.9, following a rather sharp sell-off earlier on in the day. As of this point gold is seen bumping heads with a H4 supply zone at 1261.1-1258.1, which for now is holding steady. If this area is taken out, the 1269.6 H4 resistance will likely be the next objective to reach.

Now, taking into account that the daily chart shows the buyers have responded relatively well to a daily trendline support extended from the low 1205.4, should we expect the H4 supply zone to be taken out? Not necessarily! Up on the weekly chart, the bears have been stamping down on this market ever since price connected with weekly supply at 1307.4-1280.0 a few weeks ago. Not just this, but since we believe the weekly chart has potential to decline down as far as weekly demand drawn from 1205.6-1181.2, buying this market beyond the current H4 supply would be tricky for us.

Our suggestions: Personally, we feel it may be best to leave to this unit be today. Buying would entail one going against weekly flow, whereas selling puts you against daily flow (see above in bold). Of course, if one wants to attempt a short from the current H4 supply, or buy on any break above it, we would strongly advise waiting for lower timeframe confirmation before risking capital (to see confirming techniques that we use, please scroll to the top of this report).

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).