A note on lower timeframe confirming price action

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

On the back of a rather limited economic calendar the single currency took on more of a sober tone yesterday, with the day’s range not exceeding 60 pips. In addition to this, we can see that price action failed to sustain gains beyond the H4 mid-way resistance 1.1250 on two separate occasions.

From a technical perspective, we feel a close beyond 1.12 is on the cards. Not only do we have the buyers and sellers seen battling for position around the underside of a major weekly resistance area at 1.1533-1.1278, there’s also little bullish intention currently being registered from the top edge of the daily support area at 1.1224-1.1072. Now don’t get us wrong, while there is a possibility of further consolidation around the current daily support area, we feel pressure from the overhead weekly supply will eventually push prices south to test the daily trendline taken from the low 1.0516.

Our suggestions: In the event that the market does indeed close below 1.12, a short trade could be possible on the retest of this number if followed up by a H4 bearish close. Should this come to view, we’d look to take profits at the following structures: the H4 trendline support taken from the low 1.1045 and the H4 demand base seen below it at 1.1131-1.1143. Our ultimate take-profit zone, nevertheless, is seen between the H4 support at 1.1075 and the 1.11 band. Not only is this a good take-profit area, it is also a fantastic barrier to look for longs. It sits within the depths of the aforementioned daily support area, and merges with both the above noted daily trendline support and also a deep H4 88.6% Fib support at 1.1081. Therefore, do keep an eyeball on this area during the week guys!

Levels to watch/live orders:

- Buys: 1.1075/1.11 [strong-looking buy zone which could, dependent on the time of day and approach, be sufficient enough to condone an entry without lower timeframe confirmation] (Stop loss: 1.1060).

- Sells: Watch for price to close below the 1.12 handle and then look to trade any retest seen thereafter (H4 bearish close required prior to pulling the trigger).

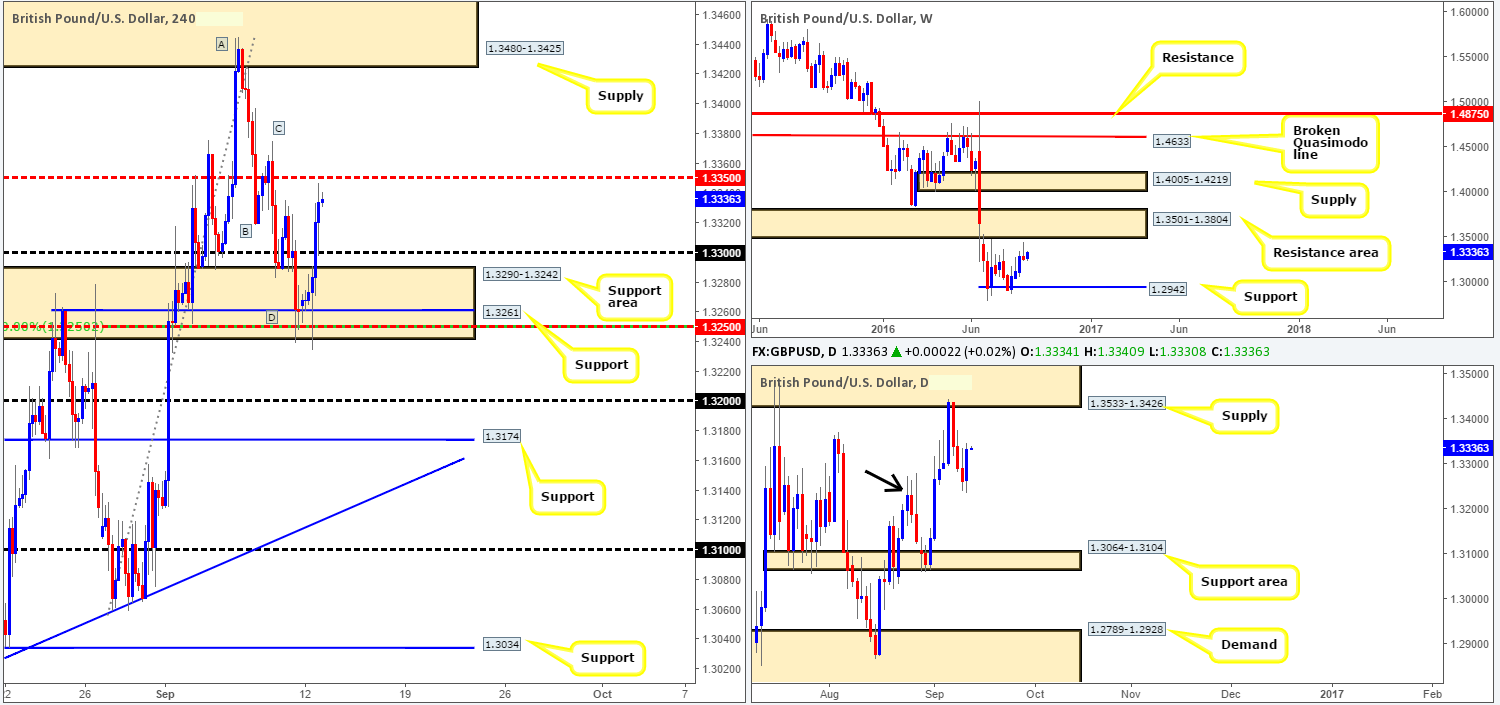

GBP/USD:

In Monday’s report we mentioned that a buy from around the H4 support at 1.3261 was certainly something to consider given its confluence: a H4 mid-level support at 1.1250, a H4 50.0% Fib support around the same level, a H4 AB=CD bullish completion point also seen around the 1.1250ish range and daily support around the 1.3240 area (recently broken highs). Well done to any of our readers who managed to jump aboard this one! We actually took a very small hit here as our stop, rather frustratingly, got tagged at 1.3235! It happens.

In light of yesterday’s daily engulfing candle, we may see H4 price continue to head north up to supply coming in at 1.3480-1.3425 (positioned within daily supply at 1.3533-1.3426). Therefore, a decisive close above the H4 mid-way resistance 1.3350 is certainly something to keep a finger on today.

Our suggestions: Quite simply, watch for a close above 1.3350. This – coupled with a retest and a H4 bullish close, our team may, dependent on the time of day (we have UK CPI data scheduled for release today at 9.30am GMT), look to enter long, targeting the above said H4 supply base.

Levels to watch/live orders:

- Buys: Watch for price to close above 1.3350 and then look to trade any retest seen thereafter (H4 bullish close required following the retest).

- Sells: Flat (Stop loss: n/a).

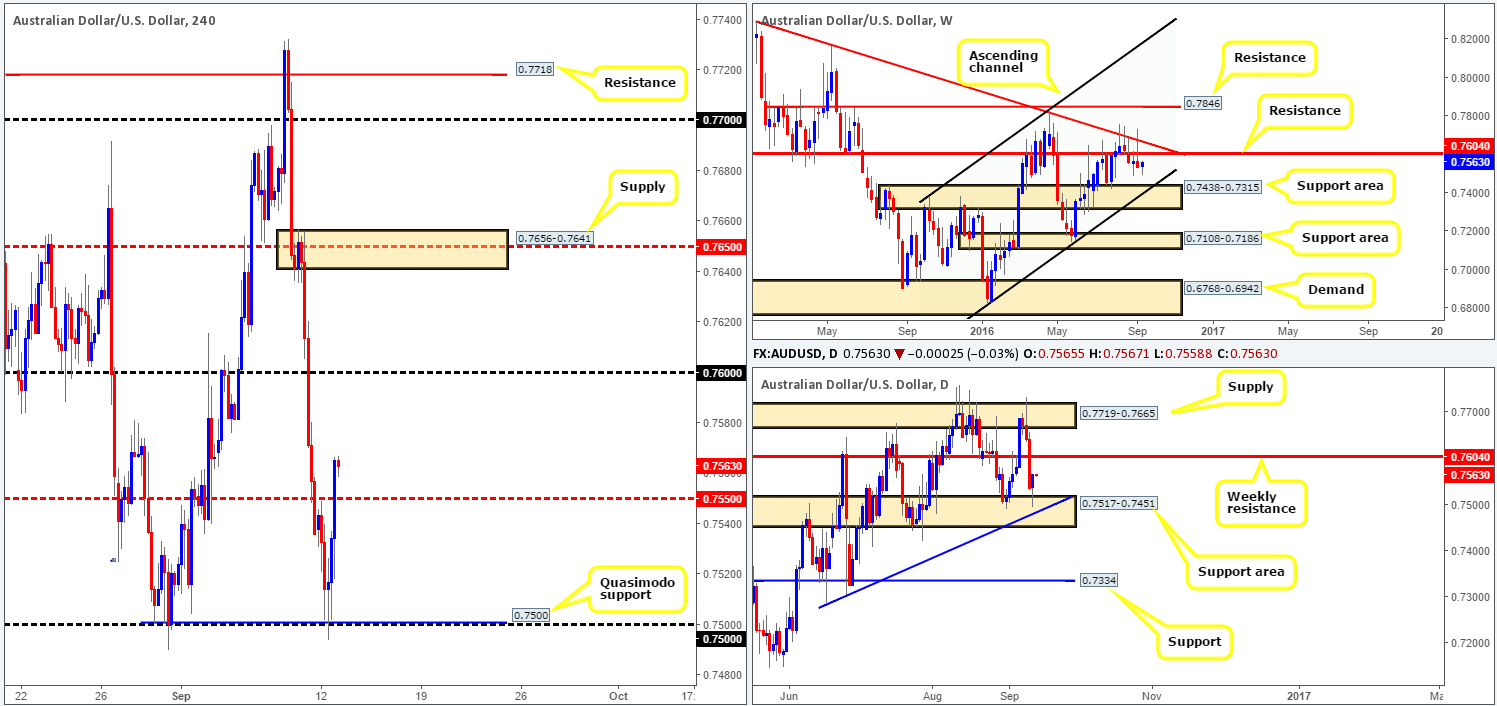

AUD/USD:

For those who read our previous report on the AUD/USD pair you may recall us mentioning that the H4 Quasimodo support at 0.7500 was an interesting place for longs. Given that there was little news around the time it connected with this level, our team entered long at 0.7501 with a stop placed below at 0.7485. The reasons behind taking this position, as we mentioned in Monday’s analysis, was simply due to it converging with the 0.75 handle and sitting within a daily support area drawn from 0.7517-0.7451. So while we took a small hit on the GBP/USD trade, we managed to recoup this loss and some. We’ve now taken 50% of the position off the table at 0.7550 and reduced risk to breakeven. In view of the strong break seen above 0.7550, we are now looking for price to marry up with the 0.76 handle (which also represents weekly resistance at 0.7604) before liquidating the remaining 50%.

For traders who missed this buying opportunity, there may be a chance to join this move should price retest 0.7550 today. We would not advise trading this line without waiting for at least a bullish H4 close though since fakeouts are extremely common around fixed psychological bands.

Levels to watch/live orders:

- Buys: 0.7501 [live] (Stop loss: breakeven).

- Sells: Flat (Stop loss: n/a).

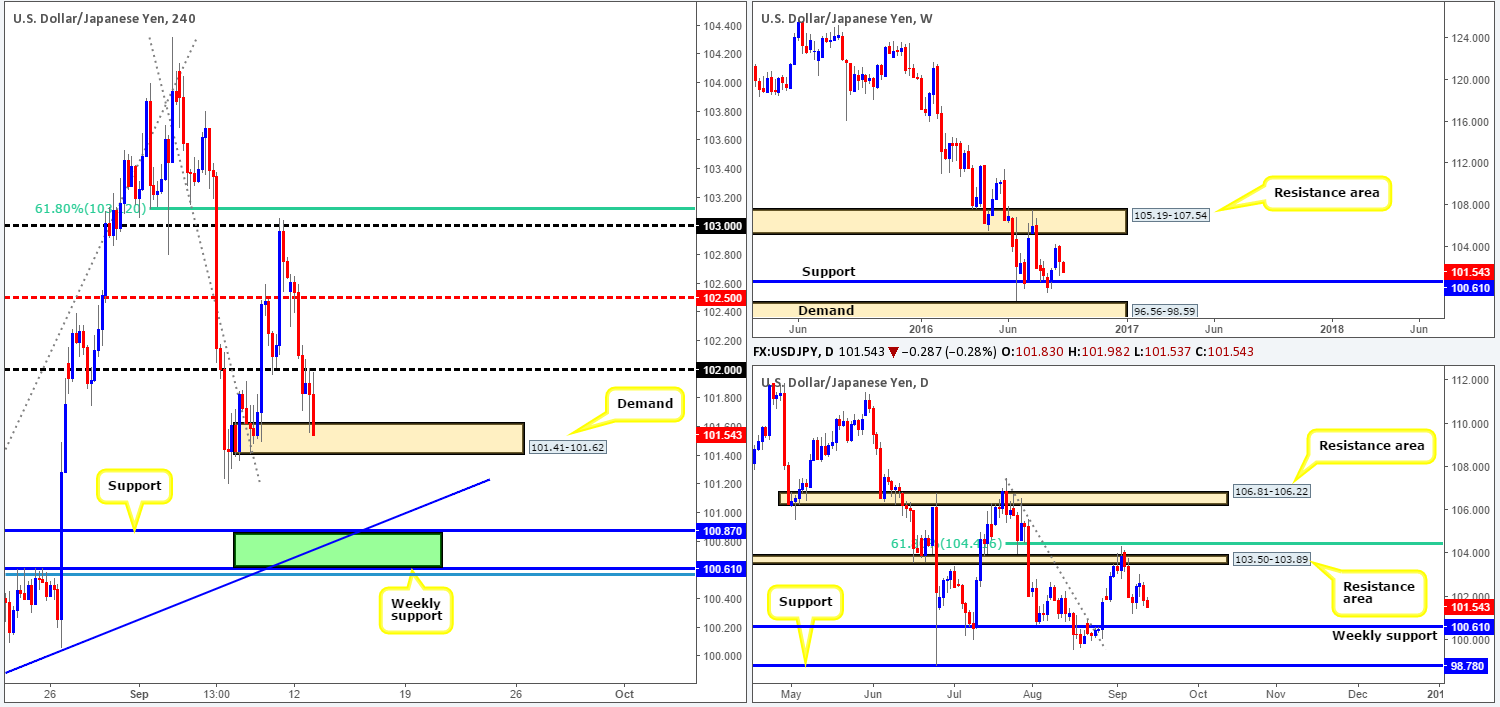

USD/JPY:

Following the week’s open, the USD/JPY initially steadied itself around the H4 mid-way support 102.50, before aggressively collapsing down to and beyond the 102 handle. As of now, we can see that price is capped by 102 and a H4 demand base seen at 101.41-101.62.

In that price was unable to retake the 102 handle after price struck the top edge of the above said H4 demand area, we feel like this zone may be on the verge of giving way. With that in mind, today’s spotlight will firmly be focused on the H4 support at 100.87 and the weekly support at 100.61 (green rectangle). Bolstered by a H4 trendline support taken from the low 99.64 as well as a H4 78.6% Fib support at 100.56 (light blue line), this zone, in our view, boasts enough confluence to buy from here without requiring the backing of lower timeframe confirmation.

Levels to watch/live orders:

- Buys: 100.88 (Stop loss: 100.48).

- Sells: Flat (Stop loss: n/a).

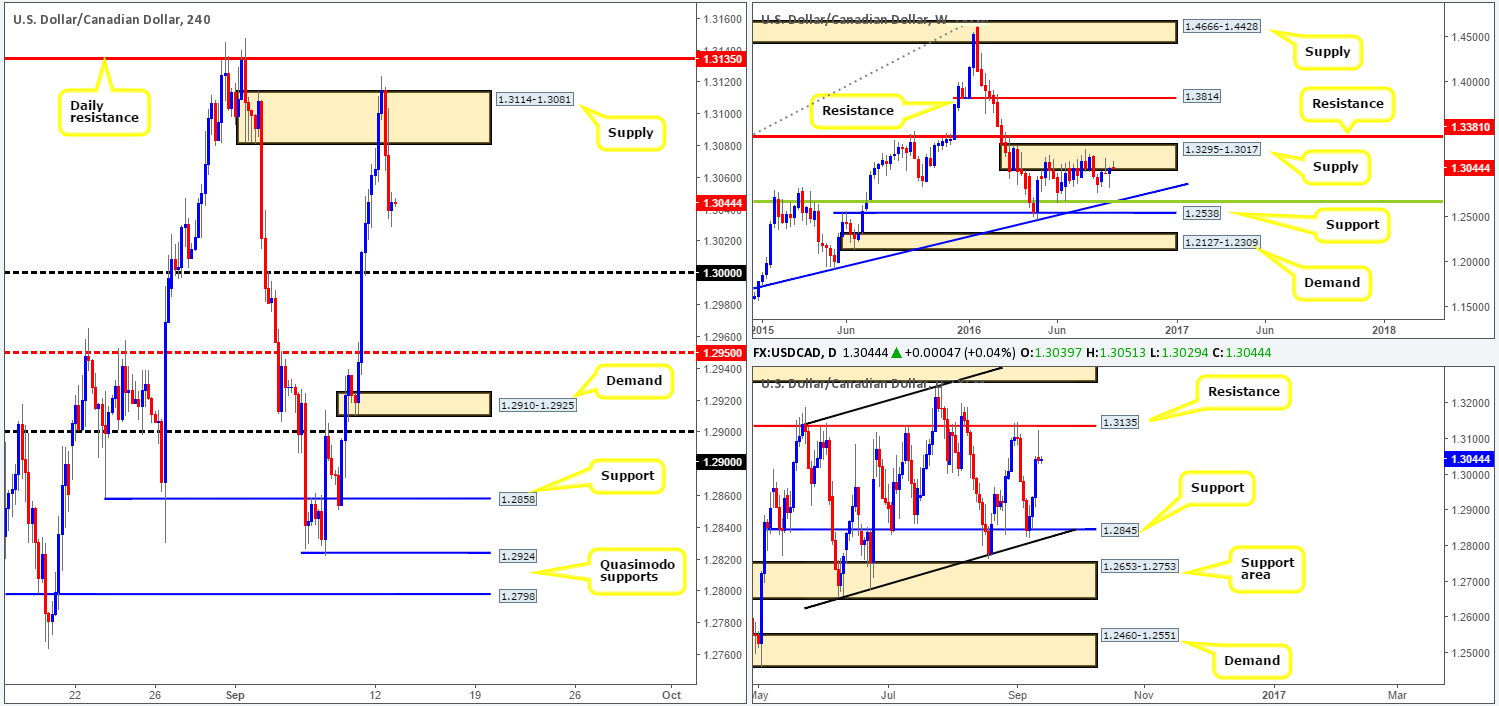

USD/CAD:

The USD/CAD, as you can see, started the week on a solid footing. This saw prices rally and slightly breach the H4 supply base coming in at 1.3114-1.3081, leaving the daily resistance level sitting just above it at 1.3135 unchallenged. However, following this, the pair began to top out going into yesterday’s London lunchtime and ended the day settling just below Friday’s close.

What with yesterday’s daily selling wick printing just ahead of the aforementioned daily resistance level, and the buyers and sellers battling for position over on the weekly chart around supply at 1.3295-1.3017, there’s a strong possibility that price is heading back to test the key figure 1.30 today.

Our suggestions: While the 1.30 handle is likely to hold prices higher today, we would not stamp this number as a high-probability reversal zone. Reason being is simply because of what we’re currently seeing on the higher-timeframe picture right now (see above). Therefore, what our team is looking for today is a decisive close beyond 1.30, followed by a retest and a H4 bearish close. Should this come into sight, we’d look to short, targeting the H4 mid-way support 1.2950, and then, with as little bit of luck, the H4 demand at 1.2910-1.2925/1.29 handle.

Levels to watch/live orders

- Buys: Flat (Stop loss: n/a).

- Sells: Watch for price to close below 1.30 and then look to trade any retest seen thereafter (H4 bearish close required following the retest).

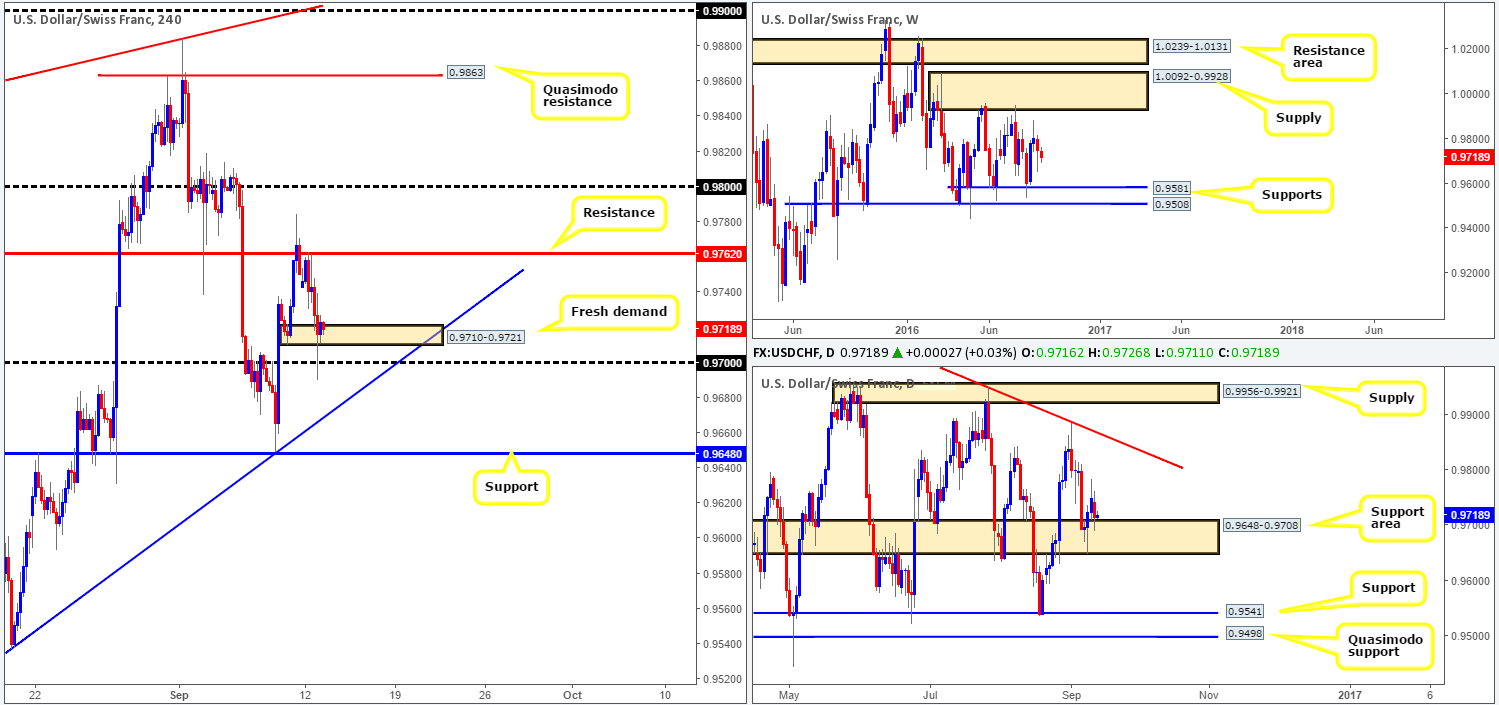

USD/CHF:

Shortly after the market opened on Sunday, the USD/CHF tagged the underside of H4 resistance at 0.9762, which continued to hold the candles lower throughout the course of yesterday’s sessions. The day, as can be seen from the H4 chart, ended with price whipsawing through a fresh H4 demand zone at 0.9710-0.9721, which as expected, went on to tag in bids around the 0.97 handle.

Looking over to the higher timeframes, we can see that weekly action has been consolidating between a supply zone painted at 1.0092-0.9928 and a support band drawn from 0.9581 since the beginning of May. Down on the daily chart, nevertheless, the Swissy remains reinforced by a support area at 0.9648-0.9708. As we mentioned in Monday’s weekly report, with weekly price seen loitering mid-range between the above said structures, and daily price reflecting more a bullish stance from the current daily support area, it’s likely we’ll see prices head north at least until we collide with the daily trendline resistance taken from the high 1.0256.

Our suggestions: Keep an eye on the lower timeframe action around the current H4 demand area today. In the event that we manage to pin down a lower timeframe buy setup here (see the top of this report for lower timeframe entry techniques), we’ll buy this market, targeting 0.9762 as our immediate take-profit area, followed by the 0.98 handle and then the daily trendline resistance mentioned above.

Levels to watch/live orders:

- Buys: 0.9710-0.9721 [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: n/a).

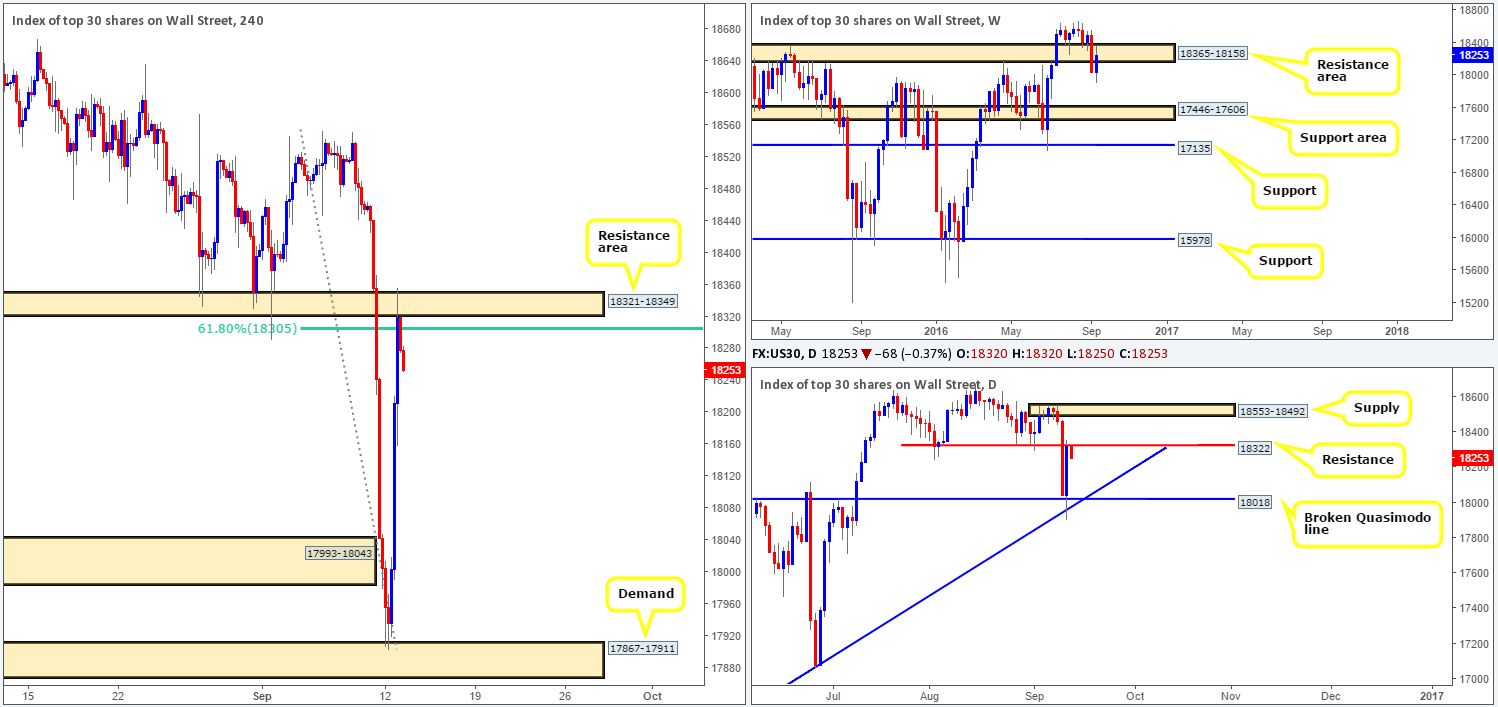

DOW 30:

Starting from the weekly chart this morning, we can see that following last week’s push south the index has since retested the underside of the recently broken support area at 18365-18158. Assuming that this area holds form, further selling from this point could potentially drag the equity market down to a support area carved from 17446-17606. The story on the daily chart, however, shows price rebounded beautifully from a broken Quasimodo line at 18018 yesterday which fused with a trendline support extended from the low 15501. The rotation here has, as you can see, brought prices up to resistance drawn from 18322 (positioned within the aforementioned weekly resistance area), which so far appears to be holding ground.

Stepping across to the H4 arena, yesterday’s action ignored H4 demand at 17993-18043 and pressed lower to test the H4 demand seen below it at 17867-17911. The response from here was almost instant and consequently brought the DOW up to a resistance area given at 18321-18349 (houses the above said daily resistance line and merges quite closely with a H4 Fib 61.8% resistance at 18305).

Our suggestions: Technically speaking, there is very little stopping this market from sliding lower today. That being the case, should price retest the above noted H4 resistance area once again, we’ll be looking to short this beauty with the backing of a lower timeframe sell signal (see the top of this report for lower timeframe entry techniques), targeting the H4 demand at 17867-17911.

Levels to watch/live orders:

- Buys: Flat (Stop loss: n/a).

- Sells: 18321-18349 [tentative – lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area).

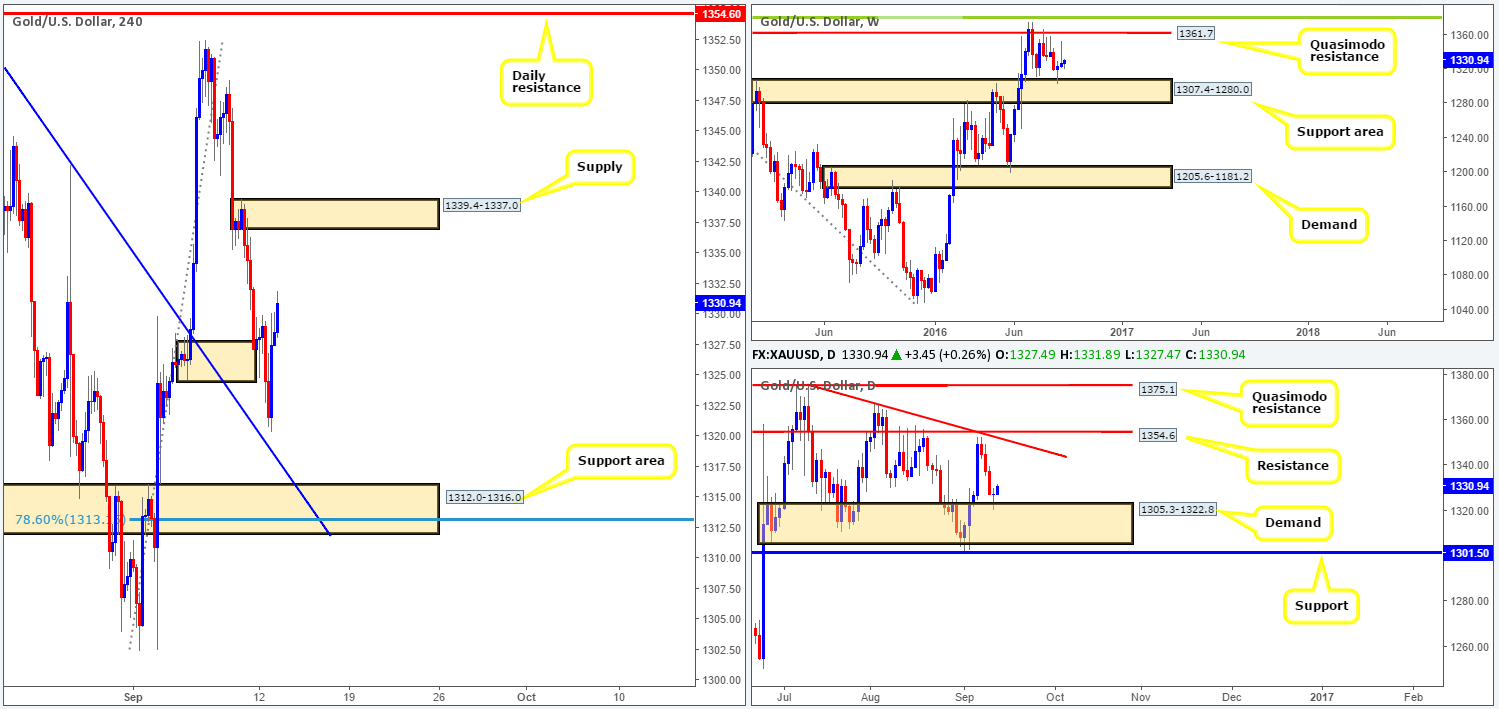

GOLD:

During the course of yesterday’s trading, we saw the yellow metal fake below H4 demand at 1324.6-1327.7 and miss the H4 trendline support (1355.9) by only a few pips, before rotating back to the upside and ending the day just below Friday’s close. Technically speaking, the recent push north can likely be attributed to daily demand coming in at 1305.3-1322.8. The big question now is, however, where does one go from here considering that weekly price is currently trading mid-range between a support area at 1307.4-1280.0 and a Quasimodo resistance line at 1361.7? Well the general sentiment of the team is prices will likely push north up to H4 supply drawn in at 1339.4-1337.0. However, apart from the H4 support barrier seen below at 1312.0-1316.0 (merges with the above said H4 trendline support and also a H4 78.6% Fib support at 1313.1), we see very little support to buy from.

Our suggestions: Given the points made above, our team has come to a consensus that should price pull back and attack the current H4 support area today, our team would consider longs (dependent on how H4 action responds to the zone). In the event that this does not happen, remaining flat in this market seems the more logical route to take in our opinion.

Levels to watch/live orders:

- Buys: 1312.0-1316.0 [H4 bullish close required] (Stop loss: below the trigger candle).

- Sells: Flat (Stop loss: n/a).