Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

US dollar index (USDX):

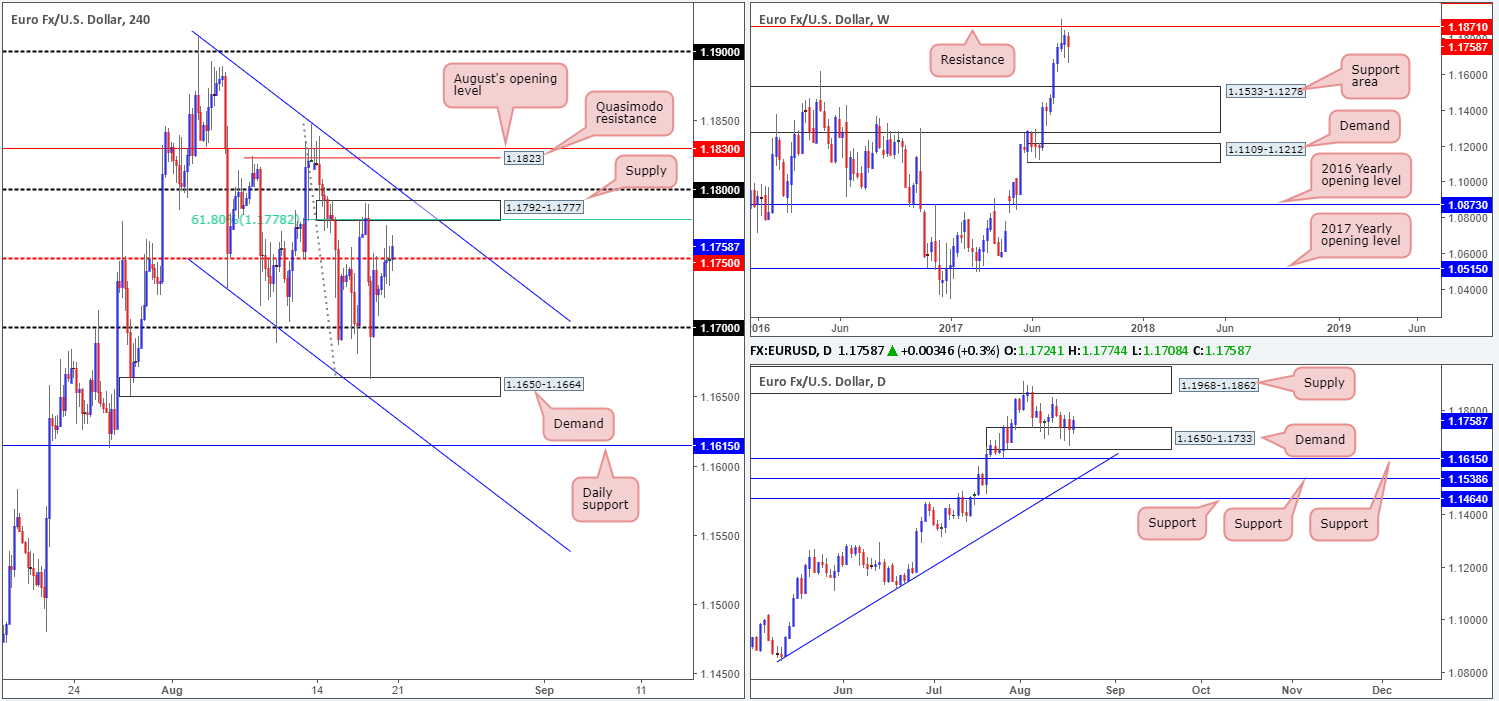

EUR/USD:

Weekly gain/loss: – 63 pips

Weekly closing price: 1.1758

Despite weekly action seen trading from resistance at 1.1871, price has yet to generate anything noteworthy to the downside. A similar picture can be seen on the US dollar index (USDX), only inverse from a weekly support drawn in at 11854. A violation of the current resistance level directly exposes another resistance pegged at 1.2044 (not seen on the screen), whereas a move south from current price could see the unit drive into a large support area at 1.1533-1.1278.

Down on the daily timeframe, demand at 1.1650-1.1733 elbowed its way back into the picture early last week and held firm. If this area caves in, a nearby support is seen lurking below at 1.1615. In addition to this, traders may have also noticed that the USDX is trading from daily demand at 11899-11932, which may suggest buyer weakness from 1.1650-1.1733.

A quick recap of Friday’s sessions on the H4 timeframe shows the shared currency inched higher, marginally closing the day above the mid-level resistance 1.1750. For breakout traders looking to buy here, you may want to take note that there’s limited upside potential from this angle. Directly above sits a supply positioned at 1.1792-1.1777, which intersects with not only a 61.8% Fib resistance at 1.1778 (taken from the high 1.1847), but also a channel resistance extended from the high 1.1910 and the psychological handle 1.18. Further adding to this, we can see that the USDX H4 candles are trading from a trendline support extended from the low 11853.

Suggestions: While it’s tempting to look for a shorting opportunity from the noted H4 supply given its surrounding confluence, one still has to remain cognizant of the current daily demand! For that reason we’re going to approach this market conservatively. Waiting for additional H4 candle confirmation to form from the H4 supply mentioned above at 1.1792-1.1777 in the shape of a full, or near-full-bodied bearish candle, is the safer route to take we believe.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.1792-1.1777 ([waiting for a reasonably sized H4 bearish candle to form – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

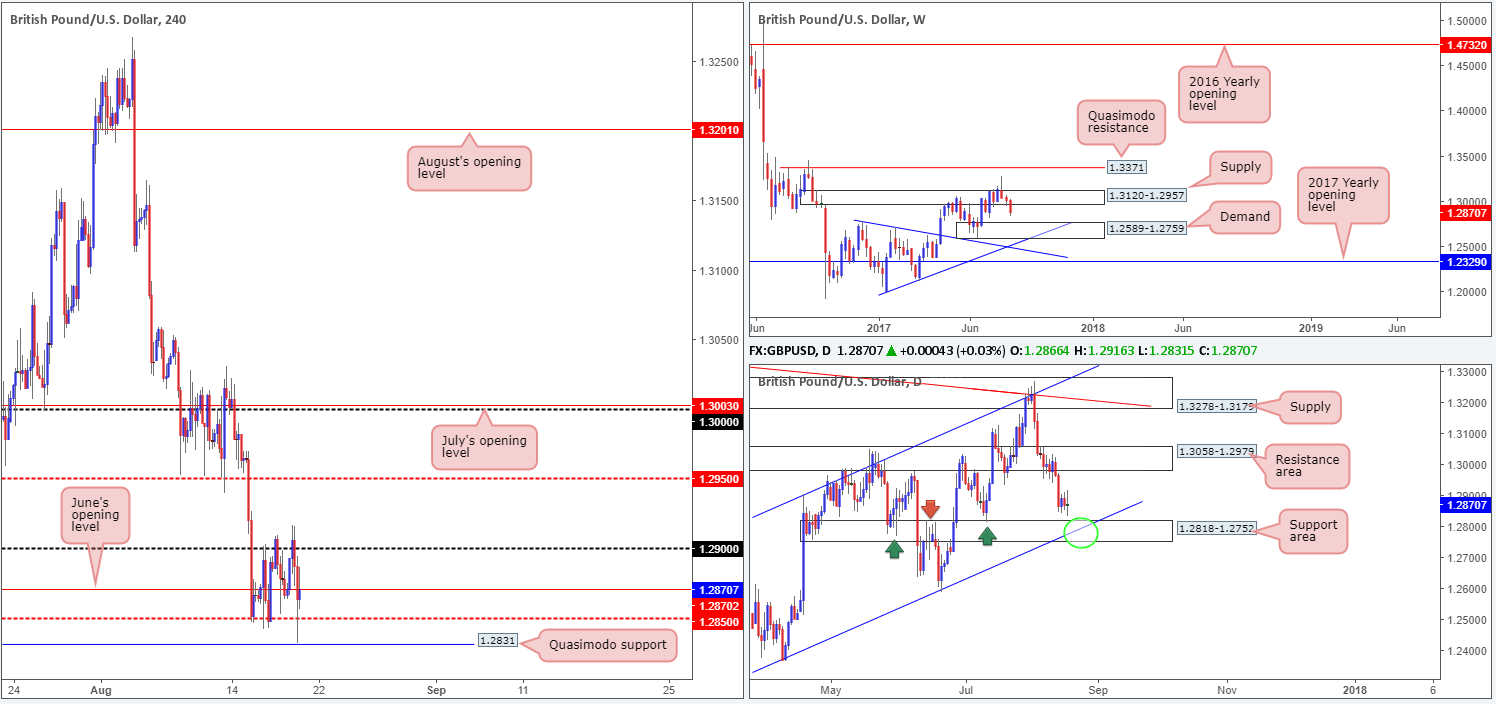

GBP/USD:

Weekly gain/loss: – 138 pips

Weekly closing price: 1.2870

Last week’s sharp run to the downside pushed the British pound into further losses, stripping close to 150 pips off its value. From the weekly timeframe, the next notable area to keep an eye on is the demand base coming in at 1.2589-1.2759. What’s also notable from a technical perspective on this chart is the two intersecting trendline supports positioned just beneath the demand zone (1.2774/1.1986).

Meanwhile, on the daily timeframe there’s a nearby support area marked at 1.2818-1.2752, seen intersecting nicely with a channel support line etched from the low 1.2365 (green circle). Also of particular interest is this area happens to be glued to the top edge of the aforementioned weekly demand.

Since Tuesday, the H4 candles have been consolidating between the 1.29 handle and the mid-level support at 1.2850 (encased within this range is June’s opening level at 1.2870). Early on in Friday’s US segment, nevertheless, the pair whipsawed through the lower edge of this range, and came within a few pips of testing a Quasimodo support level printed at 1.2831.

Suggestions: In view of the unit’s close proximity to the top edge of the daily support area at 1.2818, we have our eye on the 1.28 handle drawn on the H4 timeframe for possible longs. Given the support and resistance delivered from this psychological band in the past, and its connection with the converging daily support area and channel support, we feel a long from here is high probability.

However, since round numbers are prone to fakeouts, we would not feel comfortable placing pending orders here. Instead, we’ll wait for a H4 bull candle to form in the shape of a full, or near-full-bodied candle, before pulling the trigger. As for take-profit targets, we’ll be looking to the 1.2850 neighborhood as the initial area of concern.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: 1.28 region ([waiting for a reasonably sized H4 bullish candle to form – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

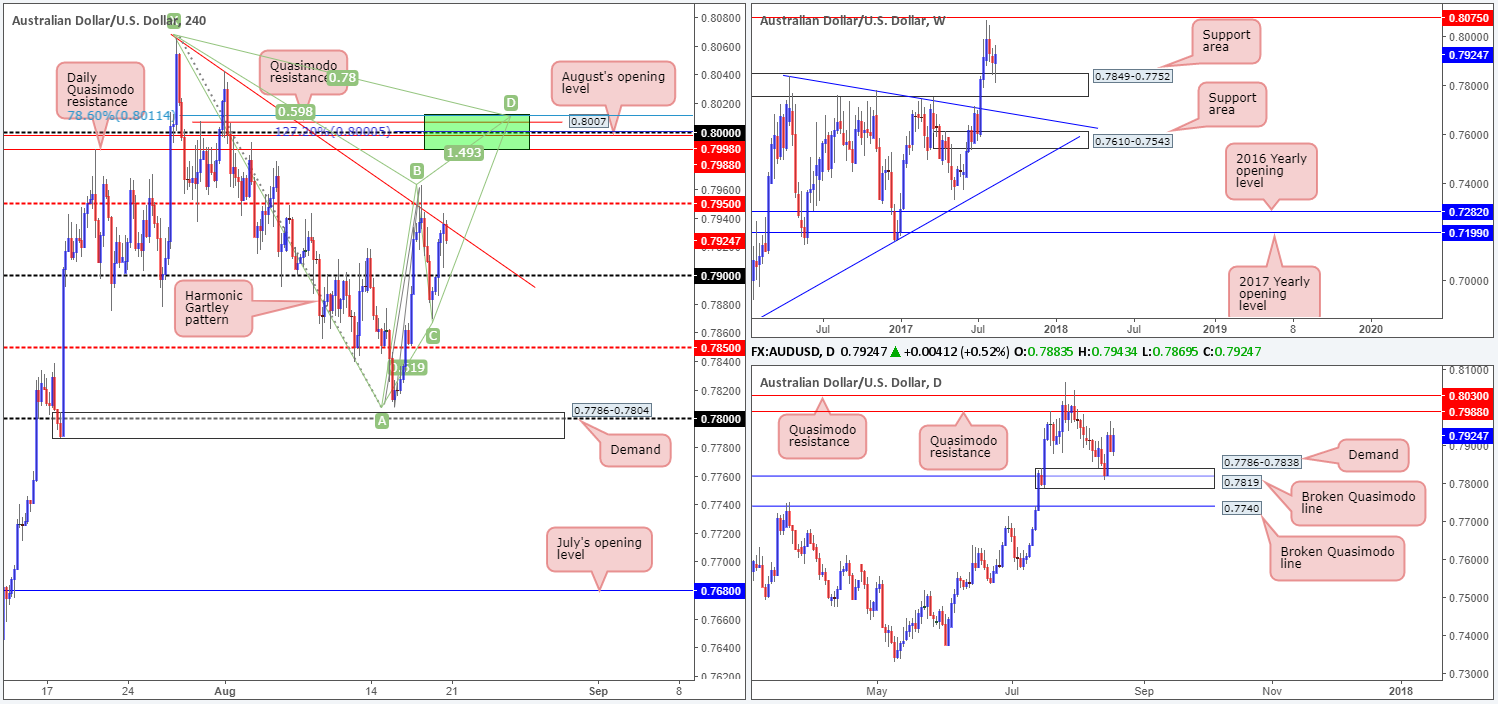

AUD/USD:

Weekly gain/loss: + 32 pips

Weekly closing price: 0.7924

Over the course of last week’s trading, the commodity currency remained above the weekly support area coming in at 0.7849-0.7752. Providing that the bulls continue to bid this market higher from here, the next upside target can be seen at 0.8075: a resistance that stretches as far back as September 2008.

The response from the weekly support zone, coupled with daily flow bouncing from a demand base seen at 0.7786-0.7838 (encases a broken Quasimodo level at 0.7819), could lead to a move north up to the Quasimodo resistance level at 0.7988 sometime this week.

A brief look at recent dealings on the H4 timeframe, however, shows price reclaimed the 0.79 handle and ended the day shaking hands with a trendline resistance extended from the high 0.8065. Consequent to this recent movement, the large psychological 0.80 level has appeared on our radar. Apart from 0.80 being a watched round number, there are several nearby structures that deserve mention:

- The daily Quasimodo resistance level at 0.7988.

- A H4 Quasimodo resistance level at 0.8007.

- A H4 127.2% Fib ext. point at 0.80 taken from the low 0.7807.

- August’s opening level at 0.7998.

- A H4 Harmonic Gartley reversal point at the 78.6% Fib resistance line drawn from 0.8011.

Suggestions: While the above structures (H4 green sell zone) boast attractive confluence, one must take into account the possibility that a fakeout may be seen up to the daily Quasimodo resistance level at 0.8030 sited just above the green zone. Traditionally, when trading the Gartley Harmonic pattern the stop-loss order should go beyond the X point (0.8065). If you were to follow this, a fakeout up to the daily Quasimodo resistance is not a concern. It is more for the aggressive traders who will likely look to position stops just beyond the green zone. Should you be one of those traders, you may want to consider waiting for the H4 candles to prove seller intent (in the form of either a full, or near-full-bodied candle), before pressing the sell button. This will help avoid a fakeout should it occur.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.8011/0.7988 (stop loss: either wait for a H4 bearish candle to form in the shape of a full, or near-full-bodied candle, and place stops above the candle’s wick. Another option is to simply enter at 0.80 and place stops above the H4 Harmonic X point at 0.8067).

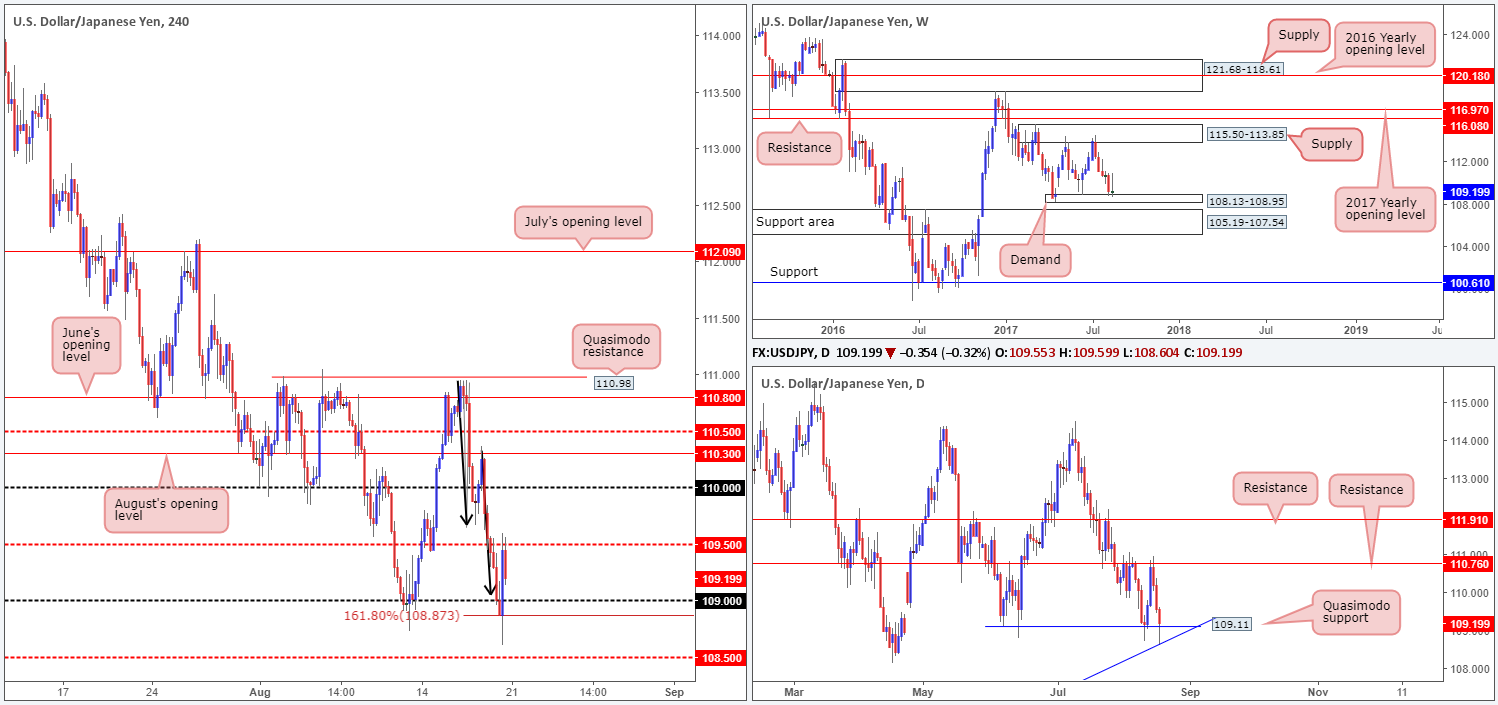

USD/JPY:

Weekly gain/loss: + 2 pips

Weekly closing price: 109.19

USD/JPY prices are little changed this morning, despite the pair ranging 230 pips last week. Weekly price, as you can see, struggled to gain momentum from the demand area at 108.13-108.95 and, as a result, has recently chalked up an inverted pin-bar candle. To candlestick enthusiasts, this is considered a buy signal.

After a rather dominant selloff from the daily resistance at 110.76 last week, daily price ended the week retesting a Quasimodo support at 109.11 and its converging trendline support etched from the low 100.08. To our way of seeing things, apart from 17/04/17 low 108.13, the next support hurdle on the hit list (should the current daily supports give way that is) is seen as far down as the broken daily Quasimodo support drawn from 106.81.

Looking at the H4 timeframe this morning, Friday’s trade saw price aggressively whipsaw through both the 109 hurdle and AB=CD (black arrows) 161.8% Fib ext. point 108.87, and end the week retesting the mid-level resistance at 109.50. A close above 109.50 would, in our humble opinion, be a sign of strength from both the weekly and daily supports currently in play.

Suggestions: Essentially, we’re going to be watching for the H4 candles to close above 109.50. This – coupled with a retest at this mid-level number and a H4 bullish rotation candle (preferably a full, or near-full-bodied candle) would, in our view, be enough to justify a long entry. As far as targets go, the daily resistance at 110.76 is of interest, but it’d be great if we could trail this beauty as far north as the weekly supply coming in at 115.50-113.85.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 109.50 and then look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bullish candle to form following the retest – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

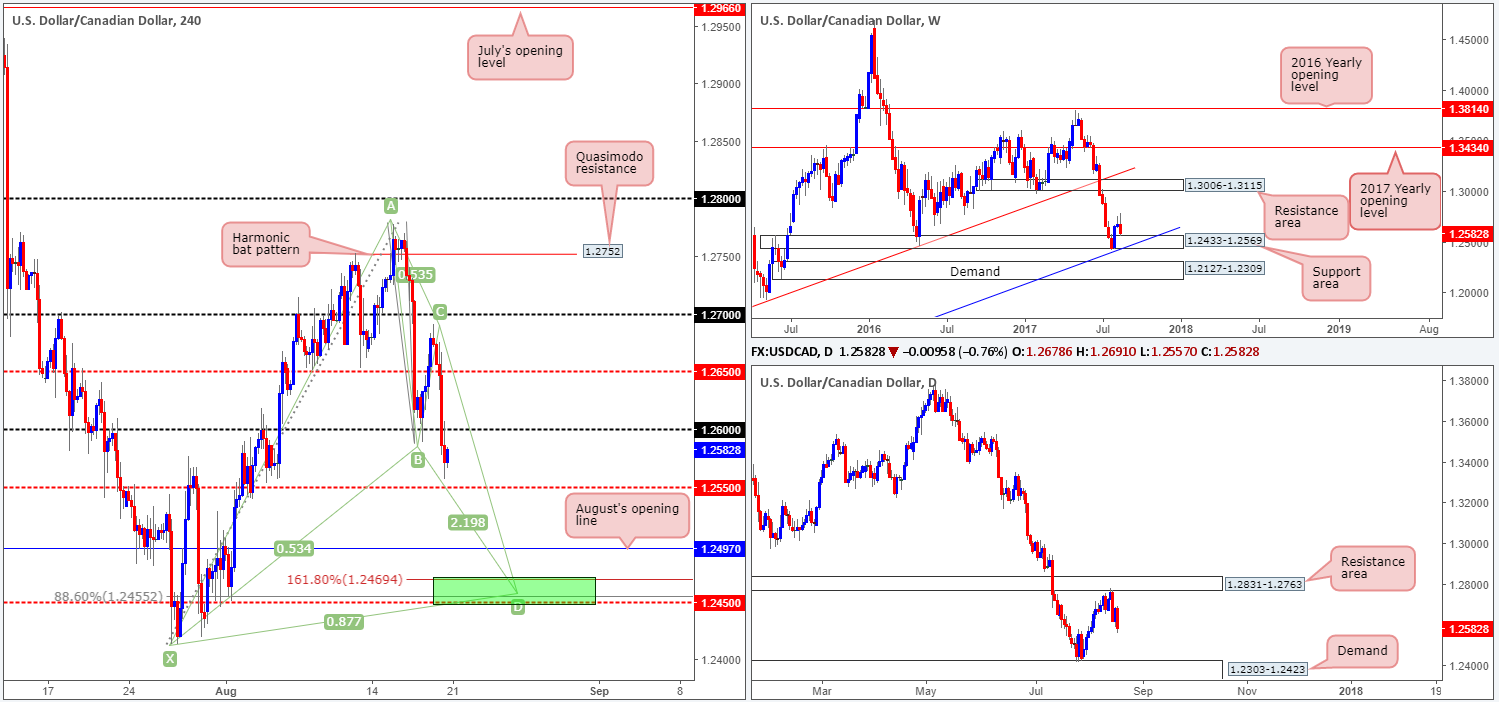

USD/CAD:

Weekly gain/loss: – 95 pips

Weekly closing price: 1.2582

Despite the stronger-than-expected rebound seen from the weekly support area given at 1.2433-1.2569 three weeks ago, weekly sellers came into the fray last week and retested the top edge of this zone.

Technically speaking, the selloff was likely due to the daily resistance area coming in at 1.2831-1.2763. Should the bears continue to dominate from this zone, the next area on the hit list is the demand penciled in at 1.2303-1.2423 (positioned just below the aforementioned weekly support area).

Looking across to the H4 timeframe, nonetheless, we have a beautiful Harmonic bat pattern forming. Not only is the powerful XA retracement (88.6% Fib retracement at 1.2455) located just ahead of the mid-level support 1.2450, it is also positioned within the noted weekly support area and its converging weekly trendline support taken from the low 0.9633.

Suggestions: In the event that the Harmonic pattern completes, we will be interested buyers here. Additional confirmation, in our opinion, is not required since we can comfortably place stops beyond the X point (1.2413). Given the lack of economic data in the market, however, it is doubtful we’ll see this area come into view today. So, we’d advise setting an alert at this zone as this will be an area that’ll likely come into play later on in the week.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: 1.2450 (stop loss: 1.2411).

- Sells: Flat (stop loss: N/A).

USD/CHF:

Weekly gain/loss: + 28 pips

Weekly closing price: 0.9646

The weekly trendline resistance extended from the low 0.9257 was brought into view over the past few weeks. The bearish selling wick recently printed from this line has, in our opinion, firmly placed the weekly support area at 0.9443-0.9515 back on the hit list.

Also of particular interest is the daily timeframe. The chart shows room for the pair to trade as far down as support coming in at 0.9546, which happens to unite with a channel support etched from the low 0.9438 and a AB=CD 127.2% Fib ext. at 0.9532.

Bouncing over to the H4 timeframe, the 0.96 handle bolstered the market on Friday. This, as you can see, brought price action up to within shouting distance of June and August’s opening levels at 0.9680/0.9672. Seeing as how there’s space for the market to trade lower on the higher timeframes, the two noted monthly levels could be an area for a potential short trade today. Still, with the 0.97 handle lurking just above here, a fakeout through the two monthly levels could be seen.

Suggestions: Wait for a H4 bearish candle to take shape from 0.9680/0.9672. Ideally the candle should be in the shape of a full, or near-full-bodied candle. This, to us, shows seller intent and is a strong signal that the trade will move in favor.

Data points to consider: No high-impacting events scheduled to be released today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.9680/0.9672 ([waiting for a reasonably sized H4 bearish candle to form – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

DOW 30:

Weekly gain/loss: – 171 points

Weekly closing price: 21694

The US equity market sustained further losses for a second straight week, erasing over 170 points. The move forced the index to shake hands with weekly demand seen at 21462-21645. In view of the incredibly strong uptrend this market has been in since, well, forever, we feel the current demand will hold ground this week.

Converging nicely with the top edge of the weekly demand is a daily AB=CD (black arrows) 127.2% Fib ext. point at 21683, and a daily 50% support line at 21680 drawn from the low 21192. Having seen little buyer intent generated from this line, we’re eyeing the daily support level seen below it at 21541 for longs, which happens to fuse with a daily AB=CD 161.8% Fib ext. point at 21549.

- Buys: 21541 region (stop loss: beyond the daily low marked with a green arrow at [21462] at 21460).

- Sells: Flat (stop loss: N/A).