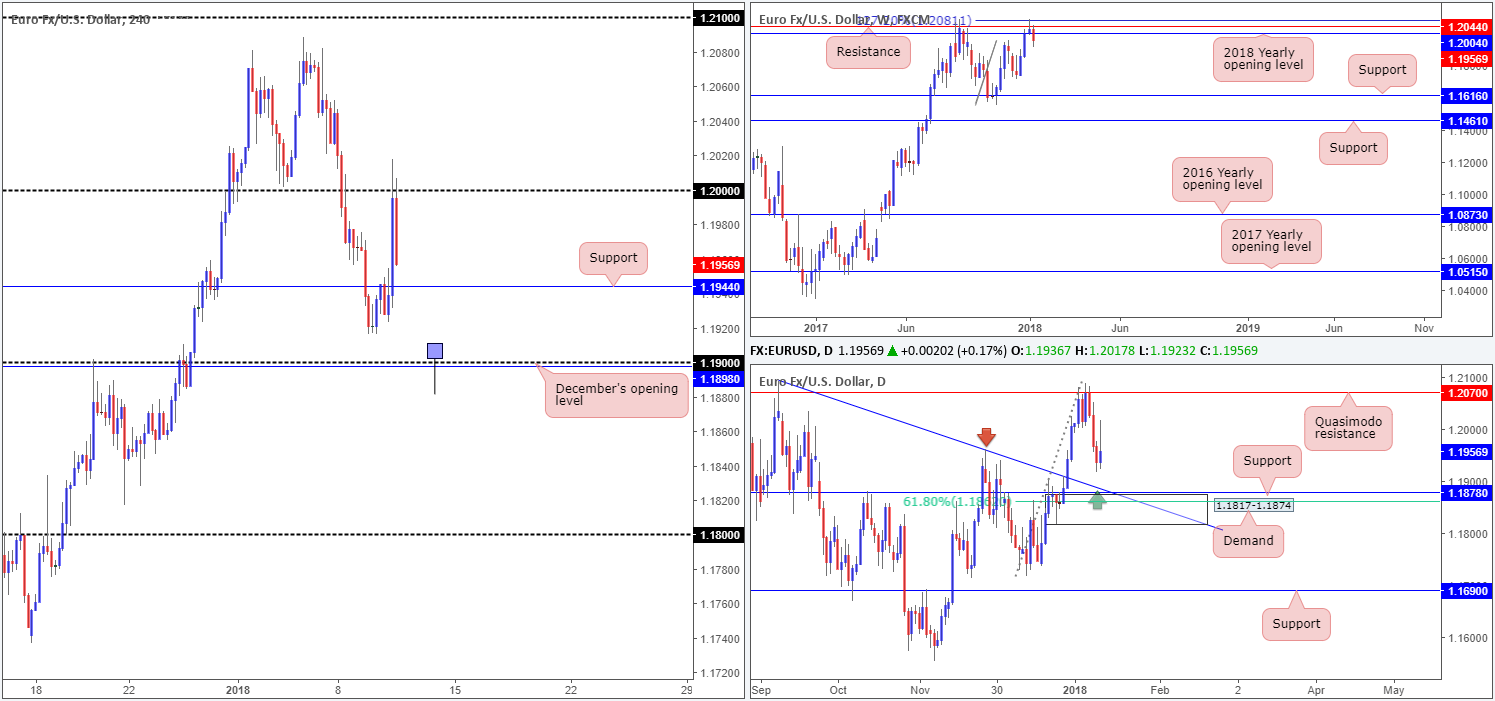

EUR/USD:

Despite displaying early signs of bearish intent around H4 resistance at 1.1944 on Wednesday, the pair gathered momentum and quickly rose higher amid the London morning segment. As you can see, H4 price succeeded in shaking hands with the large psychological band 1.20 and predictably offered market participants a stable line of resistance. Bolstered by a conservative influx of US dollar buying (see US dollar index from lows of 91.92), the euro is now currently on course to revisit the recently broken H4 resistance (now acting support) mentioned above at 1.1944.

Weekly structure, as noted in previous reports, continues to reflect a bearish position. Last week’s trade chalked up a weekly bearish selling wick around both a weekly resistance level at 1.2044 and a 127.2% weekly Fib ext. point at 1.2081. So far this week, we’ve seen weekly price breach nearby support in the form of the 2018 yearly opening level at 1.2004.

Daily structure, on the other hand, remains trading within shouting distance of a particularly interesting daily demand base at 1.1817-1.1874. Besides the nearby daily support level pegged at 1.1878, we can also see a daily trendline taken from the high 1.2092 merging with this area alongside a 61.8% daily Fib support level at 1.1862. Nevertheless, is the daily confluence sufficient enough to warrant a long entry? Does it tilt the odds knowing that the 1.19 handle (H4 timeframe) is placed above the aforementioned daily structures (possibly encouraging a fakeout through this level into daily demand)?

Market direction:

Technically speaking, there is a chance that weekly sellers could run through the noted daily area, given the lack of nearby support seen on that scale. Therefore, to be on the safe side, waiting for either a full or near-full-bodied daily bull candle to form from the daily zone, or a H4 buying tail to penetrate 1.19 and test the top edge of the daily demand (as drawn on the H4 chart) may be the better path to take. This, in our opinion, will help confirm buyer intent.

Data points to consider: ECB monetary policy meeting accounts at 12.30pm; US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 1.19 handle; 1.1898; 1.1944; 1.1878; 1.1817-1.1874; 1.1862.

Resistances: 1.2081; 1.2044; 1.20 handle.

GBP/USD:

The GBP/USD pair, as you can see, remains locked between the 1.35 handle and December’s opening level seen on the H4 timeframe at 1.3529, despite striking a session high/low of 1.3562/1.3481 on Wednesday.

Beyond 1.35, there’s space for the H4 candles to challenge a green area sited at 1.3448-1.3467 (comprised of a H4 AB=CD [see black arrows] 127.2% ext. point at 1.3462/1.3467, a H4 mid-level support at 1.3450 and the top edge of a H4 demand at 1.3429-1.3448).

A quick look at the weekly timeframe shows the GBP/USD advanced for a third consecutive session during the course of last of last week’s trading. This lifted the pair to a weekly high of 1.3612 and enabled the unit to shake hands with a weekly channel resistance extended from the high 1.2673. In the case that this channel is engulfed, the path north should be clear up to a nearby weekly resistance plotted at 1.3683. A rejection of the channel, however, could face opposition from the 2018 yearly opening level seen on the weekly timeframe at 1.3503. Turning our focus to the daily timeframe, a daily Quasimodo resistance at 1.3618 can be seen providing additional mettle for the aforementioned weekly channel resistance. Further selling on this scale could see price approach a daily demand printed at 1.3331-1.3387, which happens to merge with a daily trendline support taken from the low 1.2108.

Market direction:

A deep fakeout below 1.35 is, given the lack of change seen to structure on Wednesday, still a possibility, in our opinion. This could, with a little elbow grease, see H4 price test the aforesaid green H4 zone and rebound higher. It’s important to remember that we’re not only dealing with the 1.35 level here; we’re also working with the 2018 yearly opening level mentioned above. And considering this level is of the higher timeframes, a 30-pip fakeout is minor league in the grand scheme of things.

Conservative traders, nonetheless, might want to wait for the fakeout to take place, and also postpone pulling the trigger until a H4 break above December’s opening level is seen, since this could prove a troublesome resistance. This would, in our book of technical setups, be considered a strong indication that price is headed up to at least the 1.36 handle/daily Quasimodo resistance at 1.3618 as an initial target.

Data points to consider: BOE credit conditions survey at 9.30am; US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 1.3503; 1.35 handle; 1.3331-1.3387; daily trendline support.

Resistances: Weekly channel resistance; 1.3683; 1.3618; 1.3529.

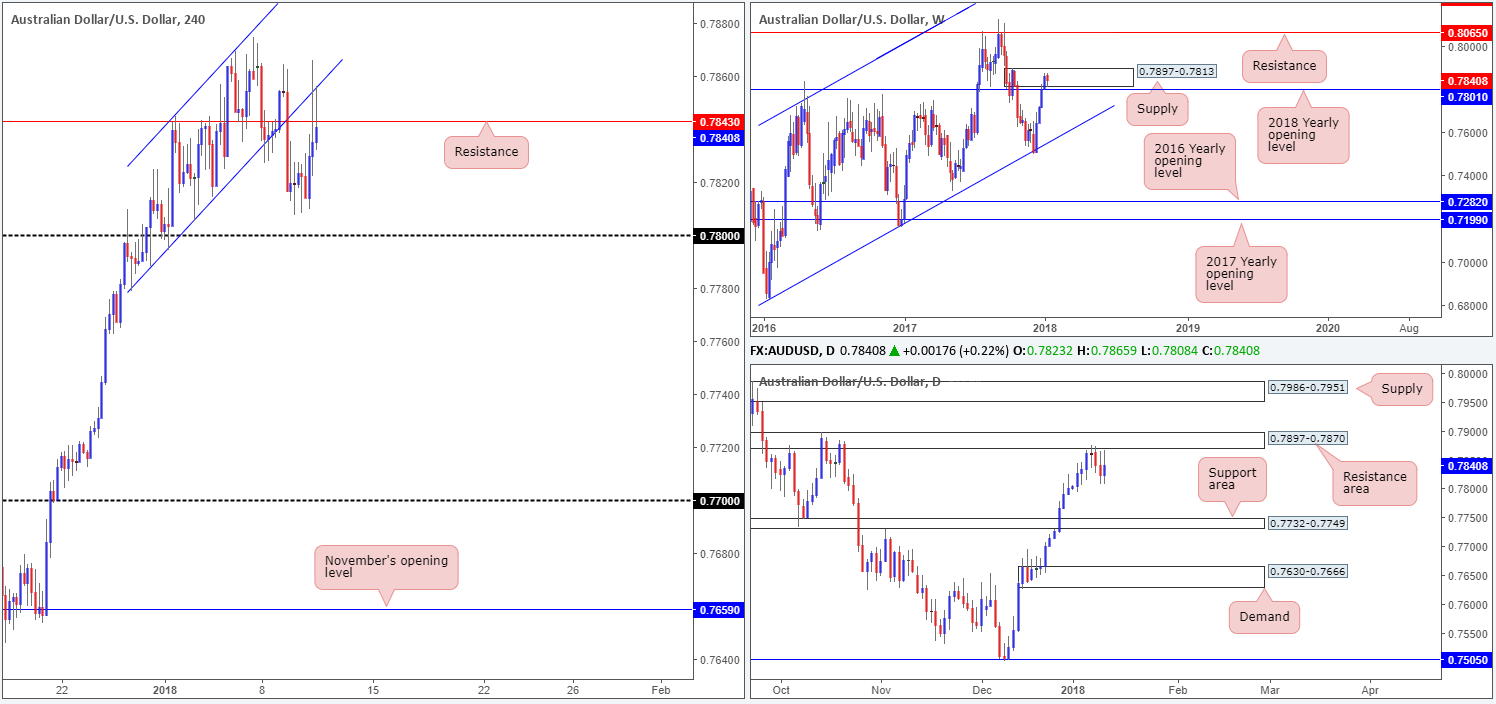

AUD/USD:

In recent sessions, we’ve seen the AUD/USD ease off from highs of 0.7865, following a modest bout of buying on the back of a declining US dollar. Despite an earnest attempt to breach both H4 resistance at 0.7843 and the recently broken H4 channel support-turned resistance taken from the low 0.7778 on Wednesday, the bulls have so far been unable to muster enough strength on this occasion.

This likely has something to do with the fact that weekly price is seen trading within the walls of a supply seen at 0.7897-0.7813, and bearish intent being seen from a daily resistance area at 0.7897-0.7870. However, from a technical standpoint, a break beyond the 2018 yearly opening level seen on the weekly timeframe at 0.7801 will, at least in our book, need to be seen before a bearish bias is confirmed from the current weekly supply.

Market direction:

Despite H4 price showing rejection off a resistance level, the unit’s close proximity to the 0.78 handle and the 2018 yearly opening level mentioned above at 0.7801 is slightly menacing for a sell. Should a clean (H4) break below 0.78 take place, then, as far as we can see, downside is free to challenge the daily support area at 0.7732-0.7749: the next downside target on the daily scale.

As such, waiting for a break below and retest of 0.78, with an initial target objective set at 0.7750 (essentially the top edge of the current daily support area), could be something to consider today.

Data points to consider: US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 0.7801; 0.7732-0.7749; 0.78 handle; 0.7750.

Resistances: 0.7897-0.7813; 0.7897-0.7870; 0.7843; H4 channel resistance.

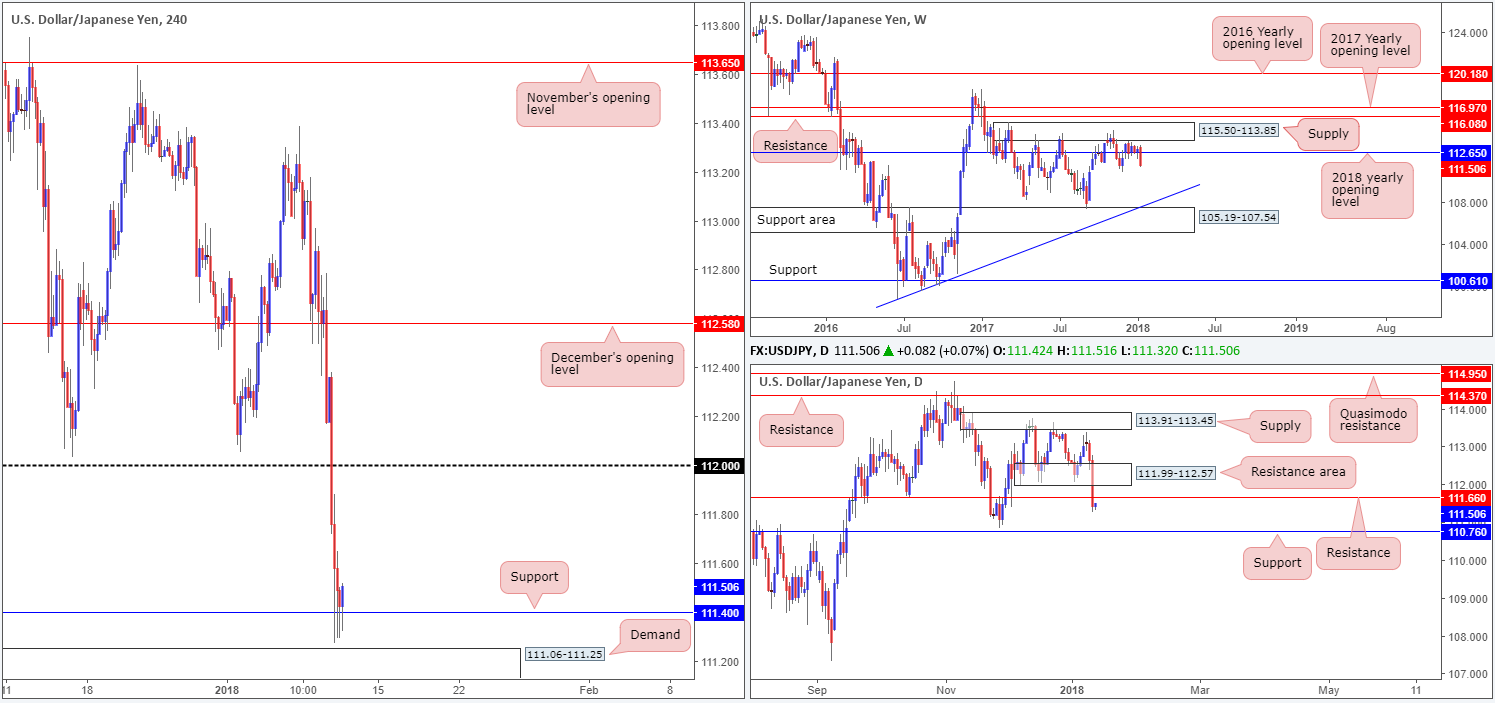

USD/JPY:

Sliding 1.07%, bearish sentiment intensified on Wednesday, breaking multiple tech supports along the way! Tuesday’s segment saw the Japanese yen appreciate after the BoJ announced the cut back of its bond purchases in the long end of the curve. Wednesday’s extension, as far as we can see, was due to officials in China reviewing the nation’s foreign-exchange holdings and recommending a slowing or halting of purchases of US debt (Bloomberg).

As can be seen on the H4 timeframe, the unit ended the day mildly paring losses from 111.40: Dec 1 low, which happens to be situated just ahead of a clean H4 demand base located at 111.06-111.25.

According to daily structure, the recent break of daily support at 111.66 (now acting resistance) has opened up the path south down to daily support pegged at 110.76. Be that as it may, knowing that there is a collection of H4 supports in play, selling this market on the basis of a violation of daily support is, at least in our view, not a high-probability setup.

Market direction:

With limited space seen to the downside right now, as well as little agreement being seen between H4/daily structures, we feel that opting to stand on the sidelines may, once again, be the best route to take today.

Data points to consider: US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 111.06-111.25; 111.40; 110.76.

Resistances: 112 handle; 111.99-112.57; 111.66.

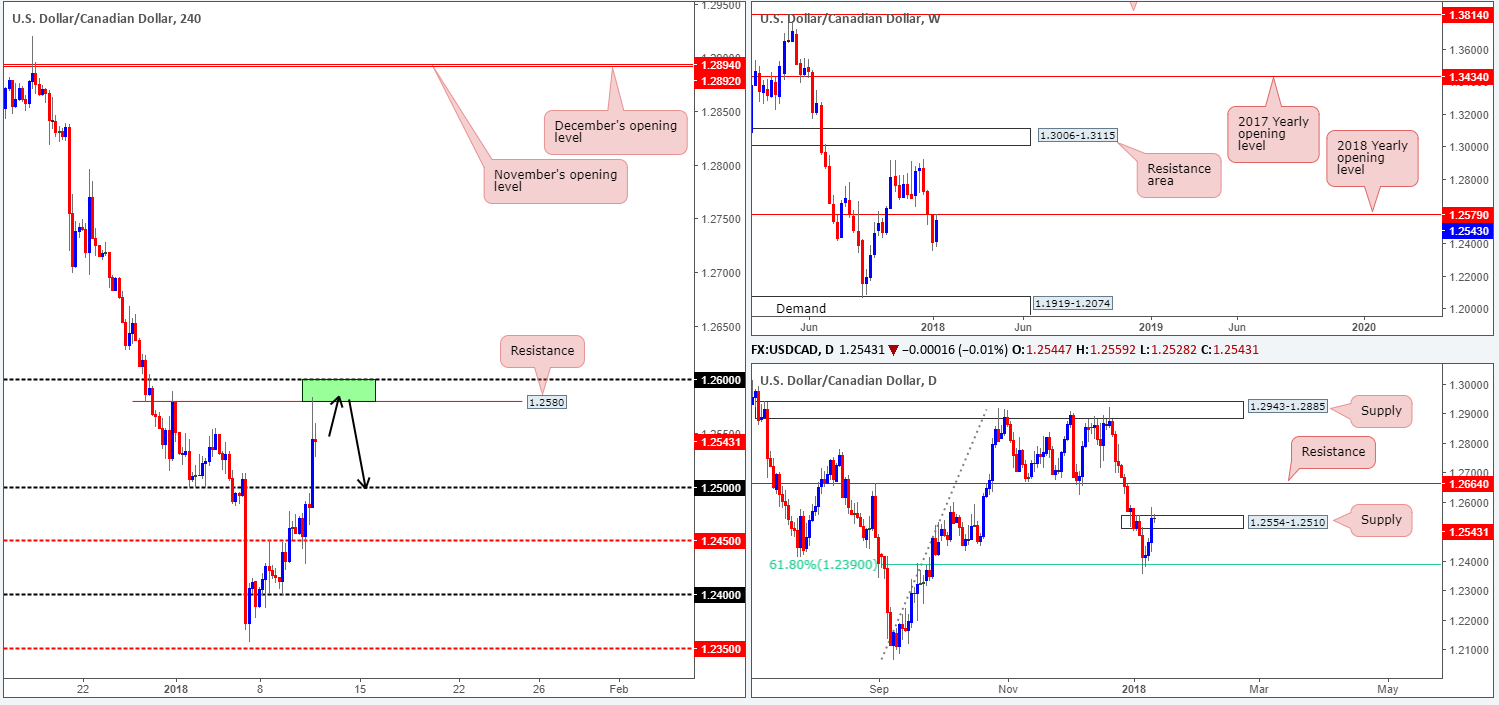

USD/CAD:

After retesting the H4 mid-level number at 1.2450 on Wednesday, the USD/CAD drove aggressively skywards. The Canadian dollar took a hit following a report (Reuters) that Canadian government officials say there’s an increasing likelihood US President Donald Trump will give six-month’s notice to withdraw from Nafta.

This lifted the H4 candles beyond the 1.25 handle up to a H4 resistance plotted a few pips ahead of 1.26 at 1.2580, before mildly paring gains into the closing bell. Bolstering the current H4 resistance is the 2018 yearly opening level seen on the weekly timeframe at 1.2579. Also possibly offering a helping hand is the daily supply zone coming in at 1.2554-1.2510. Despite having the top edge taken out, the area remains in play.

Market direction:

The 1.26 line/H4 resistance at 1.2580 (green zone) is an area worthy of consideration. Not only because of it holding back the buyers yesterday, but also due to its position on the bigger picture (see above). Therefore, should H4 price retest this H4 zone today and chalk up a full or near-full-bodied H4 bearish candle, a short with an initial target objective set at 1.25 could be a possibility. The reason for the additional candle confirmation is simply to try and avoid any fakeout that may take place around 1.26.

Data points to consider: US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm; CAD NHPI m/m at 1.30pm GMT.

Areas worthy of attention:

Supports: 1.25 handle.

Resistances: 1.26 handle; 1.2580; 1.2579; 1.2554-1.2510.

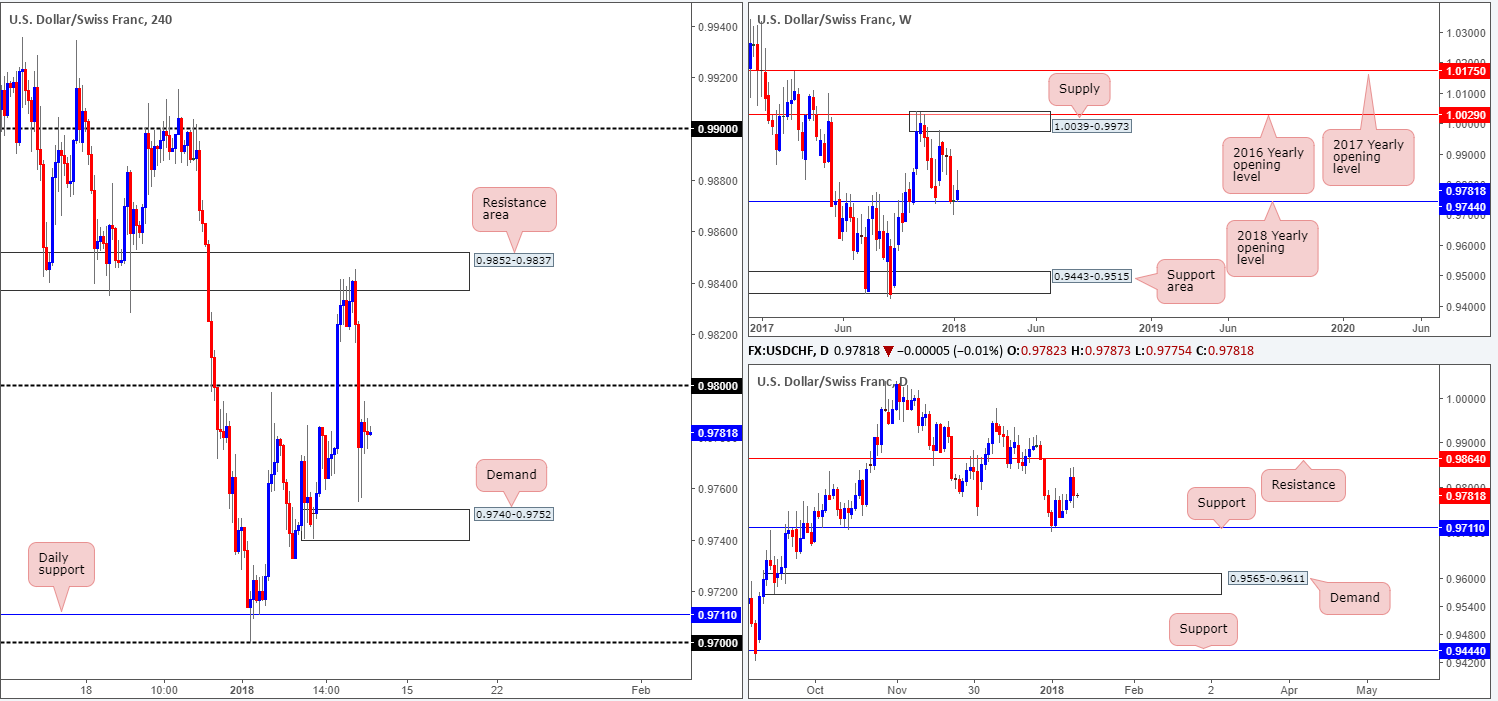

USD/CHF:

Following a brief period of consolidation, H4 price abruptly sold off from the underside of a H4 resistance area plotted at 0.9852-0.9837 during Wednesday’s segment. Quickly wiping out bids from the 0.98 handle, this allowed the unit to strike a session low of 0.9754, before mildly trimming losses just ahead of a H4 demand area coming in at 0.9740-0.9752.

Consequent to the above, traders will likely have their crosshairs fixed on the 0.98 region for a possible retest play today. While this is a valid sell, at least until down to the aforesaid H4 demand, the 2018 yearly opening level printed on the weekly chart at 0.9744 is concerning, which is shadowed closely by a daily support band registered at 0.9711.

Market direction:

It’s a tricky market to decipher at the moment, since both the 0.98 level and the noted H4 demand equally stand a good chance of being tested and holding price. Overall though, as long as the 2018 yearly line continues to hold ground, fresh upside attempts will likely be seen.

Data points to consider: US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 0.9740-0.9752; 0.9711; 0.9744.

Resistances: 0.9852-0.9837; 0.98 handle.

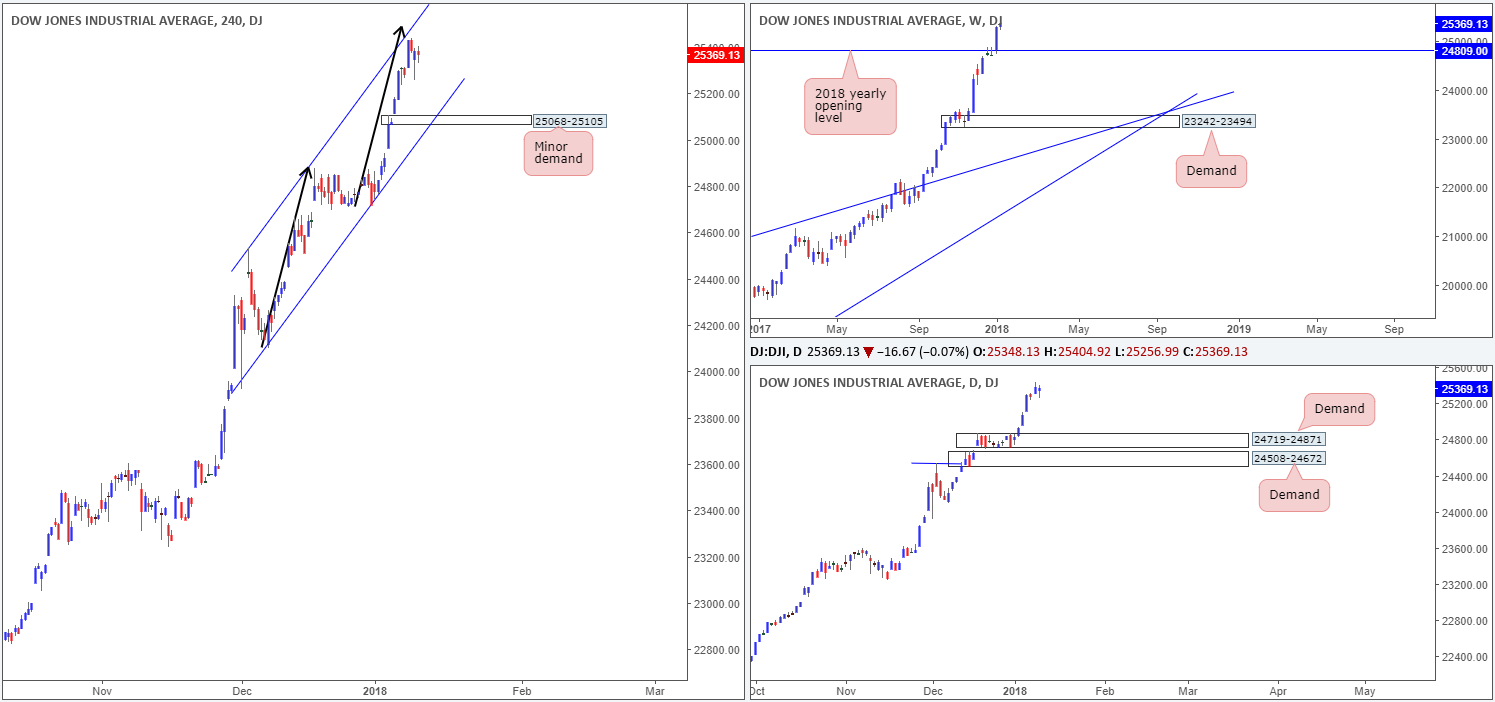

DOW 30:

Upward momentum is beginning to wane ahead of a H4 channel resistance extended from the high 24535. In order for the index to continue refreshing record highs, this obstacle would need to be engulfed.

Before this happens, though, as we’ve highlighted in previous reports, investors need to be prepared for the possibility of a pullback to a minor H4 demand base coming in at 25068-25105. Beyond this area, there’s little stopping the market from dropping down to challenge the daily demand at 24719-24871, which houses the 2018 yearly opening level at 24809.

Market direction:

Although the trend remains strong, this is still not a buyers’ market right now, in our view. Once/if H4 price engulfs the H4 channel resistance, however, then we do not see much stopping prices from moving higher, at least from a technical standpoint.

Buying on a dip seen down to the current minor H4 demand is a possibility. Nevertheless, as briefly touched on above, there is a strong chance that this area could fail given that daily action may want to test the demand seen below it at 24719-24871.

Data points to consider: US inflation figures m/m and US unemployment claims at 1.30pm; FOMC member Dudley speaks at 8.30pm GMT.

Areas worthy of attention:

Supports: 25068-25105; 24719-24871; 24809.

Resistances: H4 channel resistance.

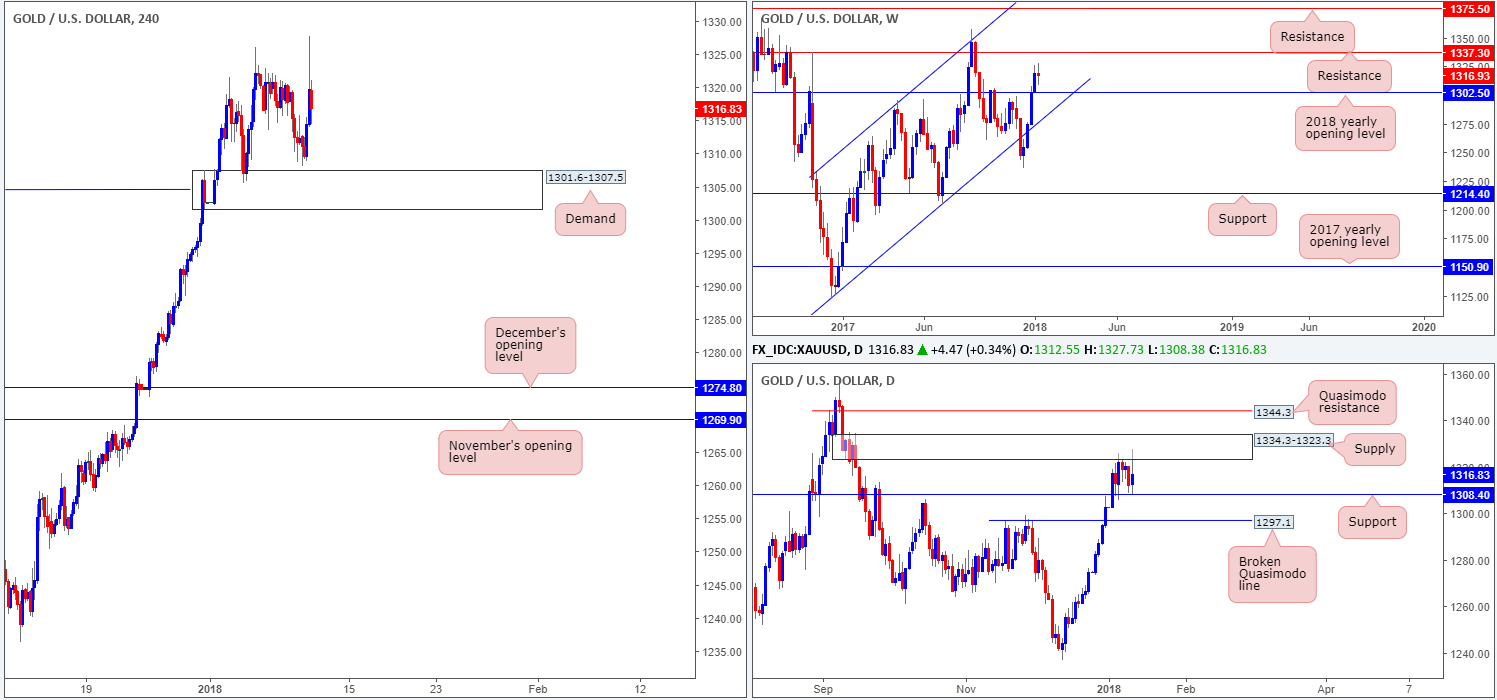

GOLD:

Beginning with a look at the weekly timeframe this morning, we can see that price is currently lurking mid-range between weekly resistance plotted at 1337.3 and the 2018 yearly opening level drawn from 1302.5. Things get a little more condensed as we head down to the daily timeframe. Since Jan 3, daily support at 1308.4 and daily supply penciled in at 1334.3-1323.3 have capped both sides of the market. A violation of this supply unlocks the door up to a daily Quasimodo resistance at 1344.3, while a push to the downside would place the daily broken Quasimodo line at 1297.1 in the firing range. A closer look at price action on the H4 timeframe reveals price missed the H4 demand at 1301.6-1307.5 by only a few pips on Wednesday, before sharply increasing in value on the back of US dollar selling.

Market direction:

With weekly price showing indecisiveness right now, and daily price sandwiched between two equally weighted zones, we feel there’s little to harvest from the higher timeframes at this time. This – coupled with H4 price highlighting limited confluence, opting to stand on the sidelines may be the better (safer) trade today.

Areas worthy of attention:

Supports: 1301.6-1307.5; 1302.5; 1308.4.

Resistances: 1337.3; 1334.3-1323.3.

This site has been designed for informational and educational purposes only and does not constitute an offer to sell nor a solicitation of an offer to buy any products which may be referenced upon the site. The services and information provided through this site are for personal, non-commercial, educational use and display. IC Markets does not provide personal trading advice through this site and does not represent that the products or services discussed are suitable for any trader. Traders are advised not to rely on any information contained in the site in the process of making a fully informed decision.

This site may include market analysis. All ideas, opinions, and/or forecasts, expressed or implied herein, information, charts or examples contained in the lessons, are for informational and educational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.