A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

During the course of yesterday’s trading sessions, the EUR currency continued to flirt with the underside of the H4 mid-way resistance level seen at 1.1250. The bulls, however, did attempt to push things higher around London lunchtime after a string of lower than expected US data hit the wire. This forced price to clock highs of 1.1283, consequently connecting with a H4 trendline resistance taken from the high 1.1366. As you can see though, price, once again, failed to sustain gains beyond the 1.1250 mark and closed the day back below the mid-way point.

Moving over to the bigger picture, the weekly candles remain positioned around the underside of a major resistance area coming in at 1.1533-1.1278. Daily action on the other hand, is still underpinned by a support area drawn from 1.1224-1.1072, but as we already mentioned in previous reports, there’s been little noteworthy bullish intent registered from this barrier as of yet.

Our suggestions: With US CPI data scheduled for release today at 1.30pm, it’s possible we may see some development in this market going into the week’s end. As far as technical setups go, nevertheless, we were initially looking to short from 1.1250. Be that as it may. due to price forming higher highs at the moment and not really much effort being seen from the bears here, one could argue that 1.1250 is now possibly unstable.

Therefore, to our way of seeing things, to become sellers here a breach of the 1.12 handle would need to be seen. In regard to buying, however, we would be a little more cautious. A close above 1.1250 would not be considered bullish by our team, since not only is there a key figure sitting just above at 1.30, let’s also not forget that there is a major-league weekly resistance area looming over the action like a big rain cloud – not really ideal buying conditions!

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Not looking to sell this market until a breach of 1.12 is seen.

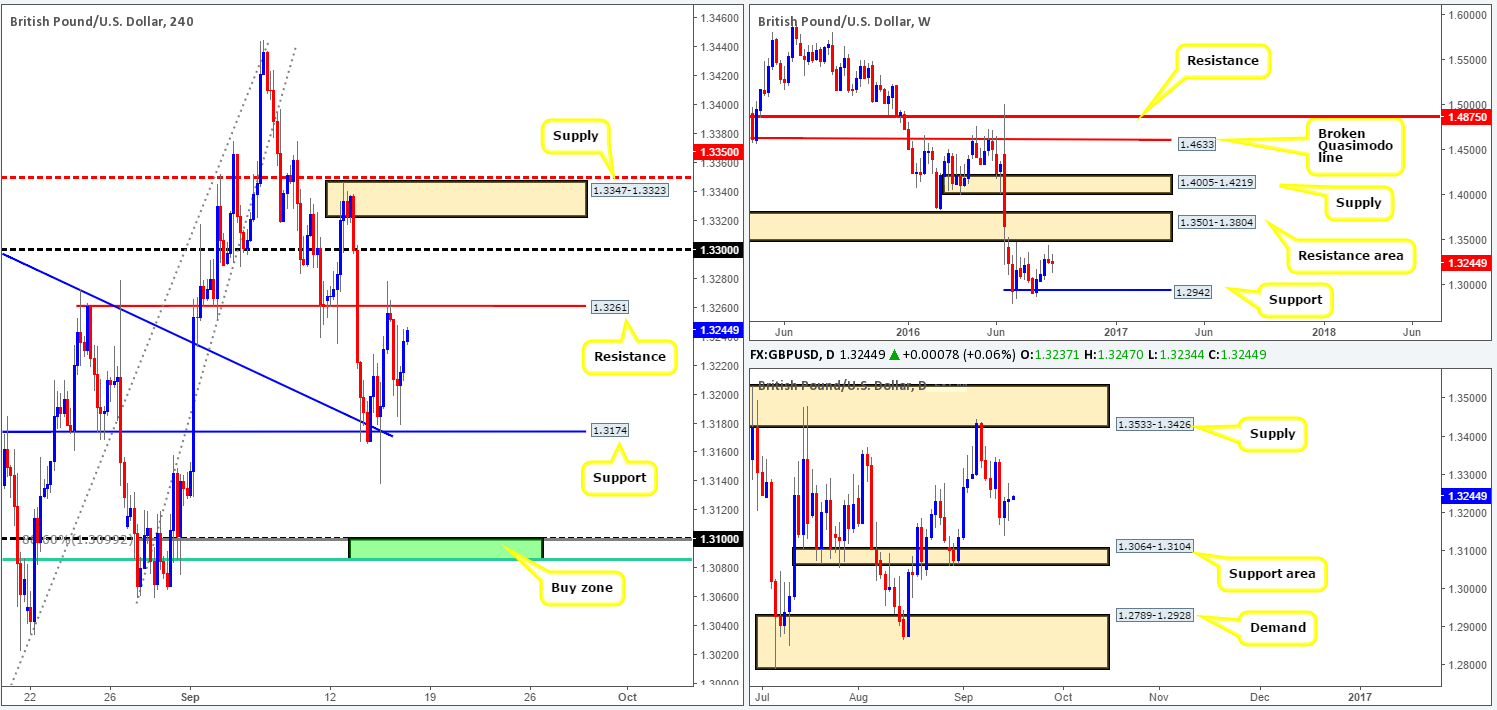

GBP/USD:

Despite the BoE leaving monetary policy on hold for the time being and a slightly better than expected reading for UK retail sales, the pair was unable to breach the current H4 range: support at 1.3174/resistance at 1.3261. Taking a look at the higher-timeframe picture for more direction, we can see that the weekly chart is seen loitering mid-range between a resistance area at 1.3501-1.3804 and a support coming in at 1.2942. This – coupled with daily price seen trading in no-man’s-land between a supply seen at 1.3533-1.3426 and a support area at 1.3064-1.3104, direction is rather limited for the time being.

Our suggestions: Technically speaking, we feel that the current H4 consolidation is adequately sized to consider trading the edges. With that being said though, with little support being seen from the higher timeframes, and fakeouts within ranging environments a common view, waiting for lower timeframe confirming price action is advised prior to pulling the trigger (see the top of this report).

Beyond this range, we have our eye on the 1.31 handle and the H4 supply coming in at 1.3347-1.3323. The supply base was simply selected due to it lurking just above the 1.33 handle and also due to its momentum. The 1.31 handle, however, was chosen due to the following converging structures:

- It is bolstered by a H4 61.8% Fib support at 1.3085 (taken from the low 1.2865).

- It also boasts a deep 88.6% Fib support at 1.31.

- Converges beautifully with the top edge of a daily support area coming in at 1.3064-1.3104.

Levels to watch/live orders:

- Buys: 1.3174 region [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area). 1.31 region [H4 bullish close required] (Stop loss: below the trigger candle).

- Sells: 1.3261 region [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area). Keep an eye on the H4 supply base at 1.3347-1.3323.

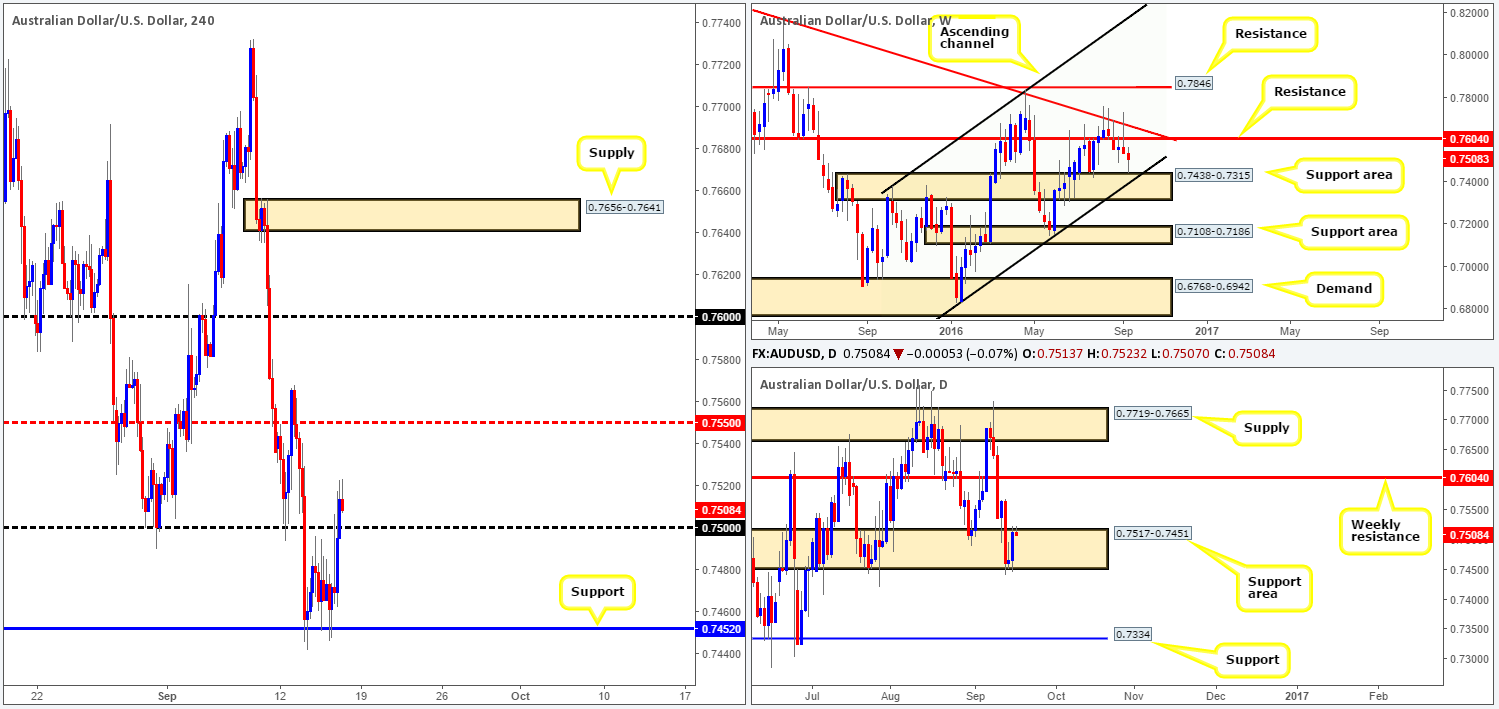

AUD/USD:

Alongside the US equity market, the AUD/USD pair rallied higher as investors clearly favored riskier assets yesterday. This, as can be seen from the H4 chart, saw the commodity currency breach and eventually close above the 0.75 handle, potentially opening the doors for a continuation move up to the H4 mid-way resistance 0.7550 today. From a technical standpoint, yesterday’s bullish assault should not really come as a shock. Weekly price was, as we mentioned in previous writings, trading just ahead of a support area drawn from 0.7438-0.7315, while the buyers and sellers down on the daily chart were teasing the lower edge of a support area at 0.7517-0.7451.

Our suggestions: In light of the recent daily bullish engulfing candle and higher-timeframe supporting structures, as well as room seen for price to move beyond 0.75, today’s spotlight will firmly be focused on looking for price to retest 0.75 as support. In the event that this comes into view and holds firm, we would, on the condition that a H4 bullish candle close is seen, look to buy here, targeting 0.7550, followed by 0.76 (represents the weekly resistance line at 0.7604 – the next upside target on the higher timeframes).

Levels to watch/live orders:

- Buys: 0.76 [H4 bullish close required] (Stop loss: below the trigger candle).

- Sells: Flat (Stop loss: n/a).

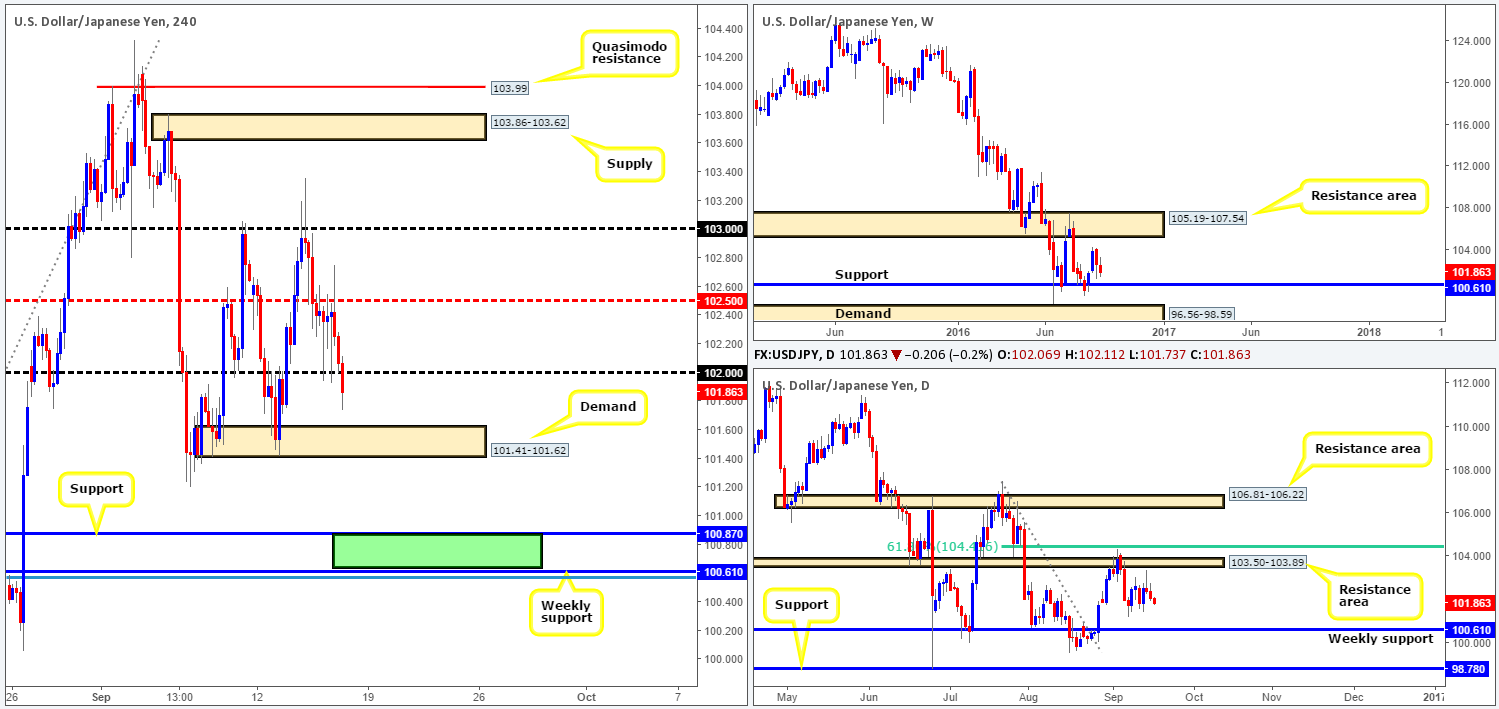

USD/JPY:

Risk appetite turned sour once again as both the USD/JPY and gold pressed to fresh lows yesterday. At the time of writing, however, we can see that price is squeezing out longs from the 102 band, which may see the unit cross swords with H4 demand at 101.41-101.62 sometime today. Initially, our team did report that they would consider buying from 102 on the basis of a H4 bullish close. We did get this, but the candle was very large and closed just ahead of the H4 mid-way resistance 102.50 – not ideal for buying!

Although the H4 demand base at 101.41-101.62 held ground on Tuesday, this is not really an area that we would stamp a high-probability reversal zone. The reason why simply comes down to there being a more attractive zone below, which is made up of a weekly support level at 100.61 and a H4 support at 100.87, as well as a H4 78.6% Fib support at 100.56 (green rectangle).

Our suggestions: Quite simply, wait and see if price attacks the 100.61/100.87 band today. If so, we’d then advise waiting for at least a H4 bullish close to be seen before looking to buy this pair. As far as targets are concerned, we will usually aim for the H4 supply formed on approach, which will, in this case, likely be formed around the underside of the current H4 demand.

Levels to watch/live orders:

- Buys: 100.61/100.87 [H4 bullish close required] (Stop loss: below the trigger candle).

- Sells: Flat (Stop loss: n/a).

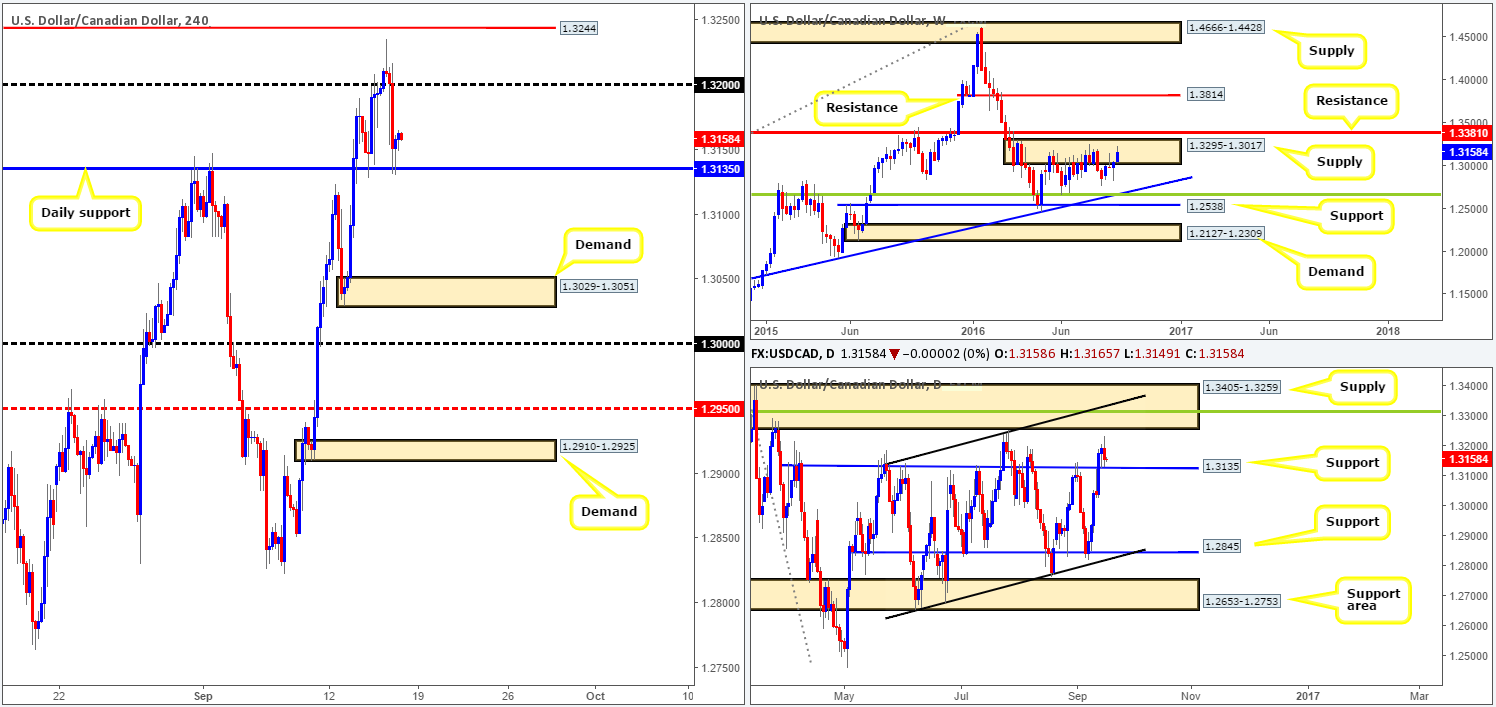

USD/CAD:

Going into the early hours of yesterday’s trading the H4 closed above the 1.32 handle and went on to clock a high of 1.3235 as we entered into the London session. Leaving the H4 Quasimodo resistance at 1.3244 unchallenged, the pair sold off at the US open, consequently bringing prices back below the 1.32 band and down to retest daily support at 1.3135 for a second time this week. While the bulls are managing to defend the current daily support, would we consider this to be a stable enough platform to condone a buy today? In short, we would not simply because weekly price currently inhabits a supply zone drawn from 1.3295-1.3017.

Our suggestions: Despite our team being against buying this market we would really would like to see the pair appreciate up to the daily supply zone coming in at 1.3405-1.3259 for sells. We like the idea of shorting from either the above noted H4 Quasimodo resistance, or the daily 38.2% Fib resistance at 1.3315, which unties with a daily channel resistance taken from the high 1.3241 and sits within the aforementioned daily supply.

To short from the H4 Quasimodo, we would require at least a H4 bearish close to form. Shorting from the daily Fib resistance, however, we feel that the confluence seen here is sufficient enough to permit a short entry at market with one’s stop placed above the daily supply itself at 1.3410.

Levels to watch/live orders

- Buys: Flat (Stop loss: n/a).

- Sells: 1.3244 [H4 bearish close required] (Stop loss: above the trigger candle). 1.3315 region (Stop loss: 1.3410).

USD/CHF:

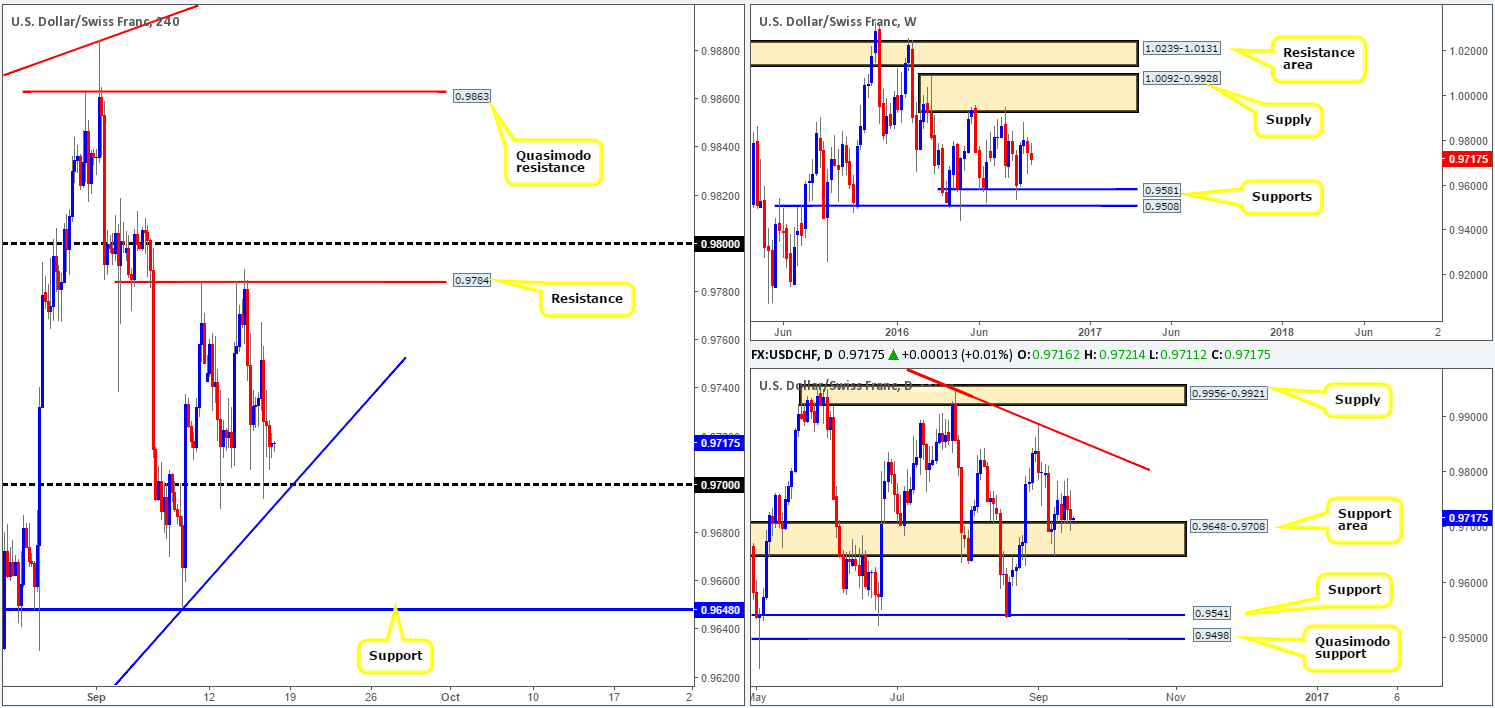

As London opened its doors for business yesterday, the Swissy sold off on the back of the Swiss National Bank leaving monetary policy unchanged. In consequence to this, the 0.97 handle was once again challenged. On the whole though, as far as we can see, the pair remains in a phase of consolidation between the above noted psychological support and a H4 resistance level coming in at 0.9784. Given that there is room seen for further upside from the current daily support area at 0.9648-0.9708 up to the trendline resistance extended from the high 1.0256, we’re relatively confident that the 0.97 band will continue to hold ground today.

Our suggestions: Looking for buying opportunities off the 0.97 number is certainly something worth considering given the daily picture (see above). However, seeing as how price could still potentially fake beyond this number (psychological levels are generally prone to fakeouts), we would be inclined to wait for lower timeframe confirming price action to form (see the top of this report) before pulling the trigger to buy here.

Levels to watch/live orders:

- Buys: 0.97 region [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: n/a).

DOW 30:

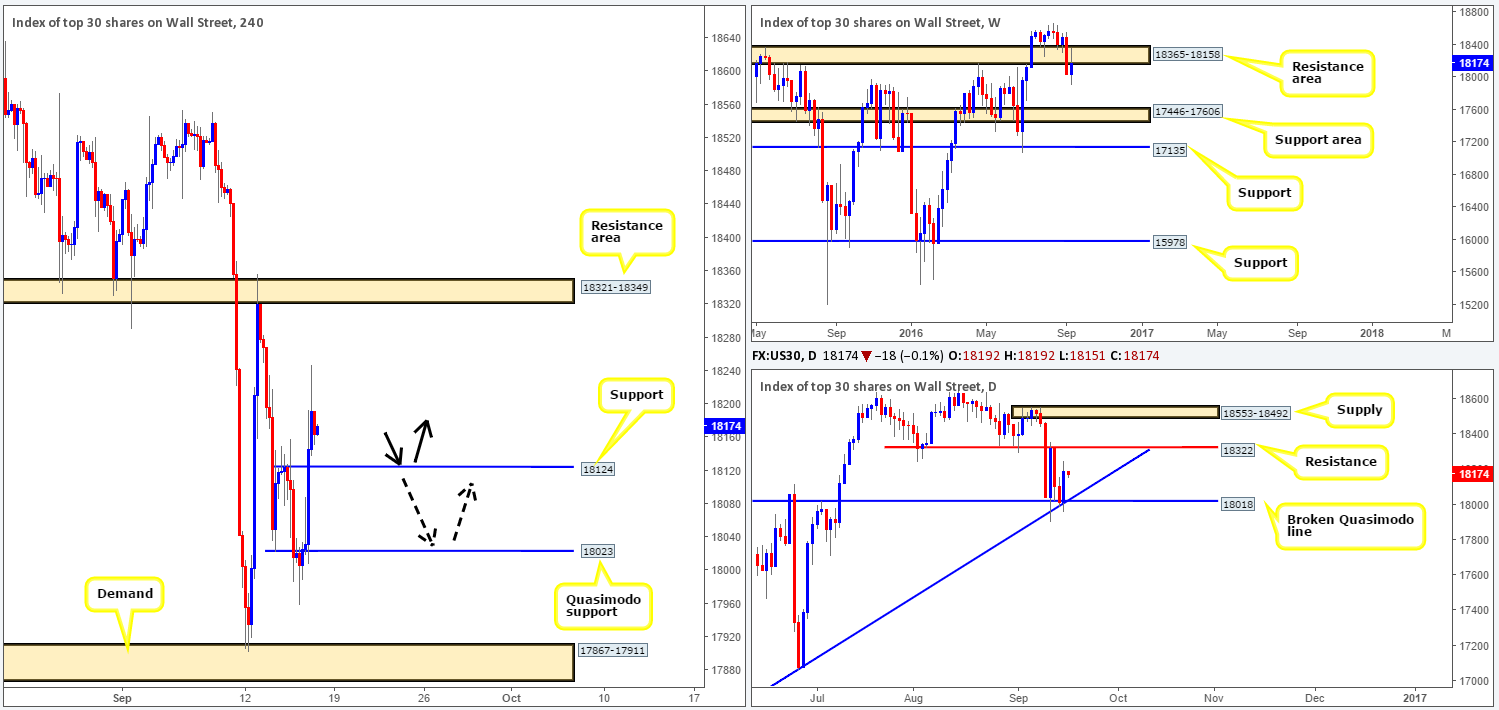

Starting with a look at the weekly picture this morning, the DOW continues to be suppressed by a resistance area seen at 18365-18158. Further selling from this point would likely bring price down to a support area painted at 17446-17606. Despite the weekly picture reflecting somewhat of a bearish stance at the moment, daily action recently chalked up a bullish engulfing candle off a broken Quasimodo line support at 18018, which converges with a trendline support extended from the low 15501.

Jumping across to the H4 chart, we can see that yesterday’s bullish run managed to reach highs of 18248 going into the close. From this angle, we see little standing in the way of further buying in this market today up to the H4 resistance area penciled in at 18321-18349, which happens to encapsulate a daily resistance level at 18322 (next upside target on the daily timeframe).

Our suggestions: Watch for buying opportunities off either the H4 support band at 18124 or the H4 Quasimodo support seen just below it at 18023. Both areas are susceptible to fakeouts so we would encourage traders to wait for lower timeframe confirming price action form before buying here (see the top of this report).

Levels to watch/live orders:

- Buys: 18124 region [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area). 18023 region [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: n/a).

GOLD:

(Trade update: Closed 70% of our long position from 1318.2 at 1320.3, with the remaining 30% taken out at breakeven)

Kicking off this morning’s analysis looking at the weekly chart, we can clearly see that price is trading just ahead of a support area logged in at 1307.4-1280.0. This, by and of itself, is considered by our team as a warning to be extra cautious about taking shorts in this market.

With this in mind, we can see that over the course of this week, the yellow metal printed two bearish daily engulfing formations as price drove lower into a daily demand area seen at 1305.3-1322.8 (see blue arrows). Therefore, although the weekly chart is sending a clear warning to be wary of shorts, daily candle action is, despite also occupying a daily demand area, suggesting that the bulls may be weak.

Moving over to the H4 chart, thanks to yesterday’s selloff a 1:1 measured move (see black arrows) was seen from a high of 1331.8 down to lows of 1309.2. Although bullion whipsawed through the current H4 support area at 1312.0-1316.0 (merges with a H4 78.6% Fib support at 1313.1), it remains on solid footing for the time being.

Our suggestions: In spite of the daily candles, we feel that a buy from the current H4 support area is worthy of consideration today. However, given the aggressive push through the zone yesterday, this could have potentially weakened it. Therefore, we would strongly encourage traders not to simply punch the buy button here and hope for the best. Be patient and wait for lower timeframe confirming price action (preferably on the M15 up) before placing your order. This could be either an engulf of supply followed by a retest as demand, a trendline break/retest or simply a collection well-defined buying tails planted within the H4 buy zone.

Assuming one manages to lock down a position from here, we’d look to target yesterday’s high 1328.1, followed closely by the H4 supply area seen at 1331.8-1329.6.

Levels to watch/live orders:

- Buys: 1312.0-1316.0 [lower timeframe confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: n/a).