A note on lower-timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

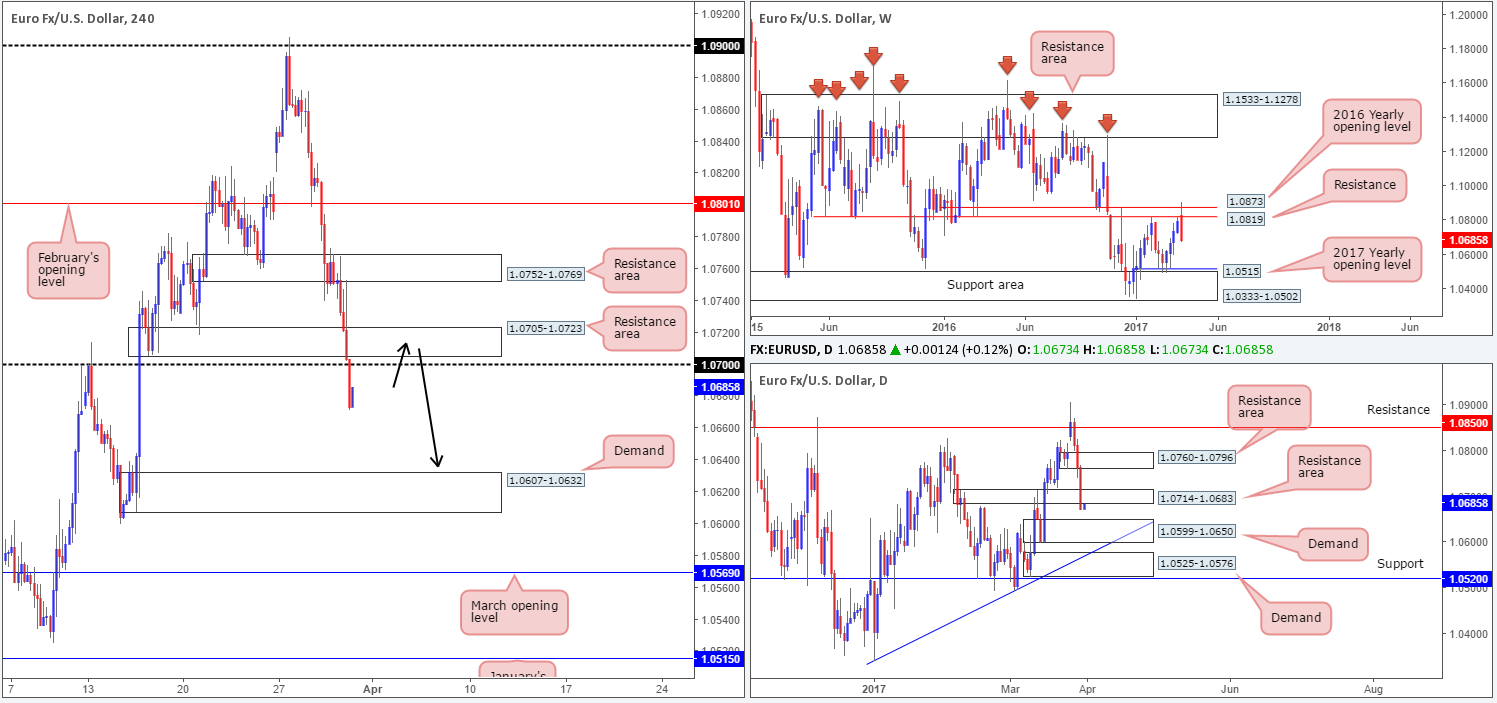

EUR/USD:

The EUR/USD, as you can see, has been trading south for the past three days, down from Monday’s high at 1.0905. Yesterday’s decline aggressively swallowed both the H4 demand at 1.0705-1.0723 (now acting resistance area) and the 1.07 handle, potentially opening up the path south down to a H4 demand fixed at 1.0607-1.0632.

Over on the bigger picture, we can see that a daily support area at 1.0714-1.0683 (now acting resistance area) was also taken out during yesterday’s bearish assault. According to the weekly timeframe, the next downside target does not come into view until the 2017 yearly opening level at 1.0515/support area at 1.0333-1.0502.

Our suggestions: To our way of seeing things, the pair reflects a strong bearish stance at present. On that account, our desk will be watching for H4 price to retest the 1.0705-1.0723/1.07 neighborhood as resistance today. Assuming this comes to fruition, and the pair chalks up a reasonably sized H4 bearish candle from this area, a short with a target objective set at the H4 demand drawn from 1.0607-1.0632 could be an option (as per the black arrows).

Should the above setup come into view today, it may be worth noting that there is also a daily demand seen just below at 1.0599-1.0650. Therefore, once price crosses paths with the 1.0650 level (the top edge of this zone), you may want to think about reducing risk to breakeven!

Data points to consider: German retail sales at 7am, German unemployment change at 8.55am, EUR CPI flash estimate at 10am. US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.0705-1.0723/1.07 ([watch for a reasonably sized H4 bearish candle to form from here before pulling the trigger] stop loss: ideally beyond the rejection candle’s wick).

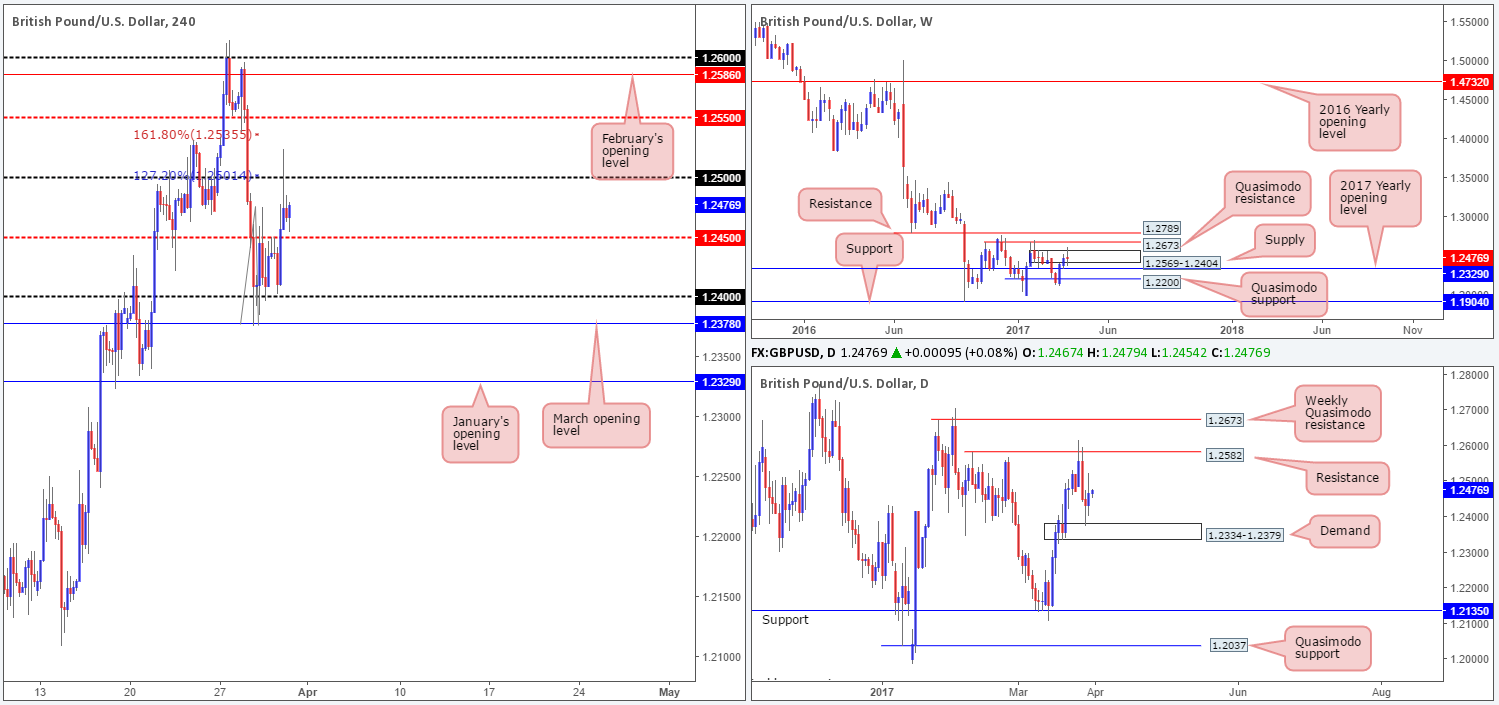

GBP/USD:

Today’s story on the GBP/USD shows that price recently extended Wednesday’s bounce from daily demand at 1.2334-1.2379 to a high of 1.2523. H4 action, however, reveals that price was unable to sustain gains beyond the Fib ext. 161.8% at 1.2535/127.2% at 1.2501 and round number 1.25 during Thursday’s segment. While H4 bulls still appear to have a hand in this fight, let’s remember that weekly price is confined within the walls of a supply base coming in at 1.2569-1.2404.

As can be seen from the higher-timeframe structure, there’s clearly a difference of opinion here. So, unfortunately we have little direction to hang our hat on at the moment.

Our suggestions: In the absence of clearer price action, our team has come to a general consensus that remaining flat is the safer route to take today.

Data points to consider: UK current account data as well as final GDP release at 9.30am, MPC member Haldane speaks at 10pm. US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

AUD/USD:

With the pair managing to break a two-day bullish phase, yesterday’s trading saw the commodity-linked currency selloff from a H4 supply zone coming in at 0.7684-0.7674, ending the day touching gloves with March’s opening line at 0.7642. Despite H4 price showing signs of recovery from this monthly level, we feel there’s scope for further downside here. This is largely due to daily action possibly forming a D-leg to an AB=CD formation taken from the high 0.7749. This pattern completes between the Fib ext. 127.2% at 0.7543 (seen within the lower limits of the daily demand at 0.7540-0.7570) and 161.8% at 0.7488, which happens to be positioned within a daily support area at 0.7449-0.7506.

Our suggestions: In view of the above points, our desk has absolutely no interest in buying from March’s opening level today. Should this level be taken out and retested as resistance on the other hand, taking an intraday short from this region, targeting the H4 Quasimodo support at 0.7603 (shadowed closely by 0.76) could be an option.

Data points to consider: US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 0.7642 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe confirming signal to form [see the top of this report] before executing a trade is advised] stop loss: dependent on where one confirms this level).

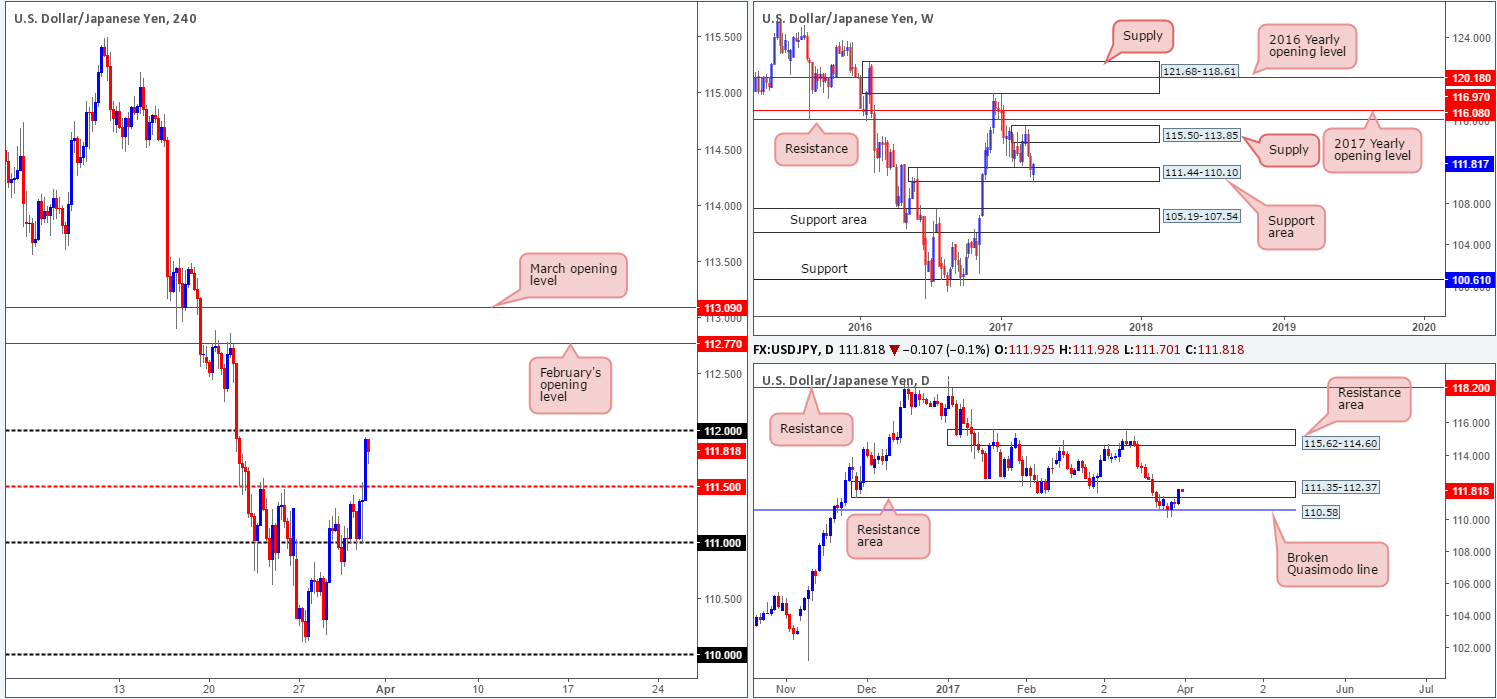

USD/JPY:

Underpinned by a weekly support area at 111.44-110.10, the bulls are showing signs of recovery. Providing that this continues, there’s potential for price to challenge the supply zone seen at 115.50-113.85. Down on the daily timeframe, however, the unit is seen trading within a resistance area coming in at 111.35-112.37. The pair is likely to find some resistance here with the zone having been a strong barrier of support on a number of occasions in the past.

With US yields rallying north and the DOW 30 punching to a fresh high of 20753 yesterday, the H4 candles broke through the mid-level resistance at 111.50 and closed just ahead of the 112 handle. Seeing as how price is close to testing 112 and the fact that daily price is seen within a resistance area right now, we would refrain from entering into a buy position just yet.

Our suggestions: A close above 112, followed by a retest as support and a reasonably sized H4 bull candle is, we believe, enough to justify a long position, targeting February’s opening line at 112.77 as an initial take-profit zone. Granted, this setup would entail buying into the upper edge of the daily resistance area, but given the strength seen from the weekly support area at present coupled with a (possible) close above 112, we feel a long is worth the risk.

Data points to consider: US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Watch for price to engulf 112 and look to trade any retest seen thereafter ([waiting for a reasonably sized H4 bull candle to form following the retest is advised] stop loss: ideally beyond the candle’s rejection tail).

- Sells: Flat (stop loss: N/A).

USD/CAD:

During the course of yesterday’s sessions, we can see that H4 price whipsawed below the consolidation fixed between 1.3323/1.34, and came within striking distance of tapping the Quasimodo support at 1.3275. Of particular interest is that this H4 range formed just below the 2017 yearly opening level at 1.3434.

With H4 price looking poised to extend north up to the upper edge of the current range, where do we go from here? Well, we still have a keen interest in the H4 1.3434/1.3419 (November, December and January’s opening levels) region for shorts. Here’s why:

- Of note is the 1.34 handle (the top edge of the H4 range). Psychological levels are prone to fakeouts, and with 1.3434/1.3419 lurking just above 1.34, we feel it’d be a fantastic barrier to help facilitate a fakeout.

- When these monthly levels converge, we typically find that they hold firm the majority of the time offering at least a bounce.

Our suggestions: To short, we are looking for the lower timeframes to respect the above noted 1.3434/1.3419 area (see the top of this report for ideas on how to short using lower-timeframe structure). From this point, 1.34 could be a potentially troublesome level, so we’d be looking for this base to be consumed, which would in turn be our cue to reduce risk to breakeven.

Data points to consider: US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm. Canadian GDP at 1.30pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.3434/1.3419 ([waiting for a lower-timeframe confirming signal to form prior to pulling the trigger is advised] stop loss: dependent on where one confirms this region).

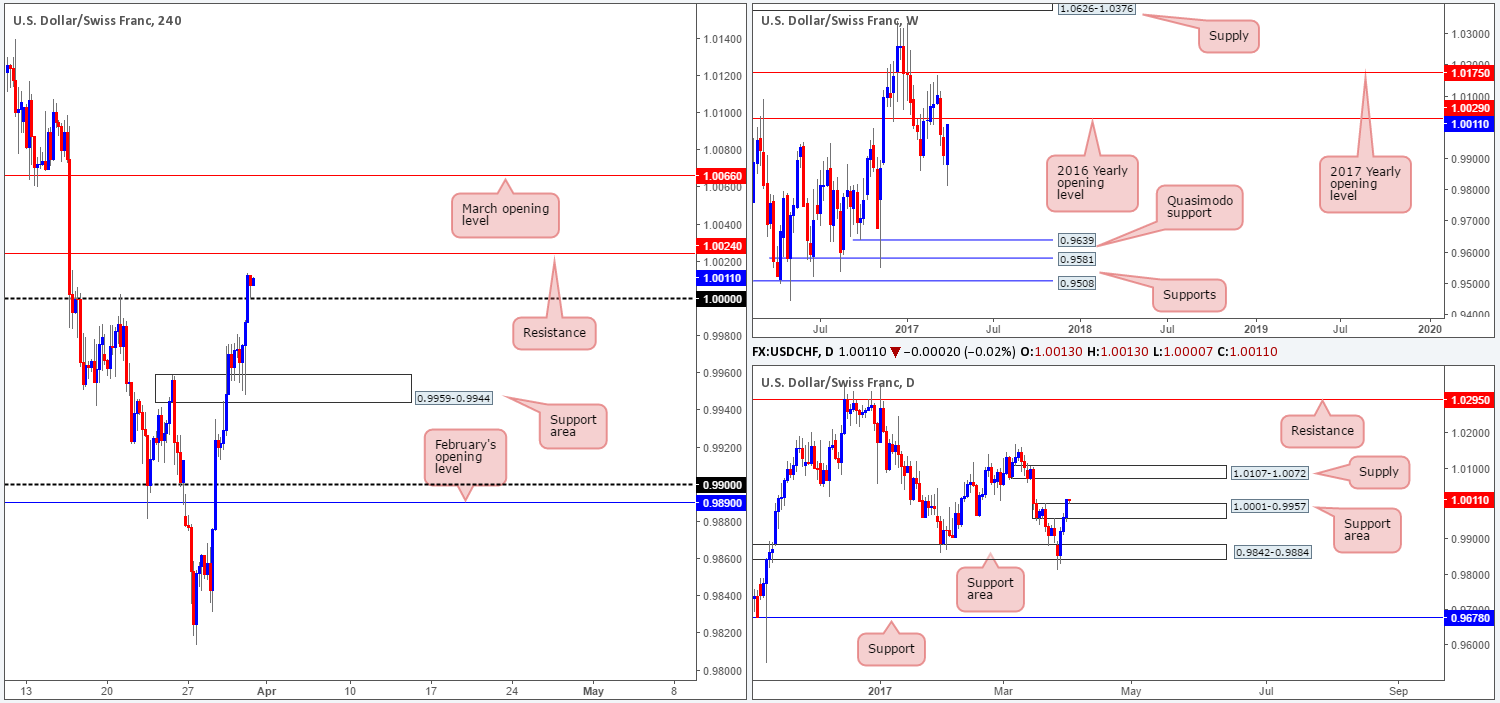

USD/CHF:

The bullish pulse continues to beat in the USD/CHF market this morning. The H4 support area at 0.9959-0.9944 held beautifully and ended the day with the candles engulfing parity (1.0000). Also noteworthy is daily price taking out the supply at 1.0001-0.9957, which is in the process of being retested as a support area.

Whilst the retest off 1.0000 looks to be an attractive buy, it might be worth noting that just ahead of H4 price sits resistance planted at 1.0024. In addition to this, we can also see the 2016 yearly opening base line at 1.0029! As a result, our desk will not be participating in any buying activity just yet.

Our suggestions: Ultimately, we would really like to see 1.0024 taken out today. A H4 close beyond this number is, at least in our view, a reasonably strong indication that the pair will trade up to March’s opening level at 1.0066. Following a H4 close higher here, we would like to see price retest this line as support and print a lower-timeframe confirming buy setup (see the top of this report), before looking to press the buy button.

Data points to consider: US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Watch for price to engulf 1.0024 and look to trade any retest seen thereafter ([waiting for a lower-timeframe confirming signal to form following the retest is advised] stop loss: dependent on where one confirms this level).

- Sells: Flat (stop loss: N/A).

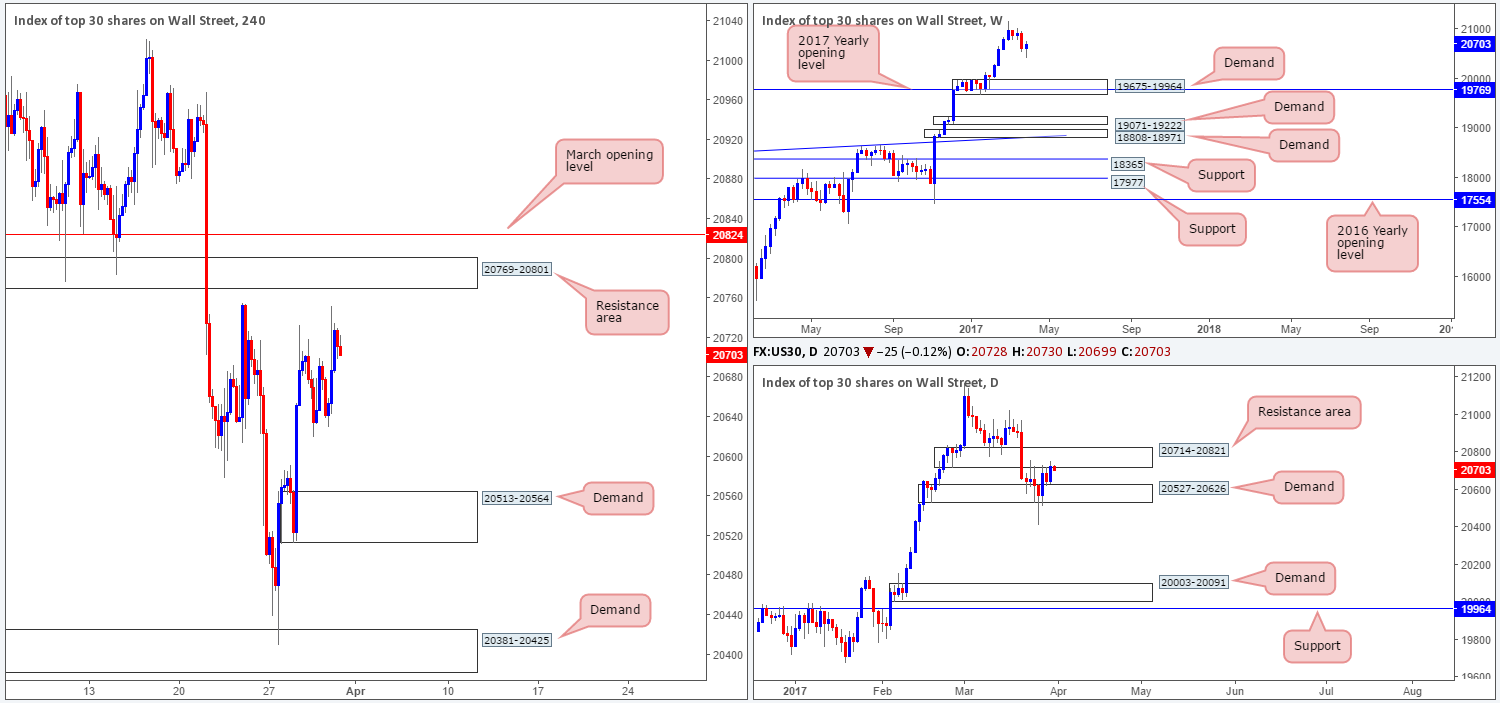

DOW 30:

The US equity market punched to a fresh high of 20753 yesterday, but concluded trade by pulling back to lows of 20699. This, as you can probably see, also brought the index slightly higher into the jaws of a daily resistance area coming in at 20714-20821. While there is a H4 resistance area seen just overhead at 20769-20801, which happens to be submerged within the above noted daily resistance area, we are a little concerned about the validity of this region. This is largely due to seeing weekly action in the process of printing a nice-looking buying tail on a pullback from record highs of 21170. It takes a lot of money (professional money) to create such a pattern on this scale!

Our suggestions: Neither a long nor short seems attractive at this time. It doesn’t help to see daily price so tightly confined between the aforementioned resistance area and demand at 20527-20626. To confirm bullish strength, we want to see H4 price close above March’s opening level at 20824.That way, we can be pretty sure that daily offers have also been taken out as well (the daily resistance area mentioned above at 20714-20821).

Data points to consider: US Core PCE data at 1.30pm, FOMC Dudley speaks at 2pm as well as FOMC member Kashkari speaking at 3pm GMT.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 20824 before considering longs in this market.

- Sells: Flat (stop loss: N/A).

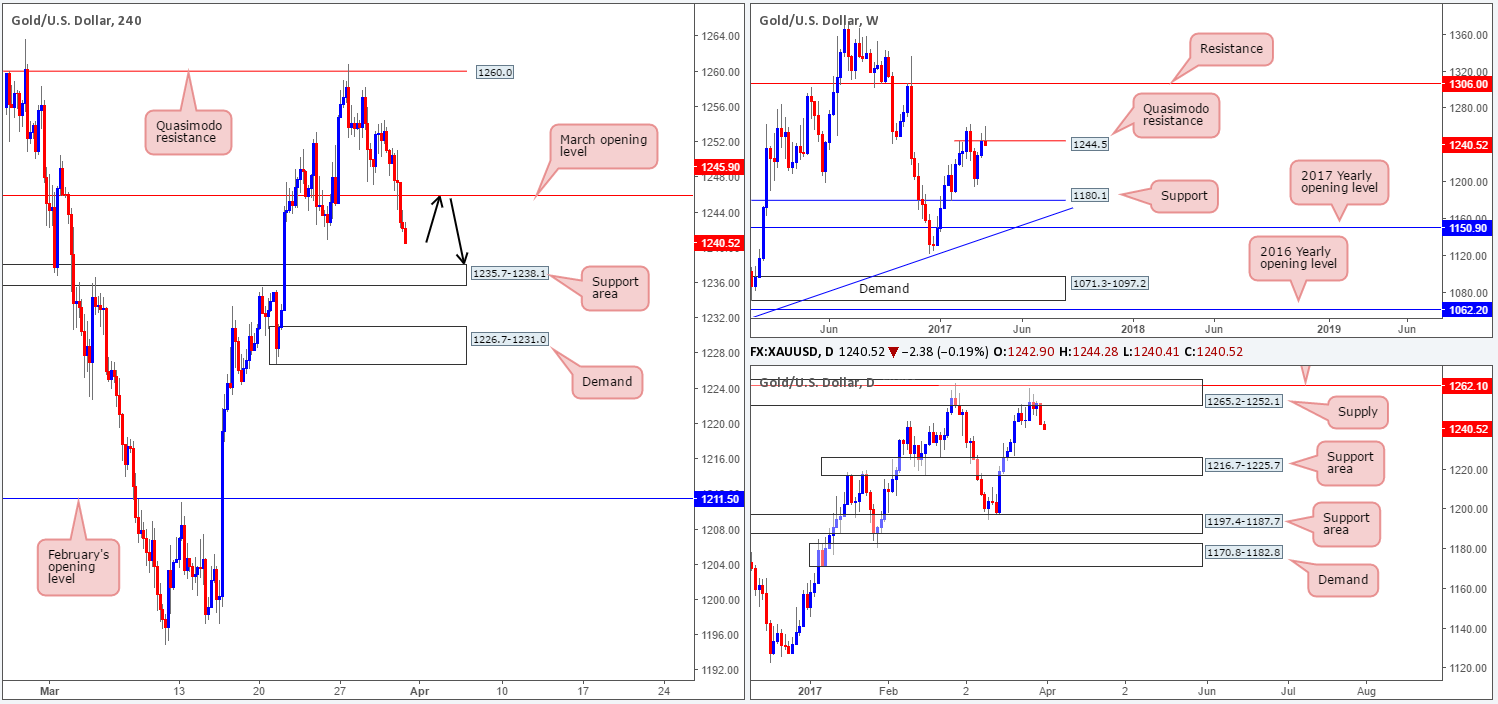

GOLD:

Despite the yellow metal bouncing from March’s opening level at 1245.9 yesterday, the unit continued to decline in value. As can be seen from the weekly chart, price is now seen trading back below the Quasimodo resistance level at 1244.5, and daily action shows little support in the way until we reach the 1216.7-1225.7 area.

Therefore, buying from the nearby H4 support area at 1235.7-1238.1 is not really something we would get excited about. In fact, we’re hoping that price does not connect with this zone before retesting March’s opening level! 1245.9 would make for a beautiful short setup, using the aforementioned H4 support area as an initial target zone.

Our suggestions: Should H4 price retest 1245.9 before shaking hands with the above noted H4 support area, we would, assuming a lower-timeframe sell signal was also present (see the top of this report), look to short this market.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1245.9 region ([waiting for a lower-timeframe confirming signal to form is advised before pulling the trigger [stop loss: dependent on where one confirms this area).