DXY:

Looking at the Weekly chart price may bearish and reversed off from 1st resistance at 94.742 in line Horizontal swing high and 127% Fibonacci extension towards 1st support at 91.817 in line with 50% Fibonacci retracement and 61.8% Fibonacci extension. Our bearish bias is further supported by stochastic testing resistance where price dropped in the past. Otherwise, price may be bullish towards the 2nd resistance at 94.742 in line with 127.2% Fibonacci retracement and 161.8% Fibonacci extension.

On the Daily timeframe, Price may bearish and reversed off from 1st resistance at 94.742 in line with Weekly 1st resistance towards the 1st support at 92.981 in line with 50% Fibonacci retracement and 61.8% Fibonacci extension. Our bearish bias is further supported by RSI is also testing resistance where price dropped in the past . Otherwise, price may bullish towards the 2nd resistance at 95.843 in line with Weekly 2nd resistance.

On the H4 timeframe, prices may face bearish towards the 1st support at 93.672 in line with 50% Fibonacci retracement and 127.2% Fibonacci extension. Our bearish bias is further supported by how Stochastic is testing resistance where price dropped in the past. Otherwise, price may bullish towards the 1st resistance at 94.742 in line with Daily 1st resistance.

Areas of consideration:

- H4 time frame, 1st resistance of 94.742

- H4 time frame, 1st support of 93.672

XAU/USD (GOLD):

On the weekly timeframe, price has recently broken below our ascending trendline support and might be dipping further towards 1st support at 1674.5, 61,8% Fibonacci extension and 50% Fibonacci retracement. Long term buyers could look to short the market as indicators are showing bearish momentum. Breaking the 1st support will see prices dipping further to our 2nd area of support at 1623.01 in line with 50% Fibonacci retracement. Alternatively, we might see price rebound to our 1st resistance at 1834 in line with 50% Fibonacci retracement and bearish trendline before dipping further.

On the Daily chart, price has dipped below our 20 EMA and has recently bounced off our 1st support at 1727.4. in line with 61.8% Fibonacci retracement. We see the possibility of bullish reversal towards 1st resistance at 1833.95 in line with 61.8% Fibonacci retracement and bearish trendline. Technical indicators are forecasting potential trend reversal.

On the H4 chart, price has been consolidating in a wedge. We foresee a possibility of slight climb in prices towards our bearish trendline and then further bearish momentum downwards towards our 1st support at 1717.82 in line with 78.6% and -27.2% Fibonacci retracement. Technical indicators are also showing bearish momentum. Alternatively, breaking our 1st resistance at 1741.52 in line with 23.6% and 61.8% Fibonacci retracement may find prices swing higher towards our 2nd resistance at 1757.18 in line with 50% Fibonacci retracement and bearish trendline.

Areas of consideration:

- 4h 1st support at 1717.82

- 4h 1st resistance 1741.52

EUR/USD:

Looking at the weekly chart we can see that the price has broken below support at 1.17250, in-line with 38.2% Fibonacci retracement and 100% Fibonacci extension. On the Daily chart, price dropped to support at 1.16000, in-line with -27.2% Fibonacci retracement and 127.2% Fibonacci extension.

On the H4 timeframe, price dropped to support at 1.16000, in-line with 100% Fibonacci retracement, 161.8% Fibonacci extension and swing low support. Price action has finally completed the head & shoulder breakdown target. We could potentially see a short-term bounce to first resistance at 1.16640, in-line with 23.6% Fibonacci retracement, 78.6% Fibonacci extension and 20EMA. Stochastic is also at support where previous bounces occurred. The next resistance could potentially be at 1.17120, in-line with 38.2% Fibonacci retracement, 61.8% Fibonacci extension and 50MA.

If price drops, it could potentially swing towards first support at 1.15140, in-line with 161.8% Fibonacci retracement, 61.8% Fibonacci extension and daily support. The next potential support could be at 1.14190, in-line with 200% Fibonacci retracement and 161.8% Fibonacci extension.

Areas of consideration:

- H4 time frame, support level at 1.15140 and 1.14190

- H4 time frame, resistance level at 1.16640 and 1.17120

USD/CHF:

On the weekly, price is holding above ascending trendline support however, it is also at the descending trendline resistance, price might reverse back down and drop towards the ascending trendline support as there is also a strong Ichimoku cloud that might prevent the breakthrough of the resistance. Price is also between 1st resistance at 0.95124 and 1st support at 0.90262. Traders should watch these levels closely for a break to see prices swing higher or drop lower. On the Daily, price is seen to have a bullish momentum abiding to the daily ascending trendline. We can expect the price to move towards the 1st resistance at 0.93683. With stochastics abiding to the ascending trendline, we can see that there is potential continuation of the bullish movement.

On the H4, price is seen to be reacting in between 1st Resistance 0.93496 and 1st Support 0.92826 and holding above the ascending trendline support . We can expect the price to rise if it breaks the 1st Resistance in line with 78.6% Fibonacci projection. Our bullish bias is further supported by the price holding above the moving average, the RSI indicator where it bounced off the strong support line and abiding to an ascending trendline. In addition,there is strong support from the Ichimoku cloud.

Areas of consideration:

- Watch 1st resistance at 0.93496

GBP/USD:

Looking at the weekly chart, the price broke below support at 1.34630, in-line with 50% Fibonacci retracement and 127.2% Fibonacci extension. On the Daily time frame, price dropped to support at 1.34435, in-line with 38.2% Fibonacci retracement and 78.6% Fibonacci extension. Price could potentially drop to next support at 1.33000, in-line with 161.8% Fibonacci retracement and 100% Fibonacci extension.

On the H4 timeframe price dropped and found support at 1.34280, in-line with 127.2% Fibonacci retracement and 100% Fibonacci extension. We could potentially see a short-term bounce to first resistance at 1.35280, in-line with 23.6% Fibonacci retracement and 61.8% Fibonacci extension. Stochastic is also at support where previous bounces occurred. The next potential resistance could be at 1.36640, in-line with 50% Fibonacci retracement and 127.2% Fibonacci extension.

If price drops, it could potentially drop to first support at 1.33650, in-line with 161.8% Fibonacci retracement and 127.2% Fibonacci extension. The next potential support could be at 1.32600, in-line with 161.8% Fibonacci retracement and 161.8% Fibonacci extension.

Areas of consideration:

- H4 time frame, 33650 and 1.32600 support level

- H4 time frame, 1.35280 and 1.36640 resistance level

USD/JPY

From the weekly timeframe, price may reversed off from 1st resistance at 112.228 in line with Horizontal swing high and 50% Fibonacci extension and may bearish to 1st support 107.480 in line with 50% Fibonacci retracement and 38.2% Fibonacci extension. Our bearish view is further supported by how Stocastic is reacting below resistance where price dropped in the past. Otherwise, price might move towards the 2nd resistance at 114.233 in line with 127.2% Fibonacci retracement and 78.6% Fibonacci extension.

On the Daily timeframe, price may reverse off from 1st resistance at 112.228 in line with weekly 1st resistance may bearish to 1st support at 110.035 in line with 61.8% Fibonacci retracement and 61.8% Fibonacci extension. Our bearish view is further supported by RSI testing resistance where price dropped in the past. Otherwise, price might move towards the 2nd resistance at 113.119 in line with -27.2% Fibonacci retracement and 200% Fibonacci extension.

On the H4 timeframe, price may reversed off from 1st resistance at 112.228 in line with Daily 1st resistance and may bearish to 1st support at 110.781 in line with 50% Fibonacci retracement and 100% Fibonacci extension. Our bearish view is further supported by how Stocastic is testing resistance where price dropped in the past. Otherwise, price may bullish towards the 2st resistance at 112.838 in line with Daily 2nd resistance.

Areas of consideration:

- H4 time frame, 2st resistance of 112.838

- H4 time frame, 1st support of 110.781

AUD/USD:

On the weekly, price is holding above the MA 130 showing bullish momentum, price is expected to push towards the first resistance in line with the 61.8% Fibonacci retracement level and graphical overlap resistance. Our bullish bias is further supported by the Stochastic indicator, where the K% line bounced off the support level. On the Daily, the price is holding below EMA 34 showing a potential bearish momentum, price bounced off from the 1st support previously in line with the 161.8% Fibonacci projection and now looking for a pull back, back to the 1st Support level.

On the H4, price is seen to have broken off the descending trendline resistance turned support. Price has bounced on the 1st support, we are expecting price to be bullish and hence, push to the 1st Resistance level in line with 200% Fibonacci projection. Our short term bullish bias is further supported by the stochastic indicator %K line where it bounces off the support .

Areas of consideration:

- H4 1st resistance level 0.73174

- H4 1st support level 0.71703

NZD/USD:

On the weekly, price is on a bearish momentum and is dipping towards 1st support at 0.68000 in line with 100% Fibonacci extension. Swing traders may potentially enter with shorts as we see potentially a bearish momentum in line with the descending trendline. MacD is also showing potential bearish momentum. Alternatively, price may climb towards our 1st resistance at 0.71760, in-line with 50% Fibonacci retracement, 100% Fibonacci extension, and descending trendline.

On the Daily chart, price is consolidating in a possible triangle with our bearish trendline being in line with 88% Fibonacci extension. We foresee a potential bounce from our ascending trendline support towards our 1st resistance at 0.70979 in line with our bearish trend line and graphical swing high. Technical indicators are forecasting potential trend reversal. Alternatively, price may dip further towards our 2nd support at 0.0.66981 in line with 61.8% Fibonacci extension.

On the H4 timeframe, price is facing bearish pressure and has dipped towards our 1st support at 0.68492 in line with 88.0% Fibonacci retracement and 127.2% Fibonacci extension. We foresee the potential of prices dipping further to our 2nd support at 0.68047 in line with 100% Fibonacci retracement and 161.8% Fibonacci extension. Technical indicators are showing bearish momentum. Alternatively, prices could experience a pullback to our 1st resistance at 0.69442 in line with 78.6% Fibonacci extension and 61.8% Fibonacci retracement.

Areas of consideration:

- H4 time frame, 1st resistance at 69442

- H4 time frame, 1st support at 0.68492

USD/CAD:

On the Weekly timeframe, price tested and reacted below long term moving average and also both 38.2% and 61.8% Fibonacci retracement level at 1.29882. As long as the price is holding below this level, we could potentially see the price facing further bearish pressure in the long term or at least to 1st support at 1.2029.

On the Daily, price bounced nicely above 1st Support at 1.26099 where further bullish momentum could be possible. With price holding above moving average, a possibility of renewed bullish pressure should price break higher than 1st resistance. Otherwise, price may push lower towards 2nd support at 1.24934.

On the H4, with stochastic testing resistance where price dropped in the past along with the current price’s respect of the trend line, a short term drop towards 1st support at 1.27154 could be possible. Otherwise, breaking above 1st resistance will see price rise higher towards 2nd resistance at 1.28473

Areas of consideration:

- H4 time frame, support at 1.27154

OIL:

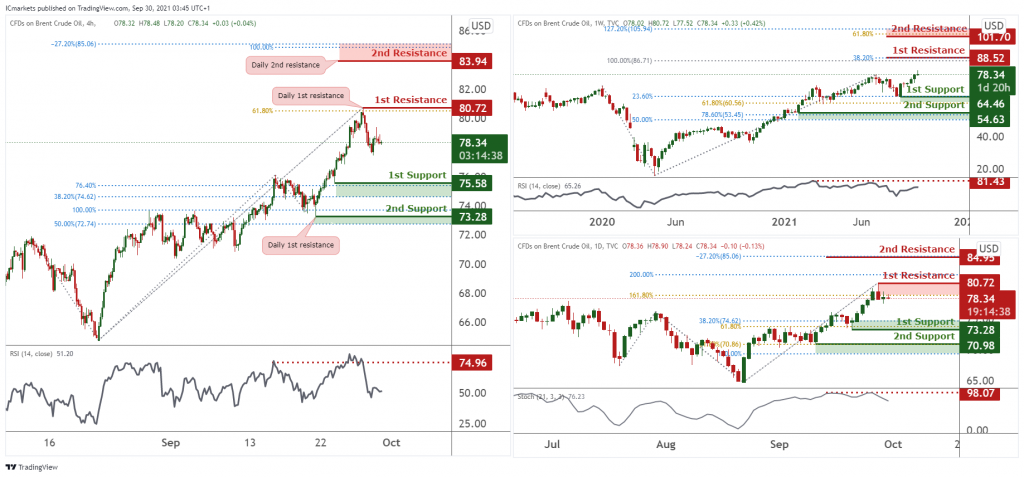

On Weekly timeframe, we see that price is below the 1st resistance at 88.52 in line with Horizontal swing high and 38.2% Fibonacci extension and may brearish towards the 1st support at 64.46 in line with 61.8% fibonacci retracement and 23.6% fibonacci extension. Our bearish bias is further supported by RSI approaching resistance where price dropped in the past. Otherwise price may bullish towards 1st resistance at 88.52 in line with Horizontal swing high and 38.2% Fibonacci extension.

On the Daily timeframe, price may reversed off from 1st resistance at 80.72 in line with horizontal swing high and 161.8% fibonacci extension to 1st support at 73.28 in line with 38.2% Fibonacci retracement and 61.8% fibonacci extension. Our bearish view is further supported by how Stochastic is testing resistance where price dropped in the past. Otherwise price may bullish towards the 2nd resistance at 84.95 in line with -27.2% Fibonacci retracement and 200% Fibonacci extension.

Lastly, on the H4 timeframe, price may reversed off from 1st resistance at 80.72 in line with our Daily 1st resistance to 1st support at 75.58 in line 38.2% Fibonacci retracement and 76.4% Fibonacci extension. Our bearish view is further supported by RSR is testing resistance where price dropped in the past. Otherwise price may bullish towards 2nd resistance at 83.94 in line with -27.2% Fibonacci retracement and 100% Fibonacci extension.

Areas of consideration:

- H4 time frame, 1st resistance of 80.72

- H4 time frame, 1st support of 75.58

Dow Jones Industrial Average:

On the Weekly, price has been trading sideways between our 1st resistance at 37770 and 1st support at 35610.57. As there are no good risk reward levels, we prefer to remain neutral at this current juncture.

On the Daily chart, similar to the weekly, price is now trading between 1st resistance at 35600 and 1st support at 33270. With technical indicators showing room for further bearish momentum, a limited drop towards 1st support could be likely. Price may even break 1st support and drop towards 2nd support at 31985. Otherwise, breaking above 1st resistance will see price rise further towards 2nd resistance at 37770.

On the H4, price pulled lower and is now approaching key 61.8% Fibonacci retracement level and 1st support at 34256 where a bounce reaction could be possible, with buyers looking at 1st resistance at 34962 as a potential upside target. Otherwise, breaking 1st support will see price drop lower towards 2nd support at 33613.

Areas of consideration:

- 4H support at 34256

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.