EUR/USD:

EUR/USD broke above 1.05 resistance overnight and has extended gains to 1.0565 so far. Resistance is seen at 1.0590, followed by 1.0650 (Dec 30 high). It would likely take a break above 1.0650 to cause a larger short squeeze, but the clear break above 1.05 signals that further gains could be ahead.

The former resistance level will now act as key support, and is likely to attract demand from traders who are looking to join the move.

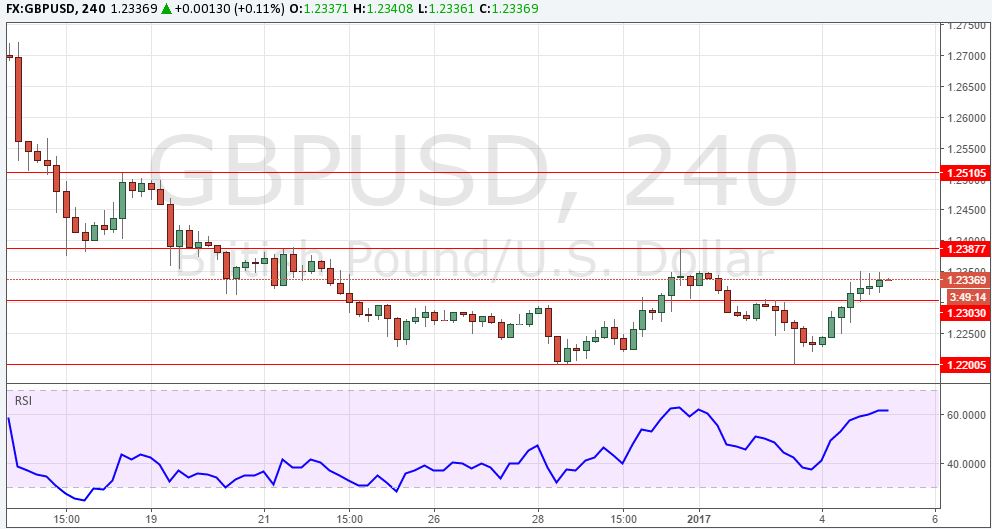

GBP/USD:

The break above 1.23 has confirmed the double bottom at 1.22 and the next obstacle is now 1.2390.

Should it be able to clear that level as well, an extension of the rally to 1.2560 seems likely.

USD/JPY:

USD/JPY is approaching a significant support area at 116.00-10. A break below would likely trigger plenty of momentum selling and further position covering, and could pave the way for a deeper retracement, towards 113.00 support.

To the topside, key resistance is now seen at 117 and likely to attract decent selling interest.

AUD/USD:

The pair has cleared two key resistance levels – 0.7245 and 0.7310. There are now no major obstacles until 0.7525 and further gains seem likely.

Expect decent buying interest in the former resistance area of 0.7245/50.

NZD/USD:

The New Zealand Dollar has been lagging and momentum is not nearly as strong as in the Australian Dollar. While it took out 0.6980 resistance overnight, it still has to clear a significant resistance area at 0.7040/50, and that might be too difficult for now.

Traders should keep an eye on that area and the reaction, should we reach it. However, if NZD/USD is able to take that resistance out, it would signal a move to at least 0.72.

USD/CAD:

Short-term techs have turned bearish following the break below key support at 1.3350/60.

The next notable support level now lies at 1.32, which is also the 76.4 % Fib of the December rally, followed by 1.3078 (mid-December low).

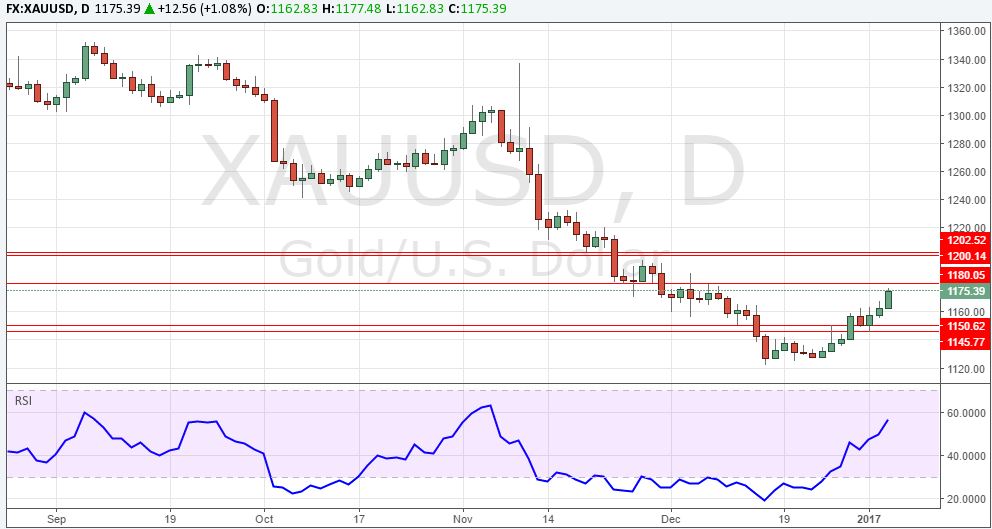

XAU/USD:

Momentum has increased and Gold is heading towards $1180 resistance.

However, that level is unlikely to be a major obstacle; the key resistance area to watch is $1200/05, and a break above would be significant, signalling an extension of the rally to at least $1250.