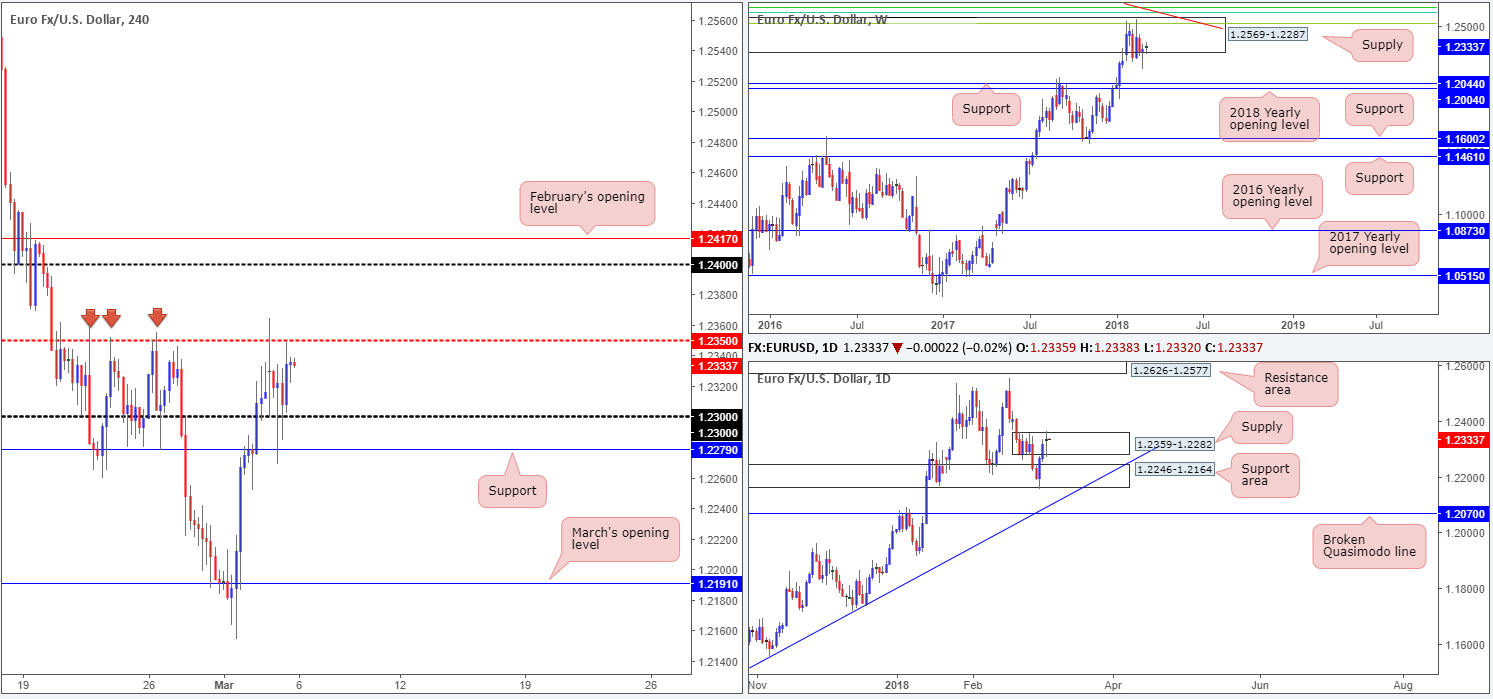

EUR/USD:

Despite receiving news out of Germany regarding government and results from Italy’s elections, the EUR/USD maintained its position between the 1.23 handle and mid-level resistance at 1.2350 on the H4 timeframe. The pair also experienced little movement following the better-than-expected US ISM non-manufacturing reading (considered a market-moving event), which came in at 59.5 for the month of February vs. 58.9 forecasted.

Looking over at the bigger picture, one will see that weekly movement remains teasing the lower limits of a weekly supply at 1.2569-1.2287. To date, this area has managed to cap upside for six consecutive weeks. On the other side of the coin, daily price was recently forced into the confines of a daily supply area coming in at 1.2359-1.2282 after rotating from a nearby daily support area drawn from 1.2246-1.2164. It might also be worth noting that yesterday’s trading formed a clear-cut daily indecision candle.

Potential trading zones:

The H4 mid-level resistance at 1.2350 – along with the current daily and weekly supplies – is likely to hinder further upside today.

It would only be after witnessing a decisive (H4) push above 1.2350 would our team label this market a potential buy up to February’s opening level at 1.2417ish (H4 timeframe).

While selling this market may seem the logical approach in view of the current resistances in play, traders need to remain cognizant of nearby supports in the form of the 1.23 handle and H4 support at 1.2279. Given history, these levels could potentially impede downside.

Data points to consider: FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 1.23 handle; 1.2279; 1.2246-1.2164.

Resistances: 1.2350; 1.2346-1.2326; 1.2359-1.2282; 1.2569-1.2287.

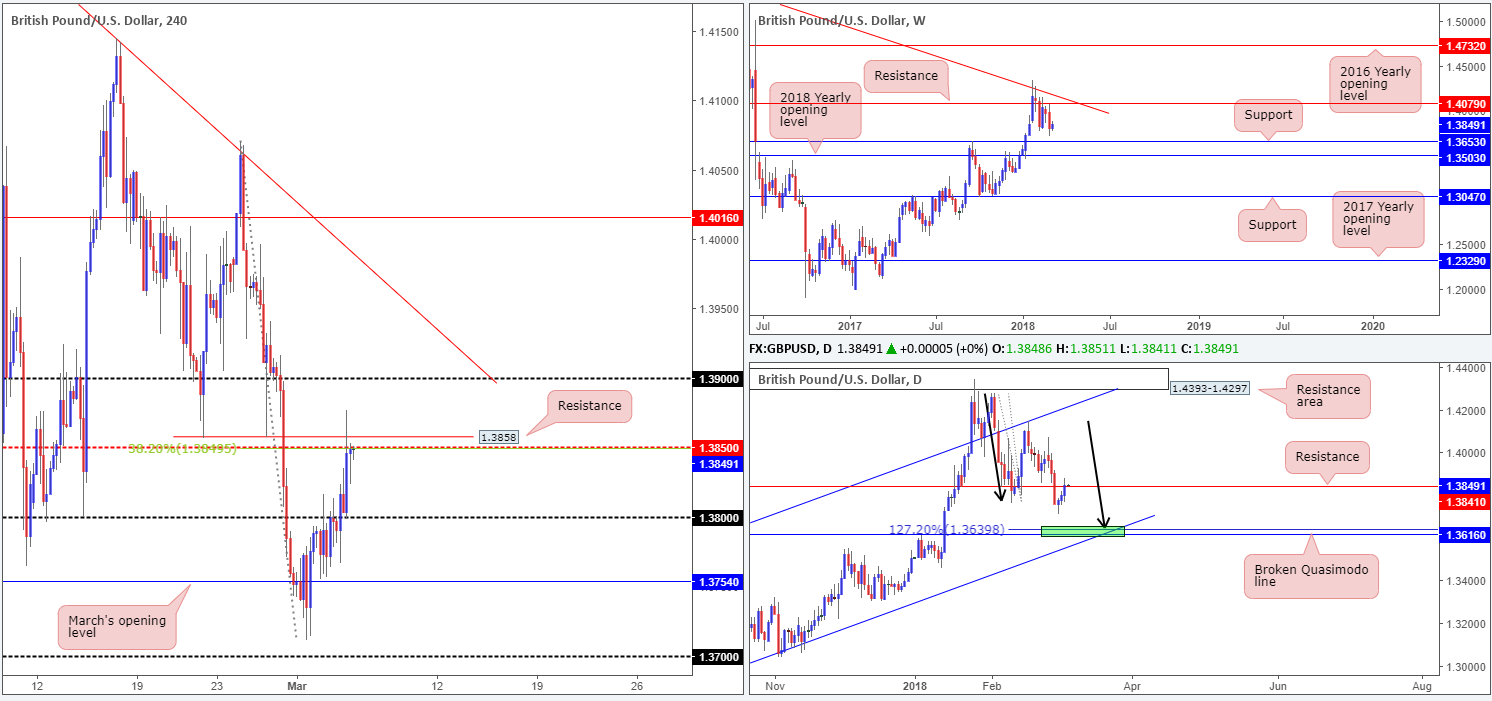

GBP/USD:

The British pound extended gains for a third consecutive day on Monday, reaching highs of 1.3877. Optimistic dialogue from UK’s Prime Minister Theresa May concerning a ‘Brexit' deal sent the market higher. In addition to this, the unit also received a boost on the back of upbeat UK services PMI, nudging H4 price above the 1.38 handle.

Trade concluded with H4 price shaking hands with the mid-level resistance point at 1.3850, which boasts a nearby H4 resistance at 1.3858 and a 38.2% H4 Fib resistance at 1.3849. Thus far, these levels have managed to curb upside.

Eyeing the weekly timeframe, we can see that last week’s flow formed a clear-cut weekly bearish engulfing candle, and is now placed within close proximity of weekly support at 1.3653 and the 2018 yearly opening level at 1.3503. A little lower on the curve, daily price, thanks to yesterday’s move higher, marginally popped above a daily resistance level at 1.3841.

Potential trading zones:

With weekly price likely going to be honing in on the aforementioned weekly supports this week, the limited close above the aforesaid daily resistance is not a concern right now.

Therefore, 1.3850 and its surrounding H4 resistances may be of interest this morning. H4 confluence, coupled with a nearby daily resistance, could be enough to put a stop to current buying. Downside targets from this region fall in at the 1.38 handle, followed then by March’s opening level at 1.3745. According to the higher timeframes, though, price could stretch as far south as the weekly support mentioned above at 1.3653.

Data points to consider: MPC member Haldane speaks at 6.15pm; FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 1.3653; 1.3503. 1.38 handle.

Resistances: 1.3858/1.3849.

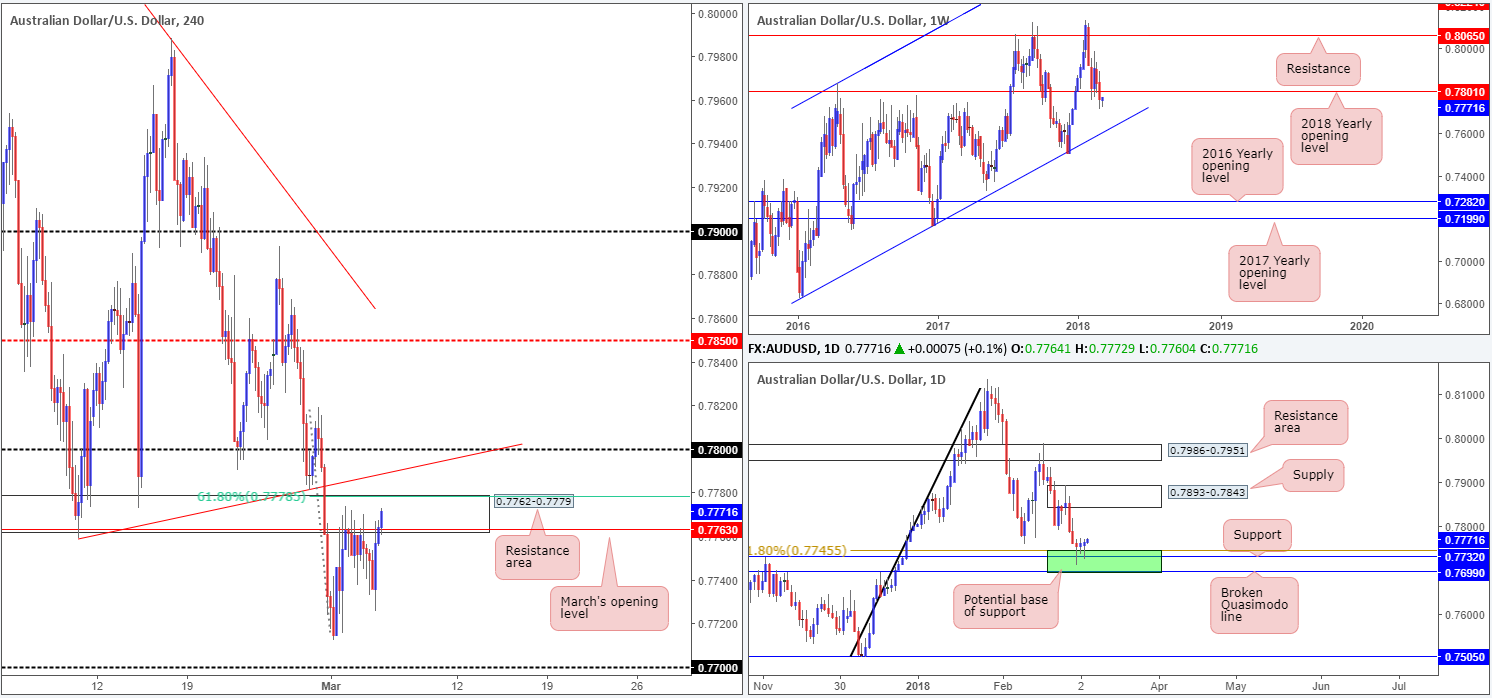

AUD/USD:

After chewing through the 2018 yearly opening level seen on the weekly timeframe at 0.7801 last week, downside remains open to connect with a weekly channel support taken from the low 0.6827. The flip side to this, however, is that daily price is currently seen interacting with a particularly interesting area of support on the daily timeframe fixed between 0.7699/0.7745 (comprised of a daily broken Quasimodo line at 0.7699, a daily support at 0.7732 and a 61.8% daily Fib support at 0.7745). The next upside target from this barrier can be seen in the shape of a daily supply zone drawn from 0.7893-0.7843.

Australian building approvals m/m and company operating profits q/q came in upbeat amid early trade on Monday, sparking a round of AUD buying. Despite this backing, H4 price failed to overcome a H4 resistance area at 0.7762-0.7779, which happens to be positioned alongside March’s opening level at 0.7763 and a 61.8% H4 Fib resistance at 0.7778, as well as just beneath a H4 trendline resistance taken from the low 0.7758.

Potential trading zones:

The current H4 resistance area, while seen holding firm, is not somewhere we’d label as a suitable sell zone. This is because weekly price could retest the 2018 yearly opening level at 0.7801 (effectively dragging H4 price up to the 0.78 handle) as resistance this week, and also due to daily price trading from a base of support (see above).

The 0.78 handle would, therefore, likely be a better location to hunt for shorts today. Though, at the same time, one would still need to keep in mind that daily price could potentially push above this number and target the aforementioned daily supply!

Data points to consider: AUD current account and retail sales m/m at 12.30am; AUD cash rate and RBA statement at 3.30am; RBA Gov. Lowe speaks at 9.35pm; FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 0.7699/0.7745.

Resistances: 0.78 handle; H4 trendline resistance; 0.7778; 0.7801; 0.7762-0.7779; 0.7893-0.7843.

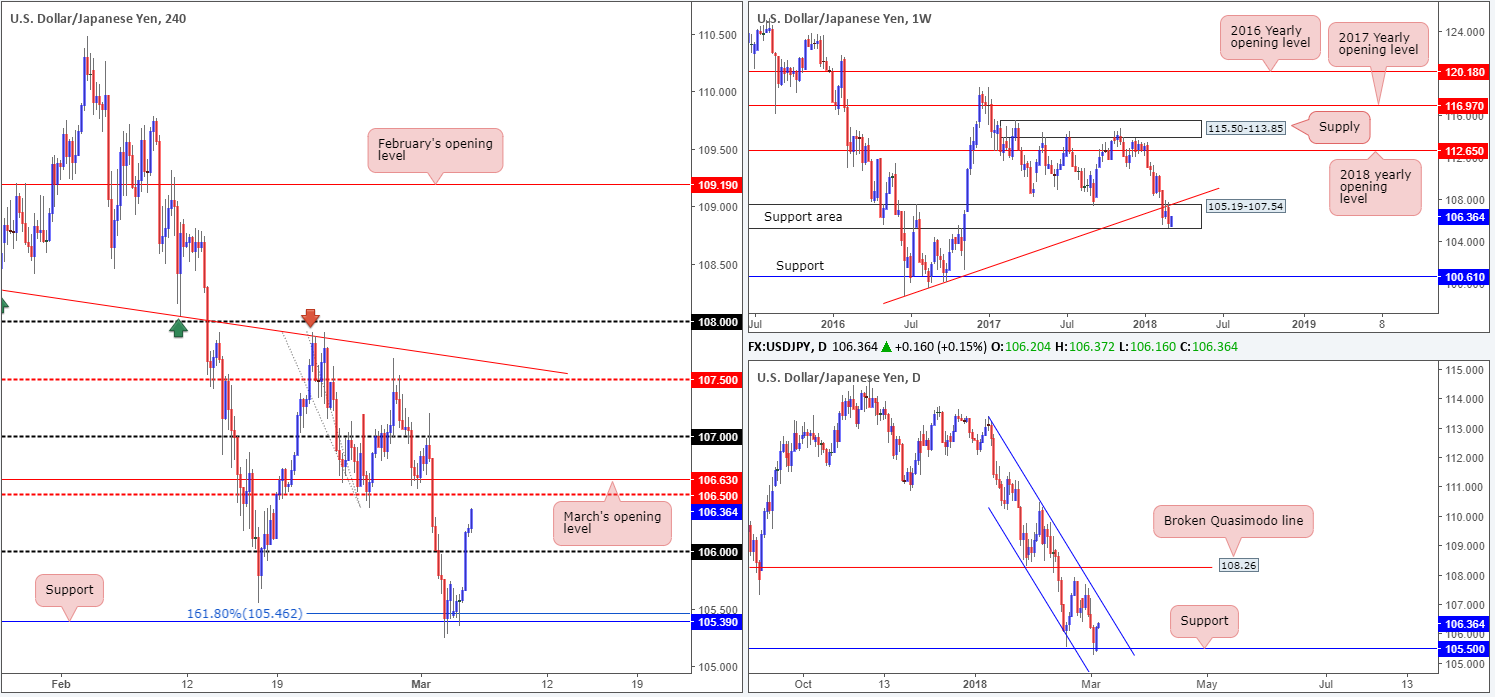

USD/JPY:

In recent trading, the USD/JPY managed to find a grip hold around H4 support at 105.39 (positioned nearby 161.8% H4 Fib ext. point at 105.46) and force itself above the 106 handle. As for the H4 timeframe, the next upside hurdles to have noted are the mid-level H4 resistance at 106.50, shadowed closely by March’s opening level at 106.63.

From a technical standpoint, yesterday’s advance had the backing of a rising US equity market, a daily support located at 105.50 and a weekly support area pegged at 105.19-107.54. Looking at the higher-timeframe structure, we do not see much stopping higher prices until we reach a daily channel resistance etched from the high 113.38.

Potential trading zones:

Unfortunately, market action is somewhat restricted at this time. A buy, although reasonable from a higher-timeframe standpoint, would place one in direct conflict with the above noted H4 resistances. Considering this, neither a long nor shorts seems attractive at this time.

Data points to consider: FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 105.39; 105.46; 105.50; 105.19-107.54.

Resistances: 106.50; 106.63; daily channel resistance.

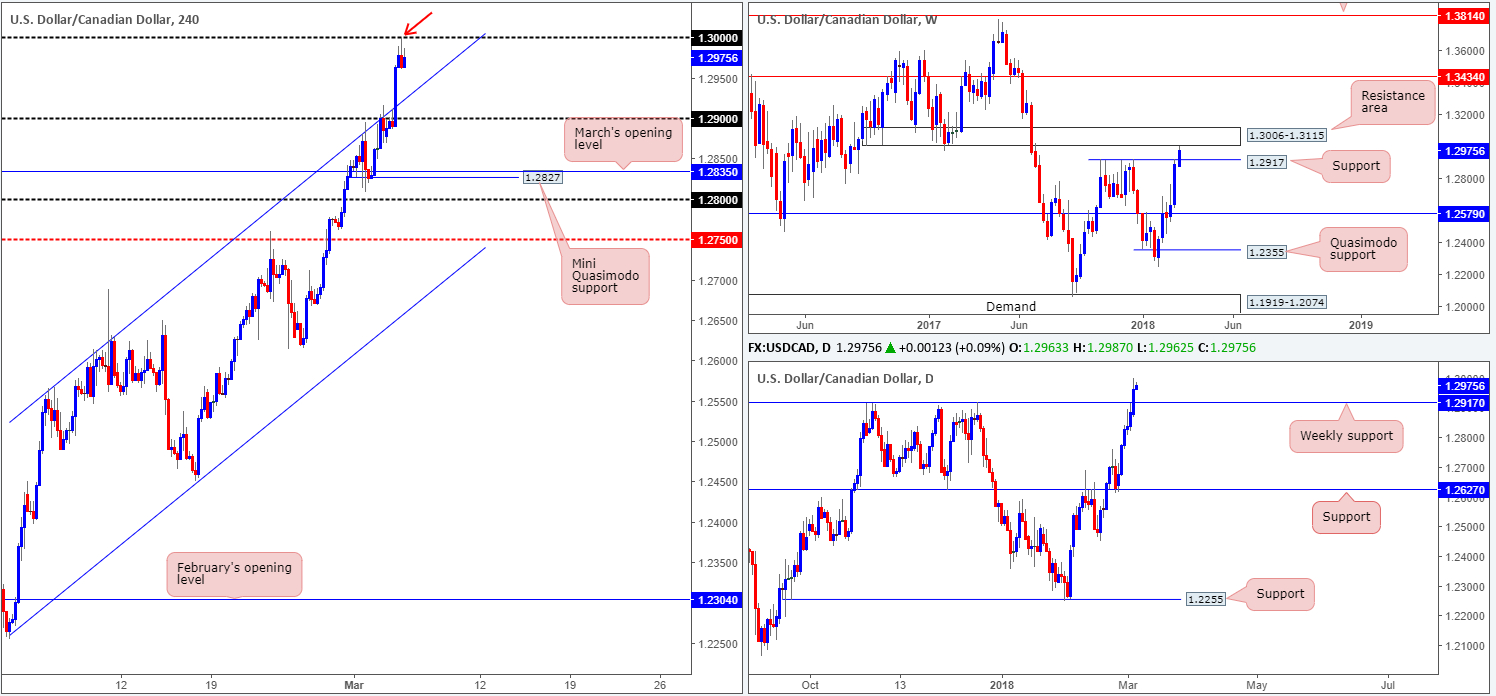

USD/CAD:

Tensions between the US and Canada over tariffs weigh heavily on the Canadian dollar, which saw the USD/CAD record its sixth consecutive daily gain on Monday.

As you can see from the H4 timeframe this morning, both the 1.39 handle and the H4 channel resistance extended from the high 1.2565 were consumed amid yesterday’s trade, consequently allowing the H4 candles to connect with the large psychological band 1.30. So far, this number has done a good job in holding back the buyers. This could have something to do with the fact that it is located a few pips ahead of a concrete weekly resistance area printed at 1.3006-1.3115.

Potential trading zones:

1.30, to us, is likely to hold ground today, and could even see H4 action make a play for the recently broken H4 channel (now acting support). This would be considered a logical first take-profit target, followed closely by weekly support at 1.2917 and then the 1.29 handle. The initial H4 reaction candle, marked with a red arrow, is likely enough to entice traders into the market owing to its strong close. Stops would be best placed 5-10 pips beyond its wick if you’re considering shorting this pair.

Data points to consider: FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 1.29 handle; H4 channel support; 1.2917.

Resistances: 1.30 handle; 1.3006-1.3115.

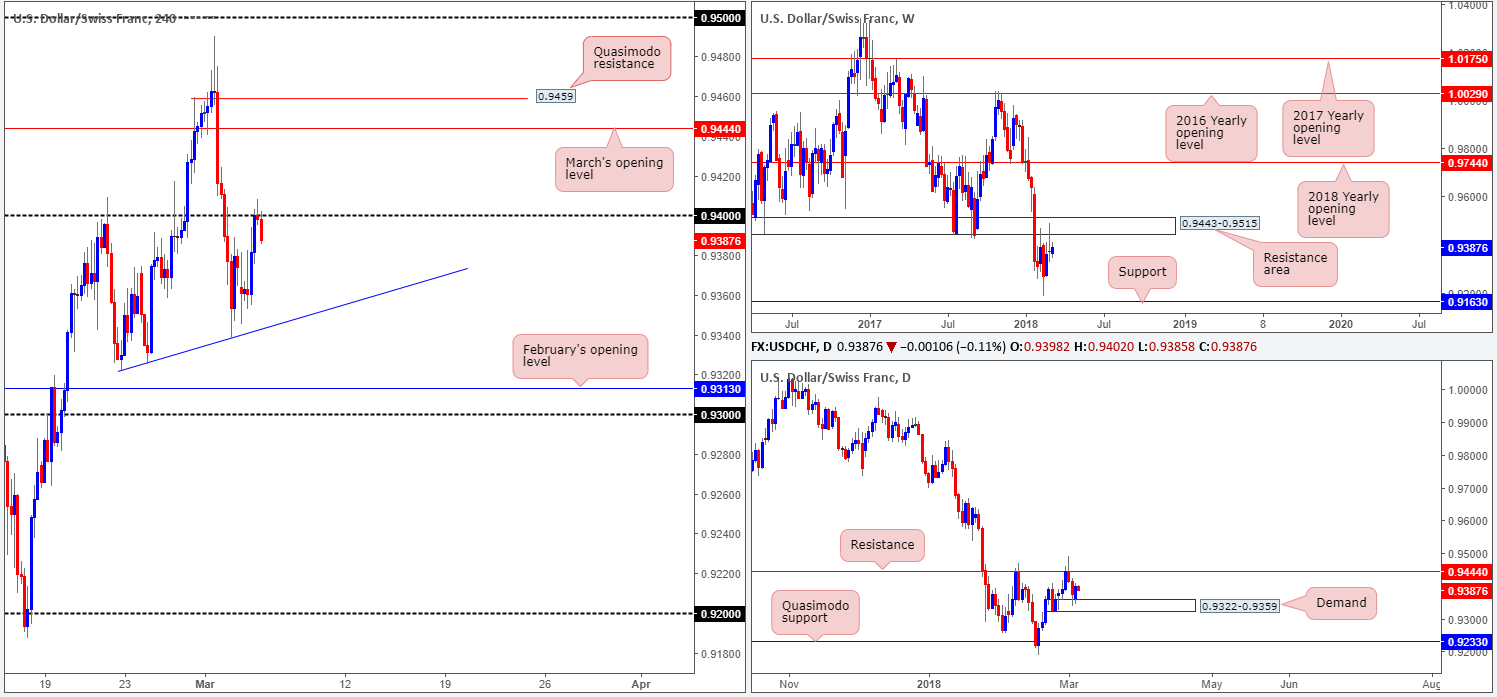

USD/CHF:

The USD/CHF, as you can see from the charts, held on to a mildly positive tone on Monday, dragging the unit up to the 0.94 handle into the closing bell. In recent hours, however, we have seen sellers defending this number, which could lead to a move being seen down to a H4 trendline support extended from the low 0.9322. Beyond this line, we have February’s opening level at 0.9313, shadowed closely by the 0.93 handle.

Supporting further downside, we can also see that weekly price is trading from a notable weekly resistance area at 0.9443-0.9515. Having seen this area hold on several occasions in the past, it was not really a surprise to see the zone hold firm as resistance last week. Continued selling from this point may bring the weekly support level at 0.9163 on to the radar this week. The story on the daily chart, however, shows that daily price recently printed a rotating candle from daily demand at 0.9322-0.9359, which could call for a retest of 0.9444: a daily resistance level that essentially represents the underside of the current weekly resistance area.

Potential trading zones:

Selling the move off 0.94 could be something to consider. In doing so, though, you would have to be content shorting into potential daily buying from the aforementioned daily demand area. A break beyond the current daily demand, as the weekly timeframe suggests may eventually happen, could see the daily Quasimodo support at 0.9233 brought into view.

Data points to consider: FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 0.93 handle; 0.9313; H4 trendline support; 0.9233; 0.9163.

Resistances: 0.94 handle; 0.9444; 0.9443-0.9515.

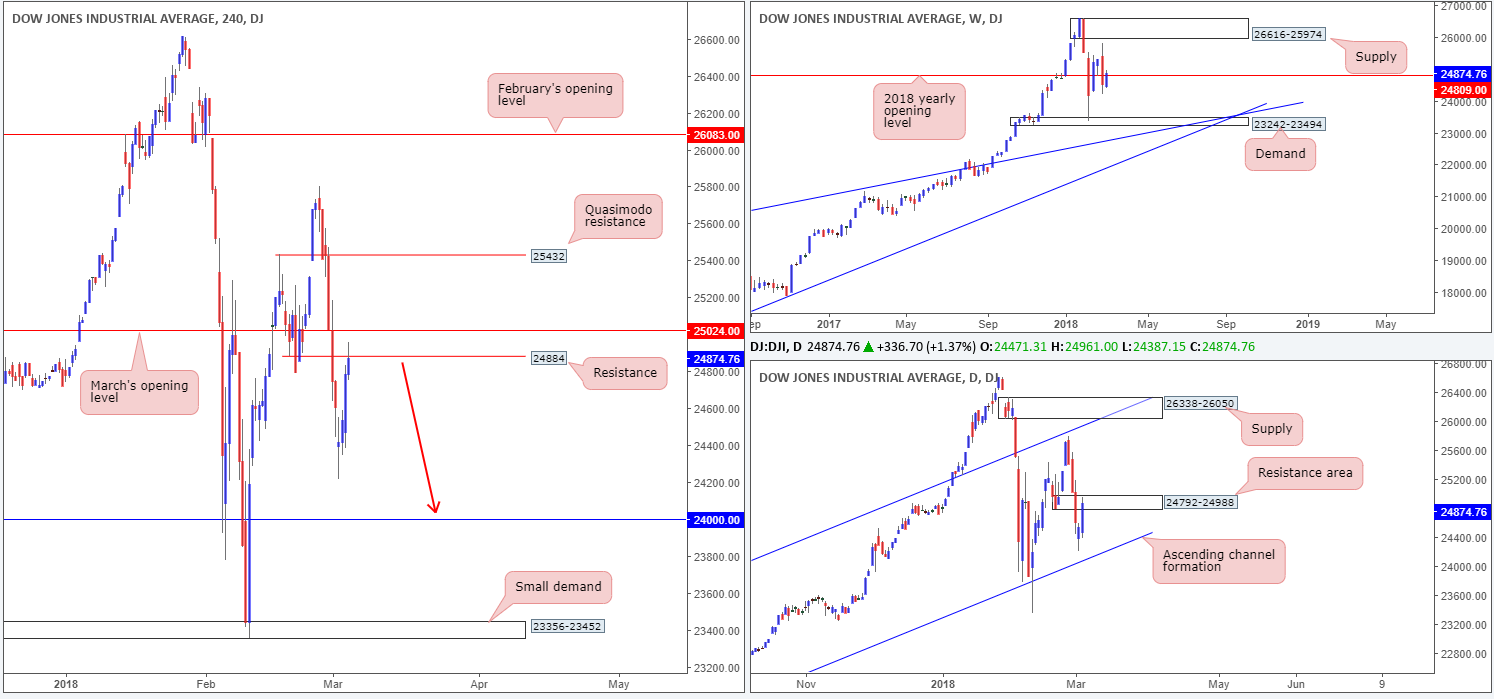

DOW 30:

US equities printed a healthy bullish candle amid Monday’s segment. Recent declines, influenced by remarks from US President Trump regarding a trade war, were brought to a halt as the market digested news that congressional lawmakers and key members of the Republican Party are working to talk Trump down from his aggressive statements.

The advance pulled weekly price marginally back above the 2018 yearly opening level at 24809, while both daily and H4 price are now seen interacting with resistances. Daily price, as you can see, ended yesterday’s session closing within the walls of a daily resistance area at 24792-24988, and H4 price connected with a resistance level drawn from 24884, which is shadowed closely by March’s opening level at 25024. A move lower in this market has the 24K mark to target and also a daily channel support extended from the low 17883.

Potential trading zones:

As far as we’re concerned, the most logical trade point in this market right now remains around the noted H4 resistance at 24884. Not only is it positioned within the walls of a daily resistance area at 24792-24988, it is also seen plotted not too far from the 2018 yearly opening band at 24809. Should your trading plan agree, we would also recommend waiting for additional candle confirmation in the form a H4 full or near-full-bodied bearish candle. This will help avoid a fakeout and emphasize bearish intent.

Data points to consider: FOMC members Dudley and Brainard speak at 12.30pm and 10.30pm GMT, respectively.

Areas worthy of attention:

Supports: 24000; daily channel support.

Resistances: 24884; 25024; 24792-24988; 24809.

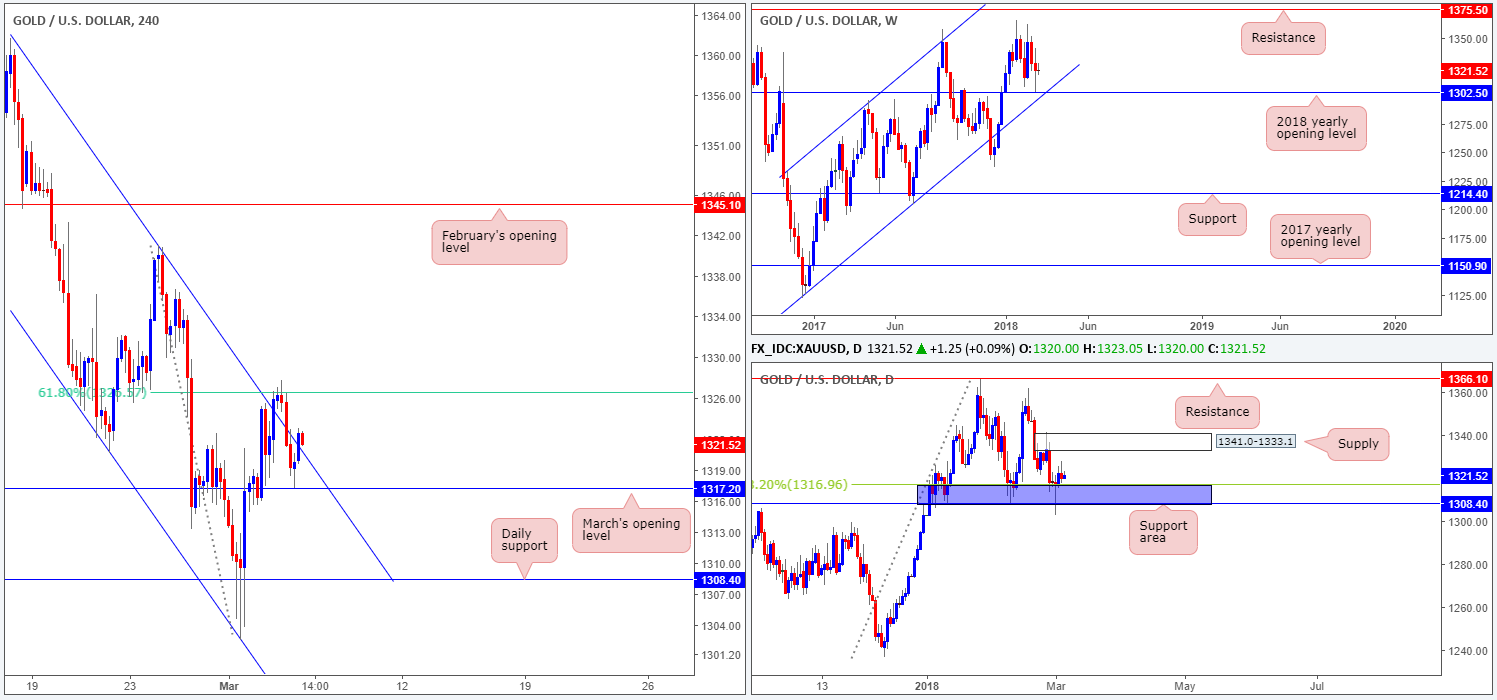

GOLD:

As you can see from the H4 chart this morning, H4 price managed to breach the current H4 channel resistance (taken from the high 1361.7) on Monday, but quickly found a home at a nearby 61.8% H4 Fib resistance level at 1326.6. Also worthy of note is the to-the-pip reaction seen from March’s opening level at 1317.2 that forced H4 price to close out above the noted H4 channel resistance.

With weekly price recently printing a strong-looking correction tail from the 2018 yearly opening level at 1302.5, and daily price making a stand from a daily support area marked in blue at 1308.4-1316.9 (comprised of a daily support and 38.2% Fib support level), further buying could be the order of the day/week.

Potential trading zones:

As long as H4 price remains above the H4 channel resistance, there’s a strong chance that the aforesaid H4 61.8% Fib resistance could be retested. Beyond this Fibo level, however, there’s not much room seen for the unit to stretch its legs given how close daily supply at 1341.0-1333.1 is positioned (the next upside target on the daily scale).

Therefore, if you’re looking to buy gold at this time, it will likely pay to employ strict trade management rules!

Areas worthy of attention:

Supports: 1317.2; 1308.4/1316.9; 1302.5; weekly channel support.

Resistances: 1326.6; H4 channel resistance; 1341.0-1333.1.

This site has been designed for informational and educational purposes only and does not constitute an offer to sell nor a solicitation of an offer to buy any products which may be referenced upon the site. The services and information provided through this site are for personal, non-commercial, educational use and display. IC Markets does not provide personal trading advice through this site and does not represent that the products or services discussed are suitable for any trader. Traders are advised not to rely on any information contained in the site in the process of making a fully informed decision.

This site may include market analysis. All ideas, opinions, and/or forecasts, expressed or implied herein, information, charts or examples contained in the lessons, are for informational and educational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.