Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

EUR/USD:

EUR/USD prices are, once again, little changed this morning. As you can see, the buyers and sellers remain battling for position around the 1.12 handle. Directly overhead we have June’s opening level at 1.1238, followed closely by the mid-level resistance at 1.1250. Below 1.12, there’s little support until price connects with the mid-level barrier at 1.1150.

A quick look at the weekly chart shows that the single currency remains trading around the underside of a major supply at 1.1533-1.1278. Managing to cap upside since May 2015, this is not an area one should overlook. Looking down to the daily timeframe, however, the candles are now seen sandwiched between supply coming in at 1.1327-1.1253 and support pegged at 1.1142.

Our suggestions: Based on the above notes our desk has shown interest around the 1.1150 neighborhood, due to the base converging with the following structures (green area):

- A H4 trendline support taken from the high 1.1268.

- A H4 trendline support etched from the low 1.1075.

- A H4 61.8% Fib support at 1.1155 drawn from the low 1.1074.

- A H4 78.6% retracement level pegged at 1.1147 penciled in from the low 1.1109.

- A daily support level seen at 1.1142.

Seeing as how this zone is rather small, we will not be placing pending buy orders here. Instead, we’ve chosen to wait for a reasonably sized H4 bull candle to form, preferably a full-bodied candle. This will help prove buyer interest exists here which IS needed due to where price is trading from on the weekly chart right now.

Data points to consider: US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: 1.1150 region ([waiting for a reasonably sized H4 bull candle – preferably a full-bodied candle – to form before pulling the trigger is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

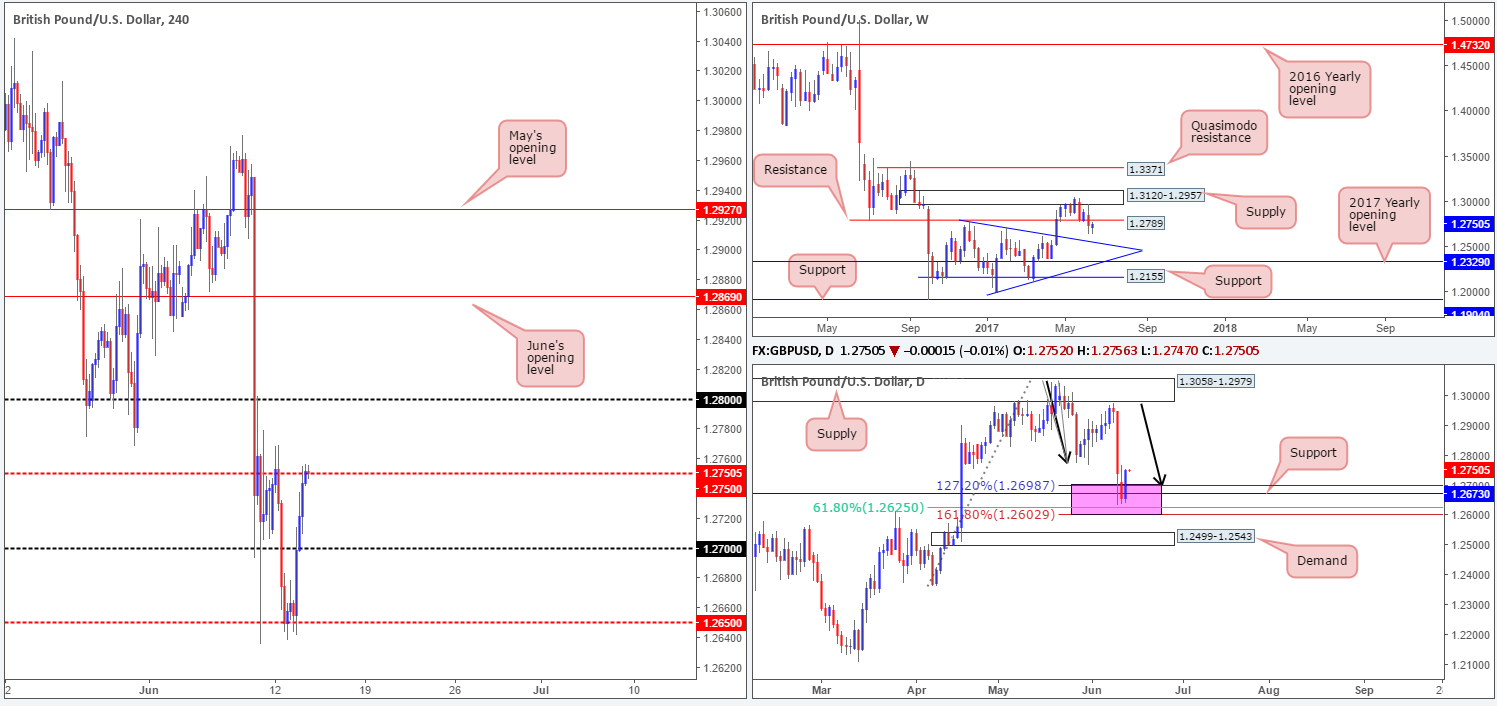

GBP/USD:

With downside attempts being limited for now by 1.2602/1.2698 (a daily zone marked in pink), further buying could take place today. There are a few notable features about this zone that deserve mention: a daily support level coming in at 1.2673, a daily 61.8% Fib support at 1.2625 (taken from the low 1.2365) and a daily AB=CD (black arrows) 127.2/161.8% ext. completion point seen at 1.2602/1.2698 (drawn from the high 1.3047). The advance from this area, however, was likely helped by the string of upbeat UK data released during yesterday’s London morning segment.

Although the H4 candles easily cleared the 1.27 handle, upside momentum seems to have diminished after connecting with the mid-level resistance at 1.2750. The next upside hurdle beyond this number can be seen on the weekly chart in the form of a resistance level pegged at 1.2789, shadowed closely by the 1.28 handle.

Our suggestions: In view of the near-full-bodied daily bullish candle printed from 1.2602/1.2698, a trade above 1.2750 could be an option today. However, to take advantage of this potential move, we would strongly recommend waiting for a H4 close to form above 1.2750, and then look to trade any retest of this level seen thereafter, targeting the 1.28 region as the initial take-profit zone.

Data points to consider: UK Employment figures at 9.30am. US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: Watch for H4 price to engulf 1.2750 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe buy signal to form following the retest – see the top of this report – is advised] stop loss: dependent on where one confirms this level).

- Sells: Flat (stop loss: N/A).

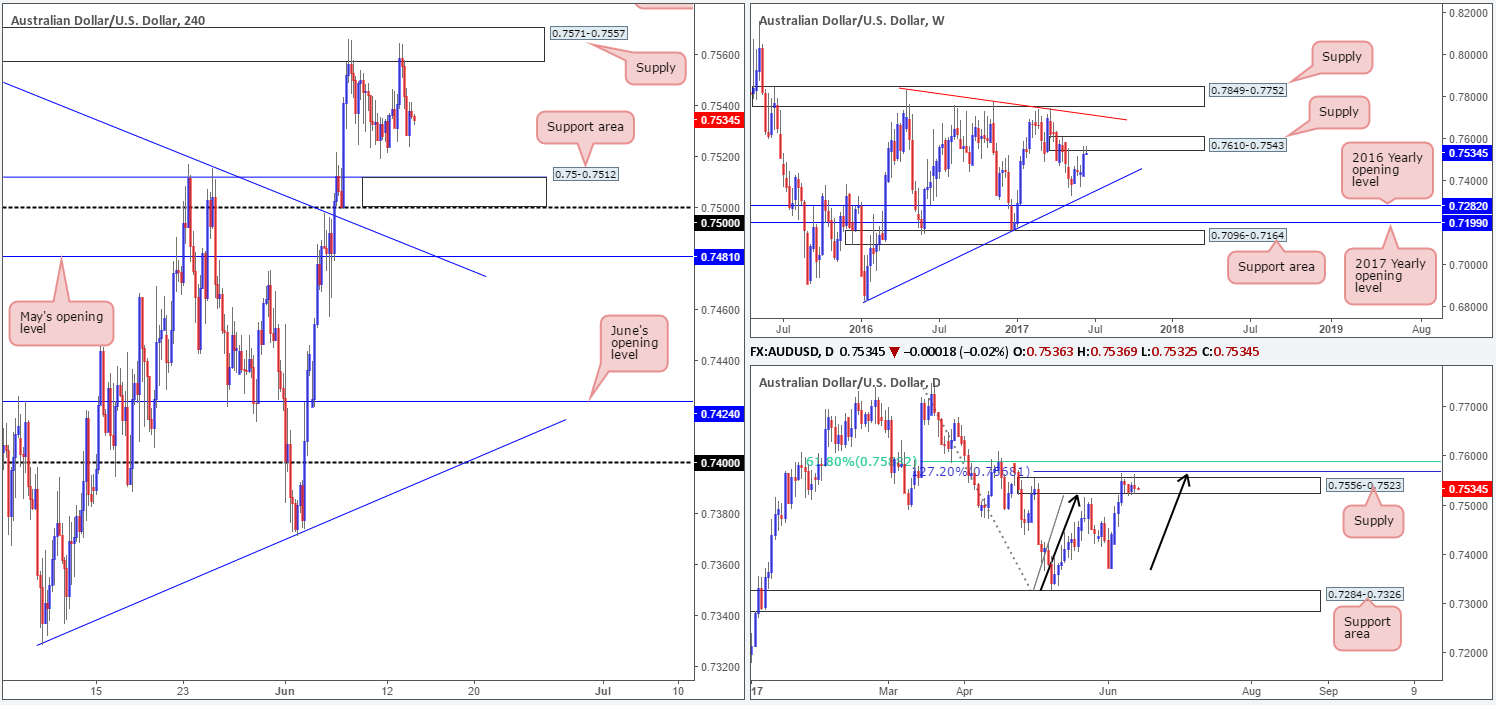

AUD/USD:

In view of weekly price recently shaking hands with supply coming in at 0.7610-0.7543, the sellers could very well make an appearance from here this week. We see little in the way of support from this angle until price links with a trendline support etched from the low 0.6827.

In agreement with weekly flow, daily action also recently whipsawed above supply formed at 0.7556-0.7523 and touched base with an AB=CD 127.2% completion point (see black arrows) at 0.7568 (taken from the low 0.7328). This move likely took out a truckload of buy stops from above the said supply and therefore has potentially provided enough liquidity for the big boys to sell into.

For those who read Tuesday’s report you may recall that our desk highlighted the H4 supply zone at 0.7571-0.7557 as a potential area to short from. This was mainly due to this area’s connection with the said higher-timeframe supplies. As can be seen from the H4 chart, the unit sold off beautifully from this base and clocked a low of 0.7524. For any of our readers who managed to get short from here, further downside is likely as we do not expect the local support at 0.7520 to hold for much longer, since the more attractive zone is positioned below at 0.75/0.7512.

Our suggestions: Other than Tuesday’s call to short the aforementioned H4 supply zone, we do not have much else to hang our hat on right now. Buying from the said H4 support area would, in our opinion, be too much of a risk given where price is coming from on the bigger picture! So therefore, remaining flat may be the safer option today.

Data points to consider: Chinese Industrial production numbers at 3am. US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

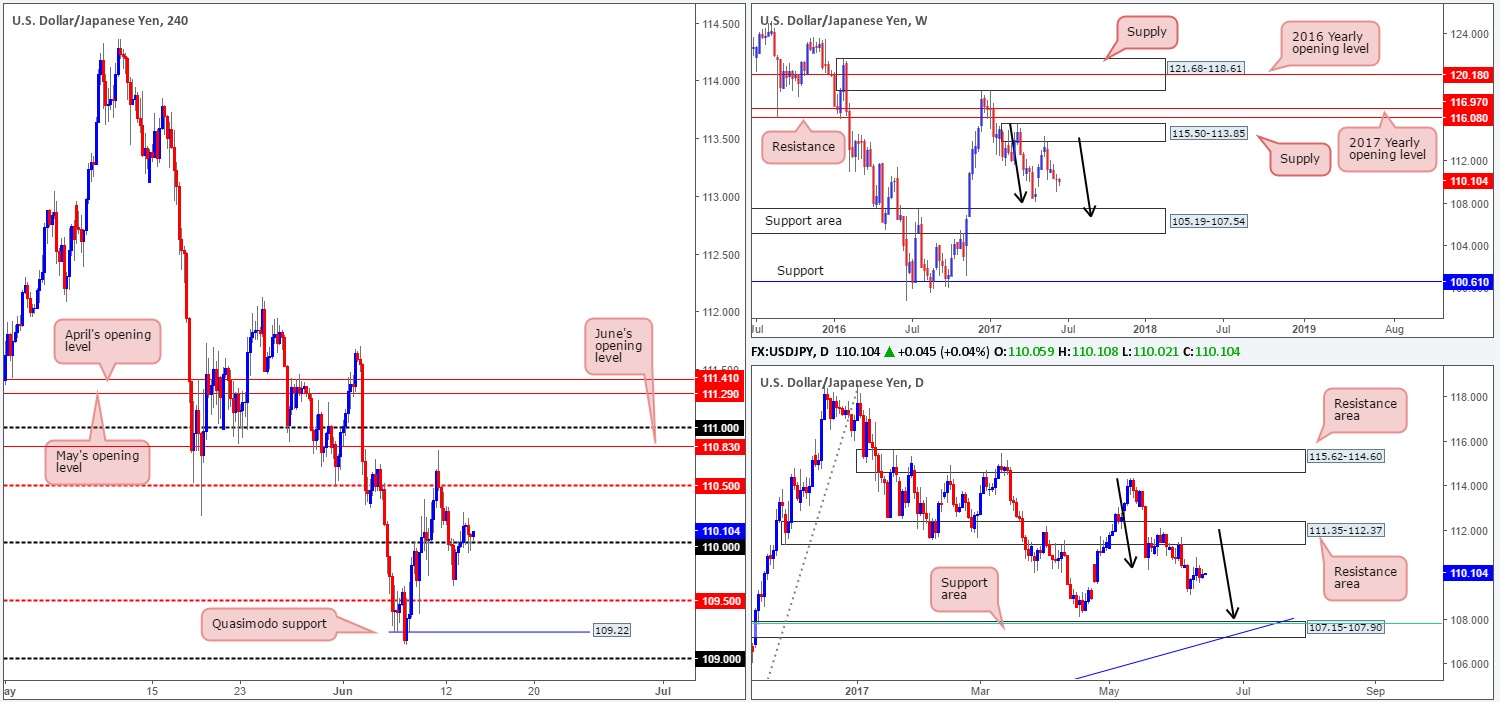

USD/JPY:

Despite the unit establishing support on the retest of the 110 handle, price was somewhat directionless during yesterday’s trading. The next hurdle in the firing range from here can be seen around the H4 mid-level resistance at 110.50, followed relatively closely by June’s opening level at 110.83.However, we do feel that the bulls are rather vulnerable here. Our reasoning lies within the higher-timeframe structure.

Weekly bears continue to remain in a relatively strong position after pushing aggressively lower from supply registered at 115.50-113.85. We know there’s a fair bit of ground to cover here, but this move could possibly result in further downside taking shape in the form of a weekly AB=CD correction (see black arrows) that terminates within a weekly support area marked at 105.19-107.54 (stretches all the way back to early 2014). In conjunction with weekly flow, daily price also shows a potential AB=CD correction in the works taken from the high 114.36, which could see price drive lower to 107.15-107.90: a support zone that’s glued to the top edge of the said weekly support area.

Our suggestions: In light of the above notes, our team has no interest in buying from 110 today. Instead, what we’re looking for is a H4 close to print below this level. That way, we’d not only have space to sell down to at least the H4 mid-level support at 109.50, but we’d also be trading in line with higher-timeframe flow.

Data points to consider: US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to engulf 110 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe sell signal to form following the retest – see the top of this report – is advised] stop loss: dependent on where one confirms this level).

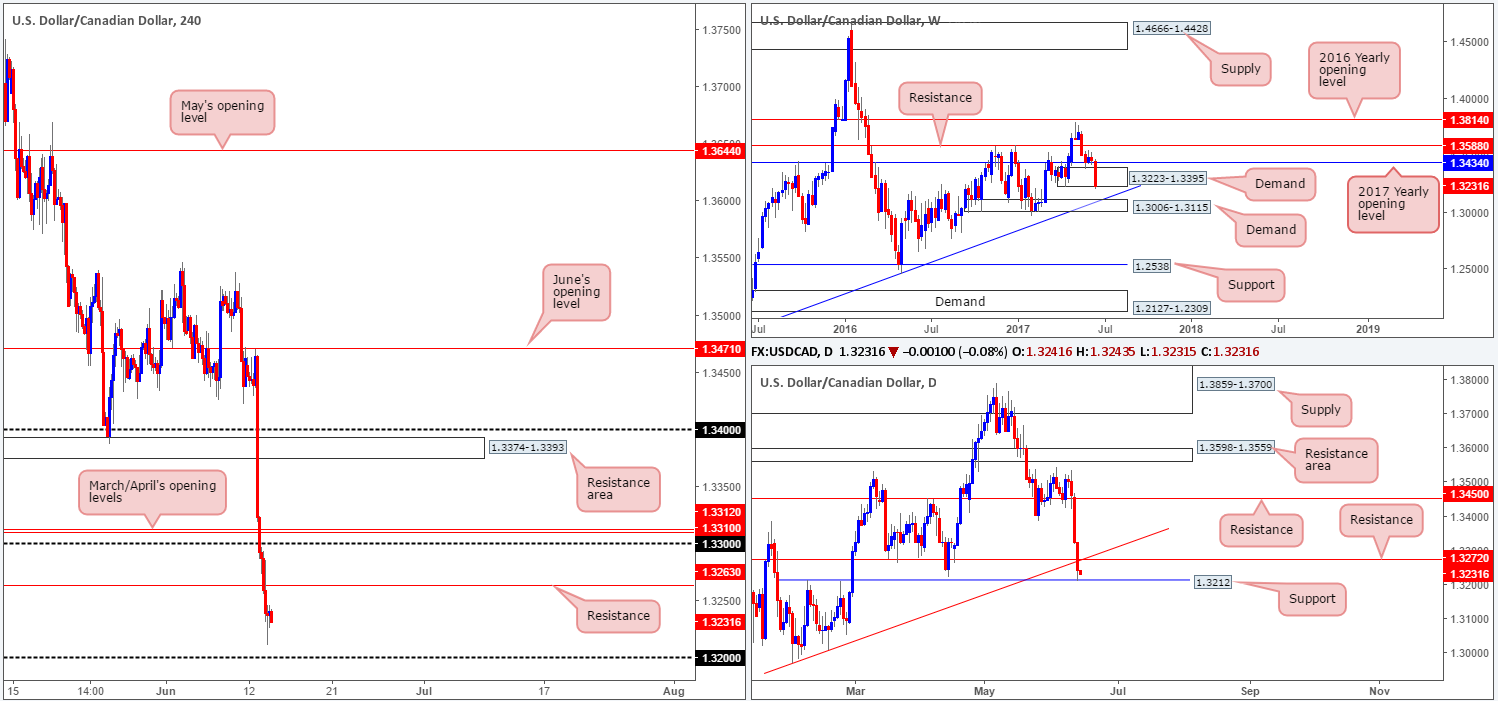

USD/CAD:

Of late, the USD/CAD has taken some significant punishment, losing over 200 pips in two days! The move was, we believe, triggered by comments from the Senior Deputy Governor at the BoC, who hinted at a hawkish shift in monetary policy.

Yesterday’s move, as you can see, ran through multiple H4 supports and ended the day bottoming just ahead of the 1.32 handle. Technically speaking, the reason for price not connecting with this psychological band was due to daily price linking with support pegged at 1.3212. Also of interest is the weekly demand at 1.3223-1.3395. Although the zone is under pressure at the moment, there’s still a chance (now we see that daily support is in motion) that bids will hold this area steady.

Our suggestions: Given the current landscape, longs from the 1.32 handle could be something to consider today. However, to be on the safe side, we would require additional confirmation in the form of a (preferably full-bodied candle) H4 bullish candle. This, of course, would not guarantee a winning trade, but it will show that there is buyer interest, and this is the best we have.

Data points to consider: US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: 1.32 region ([waiting for a reasonably sized H4 bull candle – preferably a full-bodied candle – to form before pulling the trigger is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (Stop loss: N/A).

USD/CHF:

Much like its inversely correlated cousin the EUR/USD, the USD/CHF is, once again, little changed this morning. Bids and offers appear to be balanced between the 0.97 handle and June’s opening level penciled in at 0.9680. With that being said though, a push to the upside is likely here due to having seen the weekly Quasimodo support level at 0.9639 hold steady and daily price showing room to extend up to supply pegged at 0.9825-0.9786.

Our suggestions: Despite the higher timeframes indicating that further buying may be at hand, the H4 chart is just a minefield of resistances at the moment! Not only do we have the 0.97 level sitting just ahead, we also have a H4 61.8% Fib resistance plugged at 0.9732, followed closely by the H4 mid-level resistance at 0.9750.Therefore, we believe that remaining on the sidelines may be the better bet for now.

Data points to consider: US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

DOW 30:

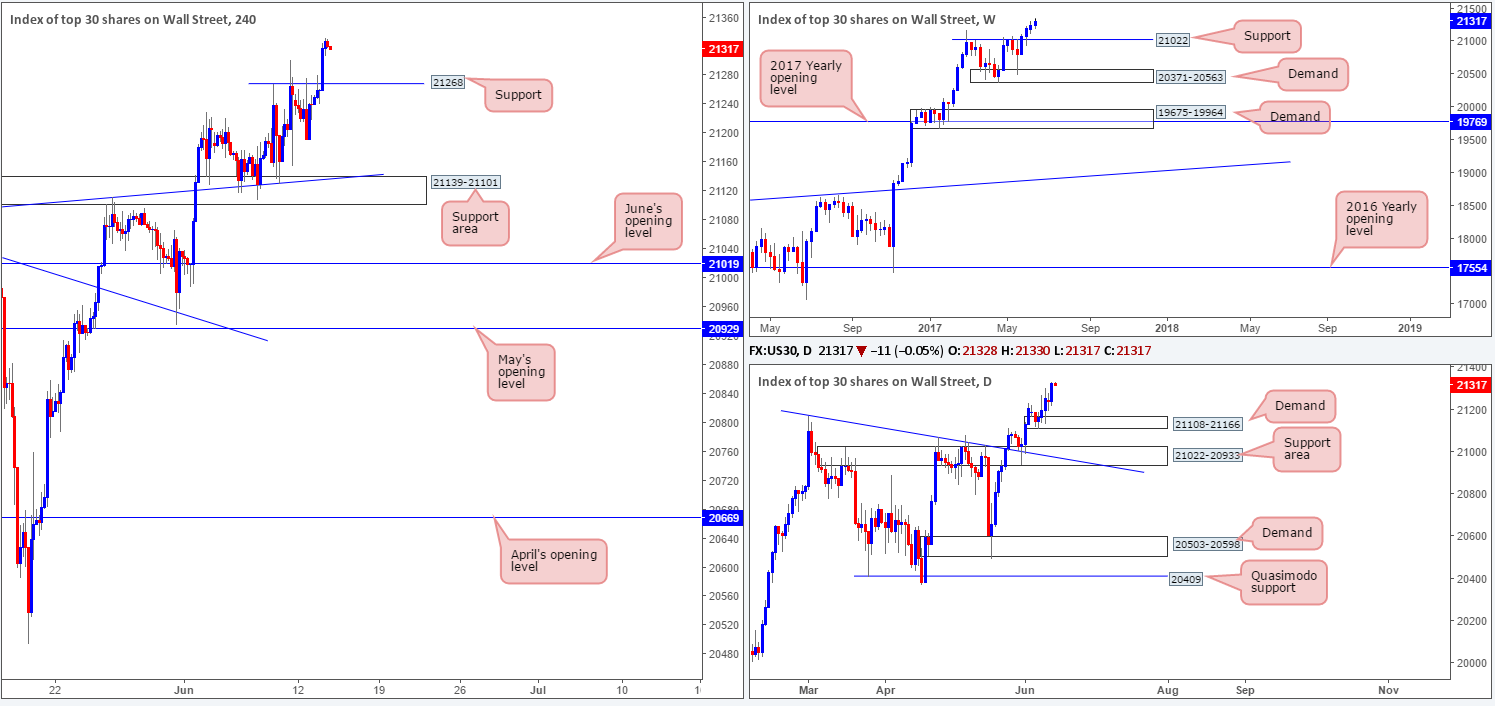

For those who have been following our reports over the past few days you may recall that our desk had recently taken a small long position at 21164 and placed stops below the H4 support area (21139-21101) at 21097. The position is still active, but we have liquidated 50% of the trade around the 21234 neighborhood.

Fortunately, the index punched to fresh record highs during yesterday’s segment, and we are now looking to trail this market with the remainder of our position. The stop is now positioned below Monday’s session low (21192) at 21188. Ideally, we’re looking for H4 price to remain above the H4 support level coming in at 21268, as a close below here could imply that our stop-loss order is at risk of being filled.

Our suggestions: Should H4 action pullback and retest 21268 and hold as support, our team may, dependent on the time of day, consider adding to our position. A H4 bullish candle (preferably a full-bodied candle) would be a fantastic sight as this would be enough evidence to trigger an additional buy in this market.

Data points to consider: US Inflation and retail sales data at 1.30pm, FOMC statement, projections and Fed funds rate decision at 7pm, followed closely by the FOMC Press conference at 7.30pm GMT+1.

Levels to watch/live orders:

- Buys: 21164 ([live] stop loss: 21188). 21268 region ([waiting for a reasonably sized H4 bull candle – preferably a full-bodied candle – to form before pulling the trigger is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

GOLD:

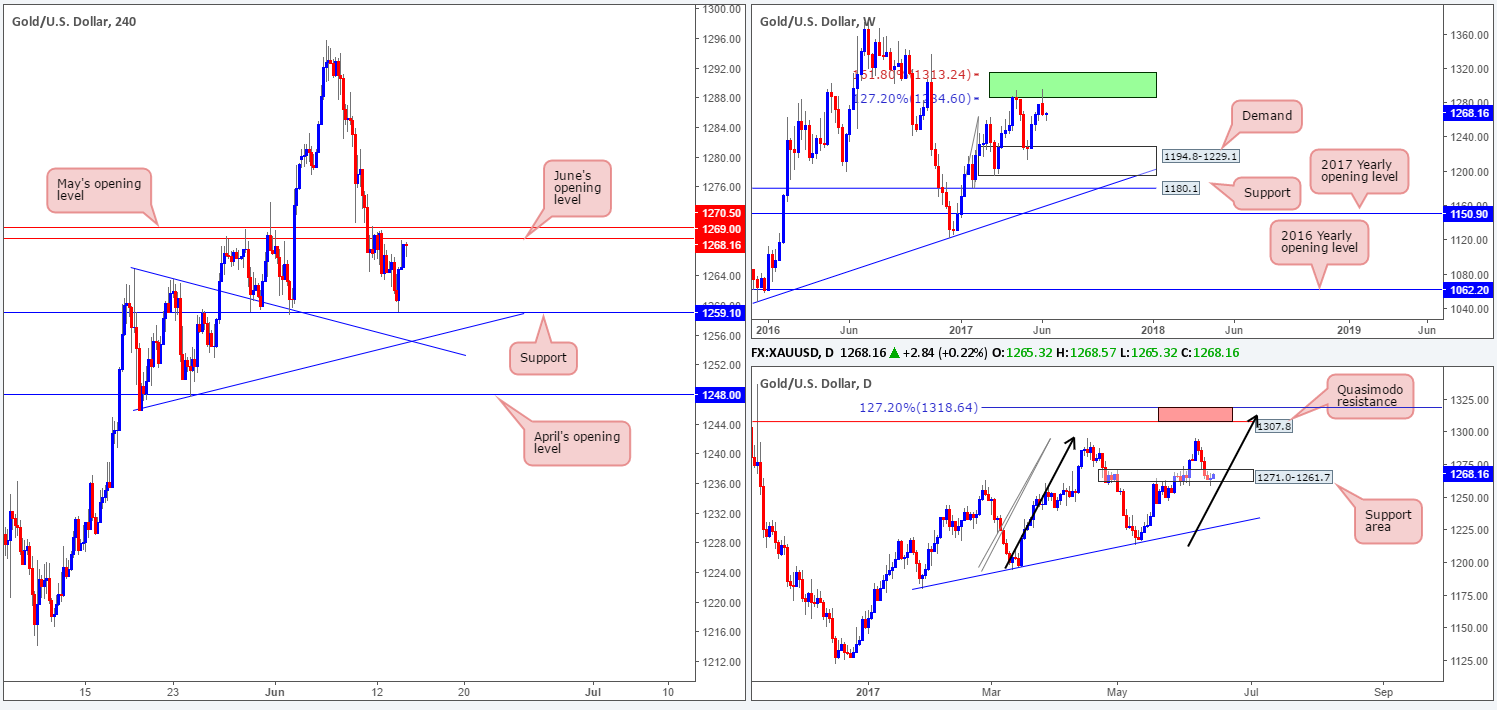

During the course of yesterday’s sessions, the yellow metal printed a clear-cut daily indecision candle that pierced through the lower edge of a daily support area coming in at 1271.0-1261.7. On the H4 chart, price came within shouting distance of the support level at 1259.1, and has since rallied back up to just ahead of June’s opening level at 1269.0. Up on the weekly chart, nevertheless, bullion continued to drive lower from an area comprised of two weekly Fibonacci extensions 161.8/127.2% at 1313.7/1285.2 taken from the low 1188.1 (green zone) last week. From this scale, there’s room for the precious metal to continue pumping lower until we reach the demand base coming in at 1194.8-1229.1.

Our suggestions: Although June’s opening level is bolstered by both May’s opening level at 1270.5 and the weekly zone mentioned above, we are still wary of selling this market, mainly due to the daily support zone currently in play. Should this area be consumed, then shorts, at least in our opinion, would be a no brainer. But for now, however, we’re going to take the side of caution and remain on the sidelines for the time being.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).