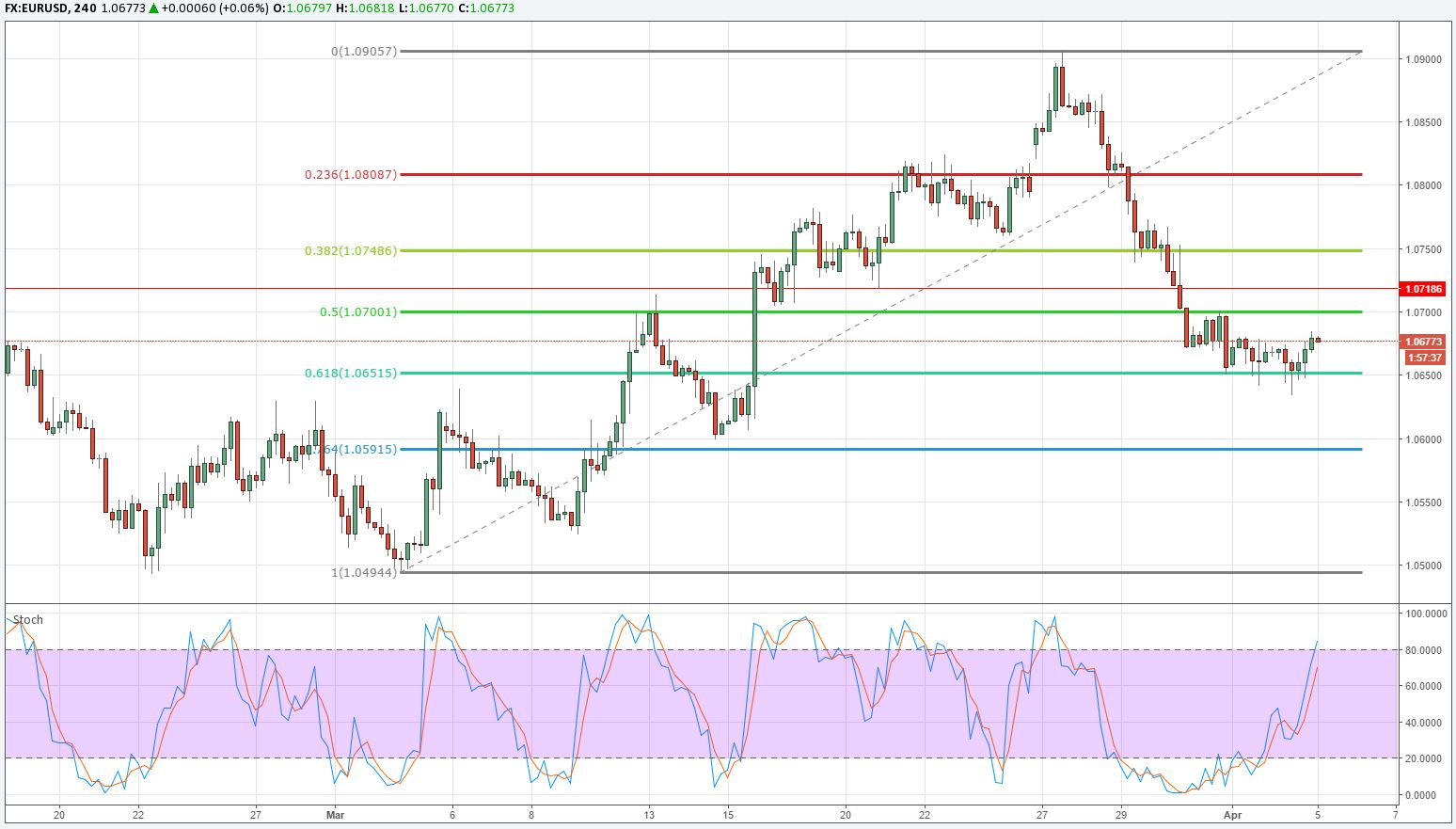

EUR/USD

Price has bounced slightly overnight. While the outlook remains negative, the currency pair does look oversold in the short-term. Initial resistance is noted at 1.07, with stronger resistance then seen at 1.0718 and 1.0750 (38.2 % Fibonacci of the March Rally).

A rally to one of those aforementioned levels is likely to attract decent selling interest.

GBP/USD

The Cable came under pressure yesterday and broke below 1.2465 support. The currency pair extended losses to 1.2420, and while it bounced from there, it still lacks momentum for a larger recovery.

Should GBP/USD break below the trendline support and 1.2420, a test of the key 1.2340-75 area seems likely. The pair is likely to encounter strong support there, and buying it there seems attractive given the risk-reward.

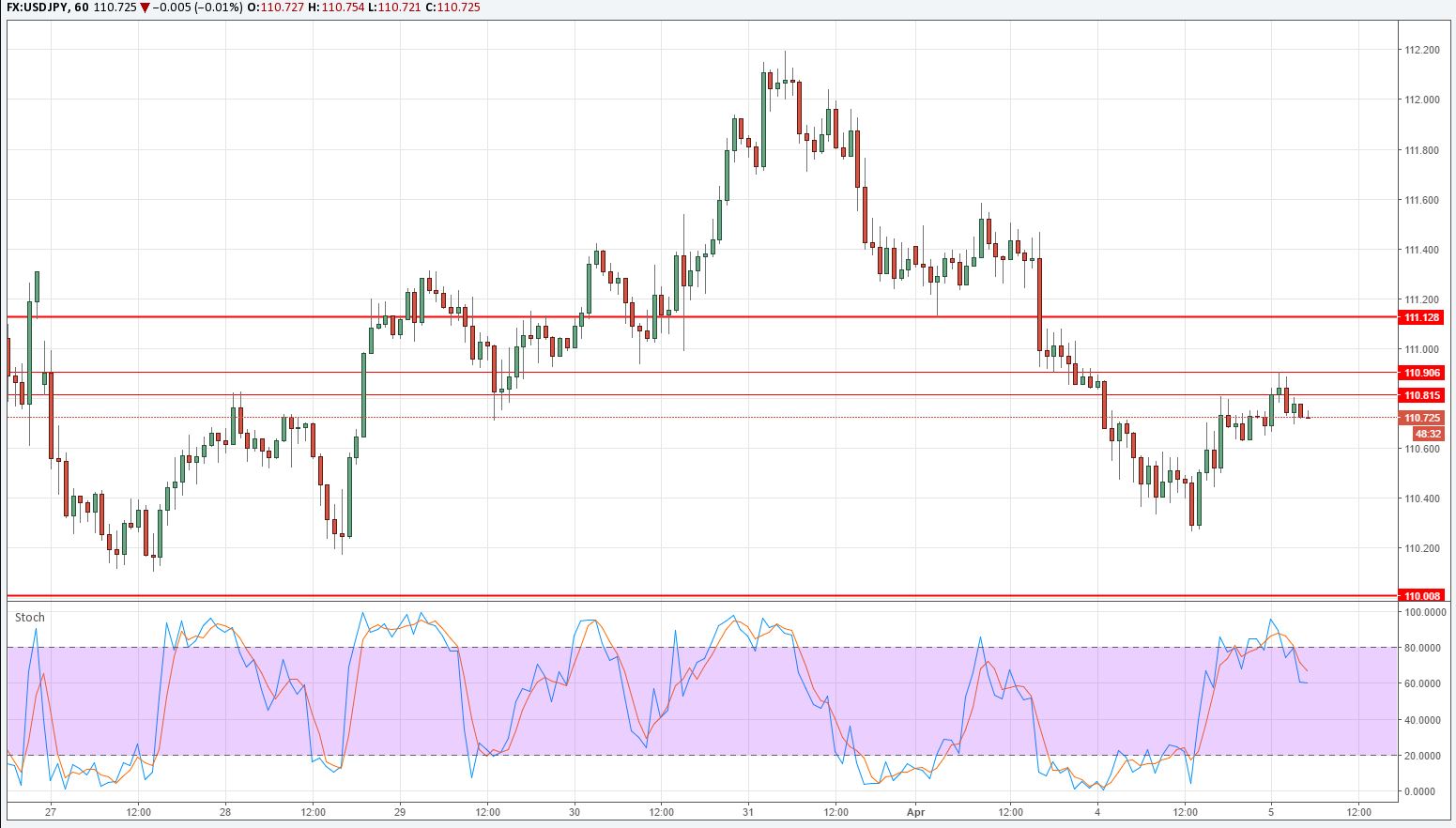

USD/JPY

The Yen has recovered slightly in the past 12 hours of trading, but struggled with resistance in the 110.80-90 area. The short-term outlook remains negative, and selling rallies still the appropriate strategy.

Keep an eye on the 111.12 level, as USD/JPY is likely to encounter strong resistance there. A test of 110 seems likely in the near-term. Should the pair break below, downside momentum will accelerate sharply and a decline towards 108 is possible.

AUD/USD

Fell sharply after the RBA rate decision yesterday and remained under pressure during the rest of the day. Former support between 0.7580 and 0.7590 is now an interesting selling area for AUD bears.

Selling the Aussie Dollar there with a stop above 0.7610 could be an option. The currency pair has immediate support in form of the 200 DMA around 0.7550, but the next important level now lies at 0.7490.

USD/CAD

Price has gathered some positive momentum in the past two trading days. This comes after a period of consolidation in a 1.33-1.34 range. However, the currency pair failed to sustain gains above 1.34 and yesterday's candle on the Daily chart suggests a fake breakout.

The level to watch intraday is 1.3367 support. Should it fall back below this level, the fake breakout would be confirmed and a move towards the lower side of the range is highly likely.

XAUUSD:

Gold failed once again at $1260-62 resistance yesterday. Nevertheless, momentum is still strong and demand should be good on any larger dip. $1240 is key – a break below that level would signal that Gold currently lacks the strength to clear resistance above $1260, and that a deeper correction is needed.

This seems unlikely at this point, though. Intraday, look at the $1250 and $1244 levels for good support.

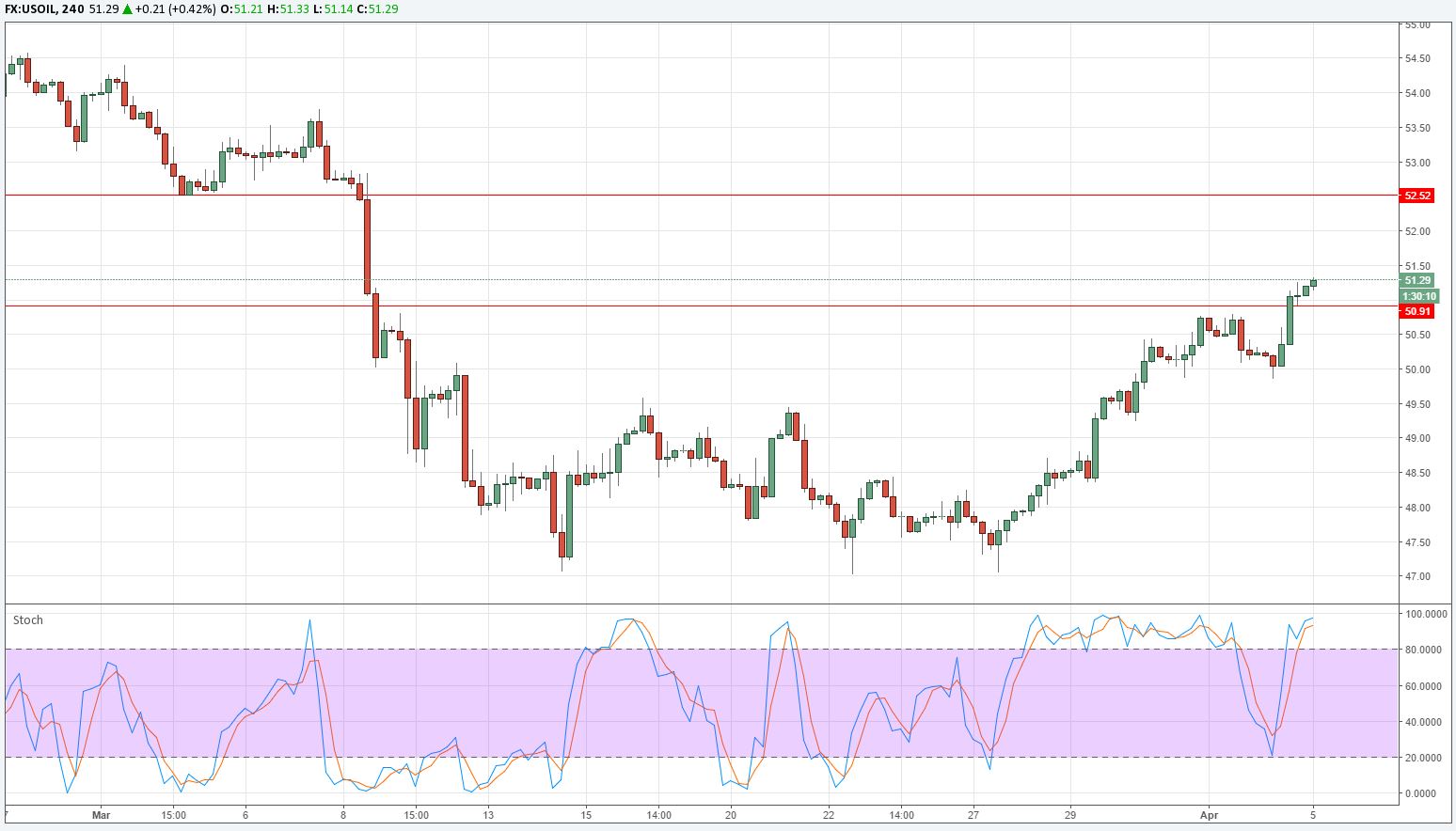

WTI

WTI is showing increased strength. While the hourly charts suggest that the commodity is slightly overbought in the short-term, it will likely continue the rally towards $52.50 without any large pullback. Intraday, keep an eye on $50.90, which should act as solid support now.

For WTI bulls, buying here might be an option, as there is now little resistance until $52.50.